AUTHOR : SAYYED NUZAT

DATE : APRIL 26, 2024

In today’s digital age, the landscape of commerce is constantly evolving, and one of the most notable developments is the rise of virtual currency payment gateways. These gateways represent a paradigm shift in the way we conduct online transactions, offering unprecedented security, efficiency, and global accessibility. In this article, we delve into the world of digital currency payment portals, exploring their functionality, advantages, integration challenges, and future trends.

What is a Virtual Currency Payment Gateway?

A virtual currency transaction processors serves as an intermediary between merchants and customers, facilitating the seamless transfer of virtual currencies for goods and services. Unlike traditional payment gateways that rely on fiat funds, such as the US dollar or euro, digital currency payment portals operate exclusively with digital assets like Bitcoin, Ethereum, and Litecoin.

Definition and Functionality

At its core, a virtual currency payment gateway encrypts transaction data and verifies the authenticity of digital currency transactions. It acts as a bridge between the buyer’s virtual wallet and also the merchant’s account, ensuring that funds are securely transferred and confirmed on the blockchain.

How it differs from traditional payment gateways

Traditional payment gateways require the involvement of banks or financial institutions to process transactions and verify the authenticity of funds. In contrast, virtual currency transaction processors operate on decentralized networks, eliminating the need for intermediaries and streamlining the transaction process.

Advantages of Virtual Currency transaction processors

Virtual currency transaction processors offer several compelling advantages over their traditional counterparts, making them an attractive option for merchants and consumers alike.

Security

Blockchain technology, which underpins virtual currencies, provides unparalleled security and transparency. Each transaction is cryptographically secured and recorded on a distributed ledger, reducing the risk of fraud and unauthorized access.

Lower transaction fees

Traditional payment processors often impose hefty transaction fees, particularly for cross-border transactions. Virtual currency payment gateways typically have lower fees, enabling merchants to retain more of their revenue.

Global accessibility

Virtual currencies are not bound by geographical borders or currency exchange rates, making them an ideal solution for businesses with international clientele. With a virtual currency transaction processors, merchants can accept payments from customers anywhere in the world with minimal friction.

Popular Virtual Currencies Accepted

Virtual currency payment gateways support a wide range of digital assets, including but not limited to Bitcoin, Ethereum, Litecoin, and Ripple. Each cryptocurrency offers unique features and capabilities, catering to diverse user preferences and requirements.

How Virtual Currency Payment Gateways Work

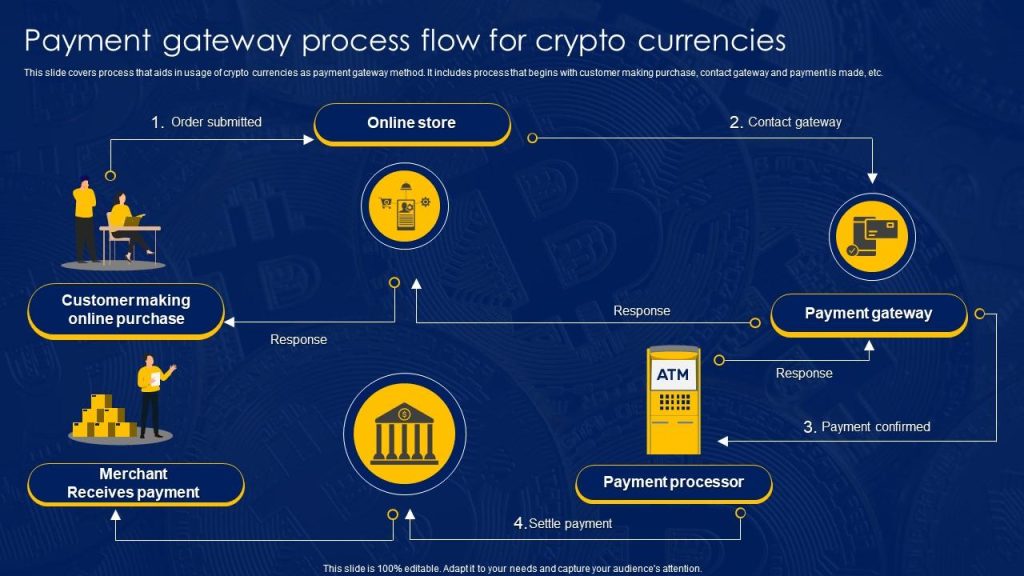

The process of transacting through a virtual currency transaction processors is relatively straightforward, involving several key steps.

