AUTHOR : EMILY

DATE : 29/08/2024

As cryptocurrencies[1] become more mainstream, businesses in India are increasingly exploring the possibility of accepting digital currencies[2] as a form of payment. The demand for reliable crypto payment processors has surged, offering businesses a secure, efficient, and modern way to handle transactions. However, choosing the right crypto payment processor is crucial for ensuring smooth operations and maximizing the benefits of accepting cryptocurrency. In this blog, we will explore the top crypto payment processors[3] in India as of 2024, detailing their features, advantages, and potential drawbacks.

Why Use a Crypto Payment Processor?

Before diving into the top processors, it’s important to understand why businesses might want to integrate a crypto payment processor. Here are some key reasons:

- Access to a Growing Market: As more consumers adopt cryptocurrencies, accepting them as payment can attract a broader customer base.

- Lower Transaction Fees: Crypto transactions[4] often come with lower fees compared to traditional payment methods[5], improving profit margins.

- Faster Settlement Times: Cryptocurrencies enable near-instantaneous payments, especially when compared to traditional banking processes that may take days.

- Security and Fraud Prevention: Crypto transactions are secure and irreversible, reducing the risk of chargebacks and fraud.

- Global Reach: Cryptocurrencies are borderless, allowing businesses to easily conduct international transactions without the need for currency conversion.

Top Crypto Payment Processors in India

1. Unocoin

Overview: Unocoin is one of India’s oldest and most reputable cryptocurrency platforms, having been established in 2013. It offers a robust crypto payment processor that is popular among Indian businesses due to its reliability and ease of use.

Features:

- Wide Cryptocurrency Support: Unocoin supports popular cryptocurrencies[1] like Bitcoin, Ethereum, and Litecoin.

- Instant INR Conversion: Merchants can instantly convert their cryptocurrency payments into INR, protecting them from the volatility of crypto prices.

- Easy Integration: Unocoin provides easy-to-use APIs for integration with websites, mobile apps, and e-commerce platforms.

- Security: The platform offers advanced security features, including two-factor authentication and cold storage of funds.

Pros:

- Established and trusted platform in India.

- Instant conversion to INR helps mitigate volatility risks.

- Comprehensive support and easy integration.

Cons:

- Primarily focused on the Indian market, limiting international reach.

- Support response times may lag during periods of high demand.

2. CoinPayments

Overview: CoinPayments is a global crypto payment processor that has gained popularity in India due to its extensive range of supported cryptocurrencies and robust feature set. It has been in operation since 2013 and supports over 2,000 different digital currencies[2].

Features:

- Multi-Currency Support: CoinPayments supports a vast array of cryptocurrencies, making it ideal for businesses that want to accept a wide range of digital assets.

- Point of Sale (POS) Integration: The platform offers POS solutions, enabling brick-and-mortar stores to accept crypto payments easily.

- Multi-Currency Wallet: Users can store multiple cryptocurrencies in a single wallet, simplifying fund management.

- Security: CoinPayments employs strong security measures, including multi-signature wallets and advanced encryption.

Pros:

- Extensive cryptocurrency support.

- Global platform with a presence in multiple countries, including India.

- POS integration for physical stores.

Cons:

- Transaction fees can be higher for smaller transactions.

- Occasionally, users have noted problems with wallet synchronization.

3. WazirX

Overview: WazirX, a leading cryptocurrency exchange[3] in India, also offers a payment processing solution. Launched in 2017, WazirX has quickly become a favorite among Indian businesses due to its deep liquidity and fast transaction processing.

Features:

- Seamless Integration: WazirX provides APIs that are easy to integrate with websites and mobile apps, allowing businesses to accept crypto payments smoothly.

- INR Withdrawal: Merchants can easily convert their crypto earnings into INR and withdraw them to their bank accounts.

- Liquidity: WazirX boasts high liquidity, ensuring quick and efficient transactions with minimal slippage.

- Security: The platform uses top-notch security measures, including two-factor authentication and encrypted wallets.

Pros:

- High liquidity for quick transaction processing.

- Fast INR withdrawal options.

- User-friendly interface with strong security features.

Cons:

- Limited to a few cryptocurrencies for payment processing.

- Customer support can be slow during times of high demand.

4. BitPay

Overview: BitPay is one of the most well-known crypto payment processors globally, and it has a significant presence in India. Founded in 2011, BitPay is a pioneer in the crypto payment industry, offering a wide range of services to businesses of all sizes.

Features:

- Global Reach: BitPay allows businesses to accept payments from around the world, making it ideal for companies with international customers.

- Instant Settlement: The platform offers instant settlement in INR, USD, and other fiat currencies, reducing exposure to cryptocurrency volatility.

- Security: BitPay employs multi-signature wallets, two-factor authentication, and other advanced security features to protect transactions.

- Invoicing: BitPay provides customizable[4] invoicing options, allowing businesses to manage payments and billing with ease.

Pros:

- Established reputation with a global presence.

- Support for international transactions and multiple fiat currencies.

- High-security standards and customizable invoicing.

Cons:

- Higher transaction fees compared to some local providers.

- Limited support for lesser-known cryptocurrencies.

5. CoinDCX

Overview: CoinDCX is a relatively new entrant in the crypto payment processing space but has quickly become a popular choice in India. Launched in 2018, CoinDCX offers a comprehensive platform that supports a wide range of cryptocurrencies and payment solutions.

Features:

- Wide Range of Supported Cryptocurrencies: CoinDCX allows businesses to accept payments in a diverse array of cryptocurrencies.

- User-Friendly Interface: The platform is designed with ease of use in mind, making it accessible even to businesses that are new to cryptocurrencies.

- Liquidity: CoinDCX has a deep liquidity pool, ensuring that transactions are processed quickly and efficiently.

- Security: The platform uses industry-standard security measures, including two-factor authentication and cold storage of funds.

Pros:

- Broad cryptocurrency support.

- Competitive fees and strong liquidity.

- Easy-to-use platform with robust security features.

Cons:

- Limited support for international payments.

- Some users have reported occasional delays in INR withdrawals.

How to Select the Ideal Crypto Payment Processor.

When selecting a crypto payment processor, it’s important to consider the specific needs of your business. Consider these key factors:

- Security: Ensure that the processor you choose offers robust security features, including encryption, multi-signature wallets, and two-factor authentication.

- Supported Cryptocurrencies: Choose a processor that supports the cryptocurrencies most commonly used by your customers.

- Fiat Conversion: If you want to avoid crypto volatility[5], opt for a processor that offers instant conversion to INR or other fiat currencies.

- Integration: Look for a processor that offers easy integration with your existing systems, whether it’s a website, mobile app, or POS system.

- Customer Support: Reliable customer support is crucial for addressing any issues that may arise, so choose a processor with a strong support system.

- Fee Structure: Compare the transaction fees and other costs associated with different processors to find one that fits your budget.

Conclusion

The rise of cryptocurrencies in India presents a unique opportunity for businesses to tap into a growing market. By choosing the right crypto payment processor, you can enhance your customer experience, reduce transaction costs, and position your business at the forefront of the digital economy. The processors highlighted in this blog—Unocoin, CoinPayments, WazirX, BitPay, and CoinDCX—are among the top options available in India, each offering a unique set of features to cater to different business needs. Whether you’re a small business looking to start accepting crypto payments or a large enterprise seeking to optimize your payment processing, there’s a solution that fits your requirements.

Top Crypto Payment Processors in India: FAQs

1. What are the leading crypto payment processors in India?

Some of the top crypto payment processors in India include Unocoin, Bitbns, WazirX, and CoinDCX. These platforms facilitate cryptocurrency transactions for businesses and individuals.

2. Can I use crypto payment processors for online shopping in India?

Yes, several merchants and e-commerce platforms in India accept payments via crypto payment processors. However, acceptance may vary, so it’s important to check if the vendor supports crypto transactions.

3. Are crypto payment processors in India secure?

Reputable crypto payment processors in India implement strong security measures, including encryption, two-factor authentication, and cold storage for funds. Always choose well-established platforms with positive reviews.

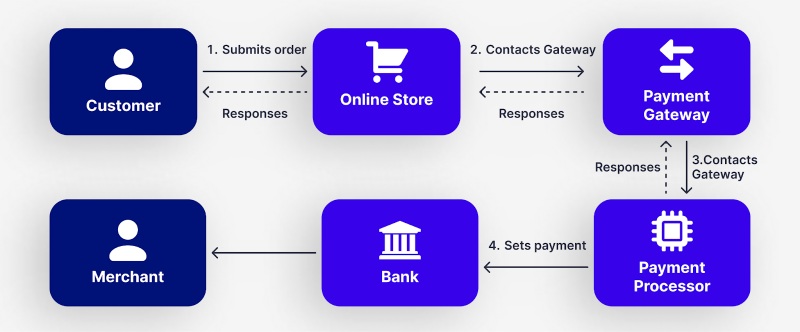

4. How do I integrate a crypto payment processor with my business?

To integrate a crypto payment processor with your business, sign up with a reputable platform, follow their setup instructions, and configure your payment gateway to accept cryptocurrency payments.

5. What fees are associated with using crypto payment processors in India?

Fees for using crypto payment processors vary by platform and may include transaction fees, conversion fees, and withdrawal fees. It’s important to review the fee structure of each processor before choosing one.