Transaction process

- Initiation: The customer initiates a payment using their virtual wallet, specifying the recipient and the amount.

- Verification: The virtual currency transaction processors verifies the transaction details and checks the customer’s account balance.

- Confirmation: Once verified, the transaction is broadcasted to the blockchain network for validation.

- Confirmation: Upon confirmation by the network, the funds are transferred from the customer’s wallet to the merchant’s account.

Integration with e-commerce platforms

Many virtual currency payment gateways offer seamless integration with popular e-commerce[1] platforms such as Shopify, WooCommerce, and Magento. Merchants can easily add virtual currency payment options to their online stores, expanding their customer base and increasing revenue opportunities.

Choosing the Right Virtual Currency Payment Gateway

Similarly, selecting the right virtual currency[2] transaction processors is crucial for merchants looking to leverage the benefits of digital currencies. Several factors should be taken into account when evaluating different gateways.

Factors to consider

- Security features: Look for robust encryption protocols and multi-factor authentication[3] options to safeguard sensitive transaction data.

- Transaction fees: Compare the fee structures of different gateways to ensure competitive pricing and cost-effectiveness.

- Supported currencies: Choose a gateway that supports a wide range of virtual currencies to accommodate diverse customer preferences.

- Integration compatibility: Check compatibility with your existing e-commerce platform[4] and ensure smooth integration without technical hiccups.

Comparison of popular gateways

- CoinbaseCommerce: is known for its user-friendly interface and extensive cryptocurrency support.

- BitPay: Offers seamless integration with major e-commerce platforms and transparent fee structures.

- GoCoin: Specializes in processing payments for high-risk industries and provides robust security features.

Integration Challenges and Solutions

Despite the many benefits of virtual currency[5] transaction processors, integrating them into existing systems can pose challenges for merchants.

Technical complexities

Integrating a virtual currency payment gateway requires technical expertise and familiarity with blockchain technology. Merchants may encounter compatibility issues with their existing systems or encounter difficulties in configuring the gateway to meet their specific requirements.

Regulatory compliance

The regulatory landscape surrounding virtual currencies is constantly evolving, with varying levels of oversight and scrutiny in different jurisdictions. Merchants must ensure compliance with applicable regulations and implement robust KYC (Know Your Customer) and AML (Anti-Money Laundering) measures to mitigate regulatory risks.

Case Studies of Successful Integration

Several businesses have successfully integrated virtual currency transaction processors into their operations, realizing tangible benefits in terms of cost savings, security, and customer satisfaction.

Business examples

- Overstock: The online retail giant was one of the first major retailers to accept Bitcoin as a form of payment, leveraging BitPay’s payment processing solution to expand its customer base and increase sales.

- Shopify: The e-commerce platform enables merchants to accept payments in Bitcoin and other cryptocurrencies through its integration with Coinbase Commerce, empowering small businesses to tap into the growing market for digital currencies.

- Expedia: The travel booking platform partnered with Coinbase to offer Bitcoin payments for hotel bookings, providing travelers with a convenient and secure payment option.

Future Trends in Virtual Currency Payment Gateways

The landscape of virtual currency payment gateways is poised for continued innovation and growth, driven by technological advancements and shifting consumer preferences.

Innovations and advancements

- Tokenization: The emergence of tokenized assets and non-fungible tokens (NFTs) is expected to revolutionize the way we transact and interact with digital assets.

- Interoperability: Efforts to enhance interoperability between different blockchain networks will facilitate seamless cross-border transactions and foster greater adoption of virtual currencies.

- Scalability solutions: Scaling solutions such as layer 2 protocols and sidechains will address the scalability limitations of existing blockchain networks, enabling faster and more cost-effective transactions.

Market projections

Analysts predict a steady increase in the adoption of virtual currency payment gateways, driven by growing consumer demand for alternative payment methods and the expanding use cases for blockchain technology. The global market for virtual currency payment gateways is projected to reach billions of dollars in the coming years, with continued innovation and regulatory clarity driving further growth.

Risks and Concerns

While virtual currency payment gateways offer numerous benefits, they are not without risks and concerns.

Volatility

The value of virtual currencies can be highly volatile, subject to rapid fluctuations and speculative trading activity. Merchants may face challenges in managing currency risk and pricing products/services accordingly.

Security vulnerabilities

Despite the inherent security features of blockchain technology, virtual currency payment gateways are not immune to cyber threats and hacking attacks. Merchants must implement robust security measures to protect against unauthorized access and data breaches.

Regulatory Landscape

The regulatory environment for virtual currencies varies significantly from one jurisdiction to another, with some countries embracing innovation and others imposing stringent regulations and restrictions. Regulatory uncertainty poses challenges for businesses operating in the virtual currency space, necessitating ongoing compliance efforts and engagement with policymakers.

Impact on Businesses

The adoption of virtual currency payment gateways has profound implications for businesses of all sizes, from small startups to multinational corporations.

Small vs. large enterprises

Small businesses stand to benefit from the lower transaction fees and global accessibility of virtual currency payment gateways, enabling them to compete more effectively in the digital marketplace. Large enterprises can leverage virtual currencies to streamline cross-border transactions and they also reduce reliance on traditional banking infrastructure.

Adaptation strategies

Businesses must adapt to the changing landscape of commerce by embracing digital innovation and incorporating virtual currency payment options into their operations. Hence, this may involve investing in technology infrastructure, educating staff and customers, and staying abreast of regulatory developments.

Consumer Adoption and Acceptance

Consumer adoption of virtual currency payment gateways is influenced by factors such as trust, convenience, and familiarity with digital currencies.

Education and awareness efforts

Educating consumers about the benefits and risks of virtual currencies is essential for driving adoption and then fostering trust. Merchants can play a key role in promoting awareness by offering incentives and then educational resources to encourage customers to explore virtual currency payment options.

Conclusion

Virtual currency payment gateways represent a transformative innovation in the field of online transactions, offering unparalleled security, efficiency, and global accessibility. As businesses and consumers increasingly embrace digital currencies, virtual currency payment gateways will play a pivotal role in shaping the future of commerce.

FAQs

- Are virtual currency payment gateways secure?

- Virtual currency payment gateways leverage blockchain technology to ensure secure and transparent transactions. However, merchants should implement additional security measures to protect against cyber threats.

- Can I accept multiple virtual currencies with a single payment gateway?

- Many virtual currency payment gateways support multiple cryptocurrencies, and also they allowing merchants to accept payments in various digital assets.

- How do virtual currency payment gateways handle transaction fees?

- Transaction fees vary depending on the virtual currency payment gateway and the specific cryptocurrency being used. Merchants should carefully review the fee structure and consider the overall cost-effectiveness of each gateway.

- What are the regulatory implications of accepting virtual currencies?

- Similarly,the regulatory landscape for virtual currencies is complex and evolving. Merchants should stay informed about applicable regulations and compliance requirements to avoid potential legal pitfalls.

- What are the benefits of integrating virtual currency payment gateways into my business?

- Moreover, virtual currency payment gateways offer several benefits, including lower transaction fees, global accessibility, and enhanced security. By accepting virtual currencies, businesses can tap into new markets and attract tech-savvy consumers