AUTHOR : SAYYED NUZAT

DATE : MAY 12, 2024

In the rapidly evolving landscape of online transactions, security and convenience are paramount. This has led to the emergence of innovative payment solutions, one of which is the token payment gateway. Let’s delve into what token payment gateways are, how they work, and their significance in the Indian market.

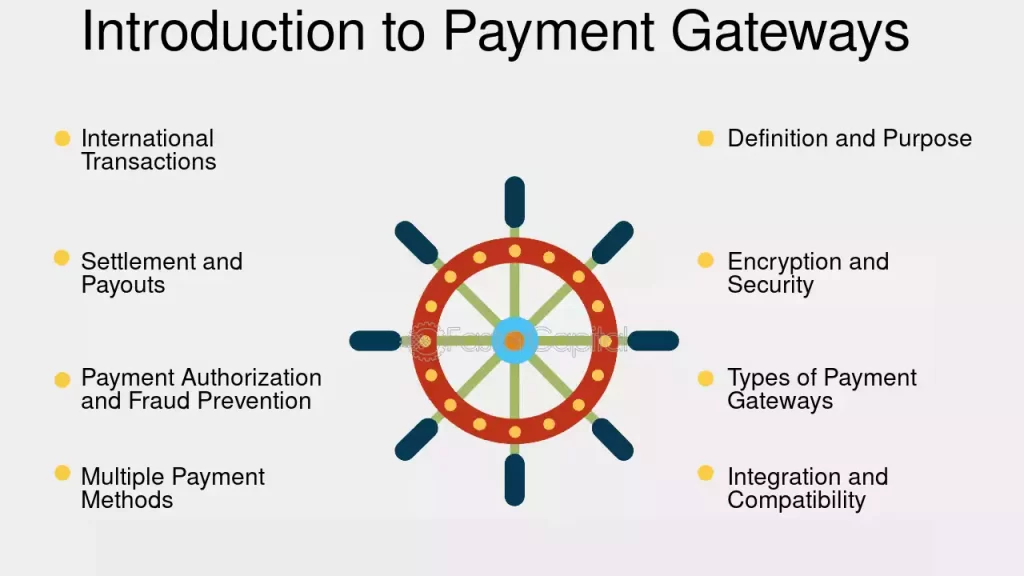

Introduction to Token Payment Gateway

What is a token payment gateway?

A token payment gateway is a secure method of processing online transactions where sensitive payment data is replaced with a unique identifier, known as a token. This token acts as a substitute for the actual payment information; thus, it significantly reduces the risk of data theft during online transactions.

Importance of tokenization in online transactions

Tokenization enhances the security of online payments by eliminating the need to store sensitive payment information.

Advantages of Token Payment Gateways

Enhanced security

Tokenization[1] reduces the risk of data breaches and fraud by replacing sensitive payment[2] information with non-sensitive tokens. Even if a token[3] is intercepted, it holds no value to hackers; moreover, without the corresponding decryption key[4], the token remains useless. Consequently, the security of the sensitive information is maintained effectively.

Token Payment Gateway Providers in India

India’s burgeoning digital economy[5] has spurred the growth of numerous payment gateway providers offering tokenization services. Some of the prominent players in the market include Razorpay, PayU, and Instamojo, each offering a range of features tailored to the needs of businesses operating in India.These providers offer seamless integration with e-commerce platforms, mobile applications, and websites.

Integration of Token Payment Gateway

Integrating a token payment gateway into an online platform involves several steps, including registration with the chosen provider, obtaining API keys, and configuring payment settings. Most providers offer comprehensive documentation and developer support to facilitate the integration process.

Regulatory Compliance

As with any financial service, token payment gateways in India are subject to regulatory oversight by authorities such as the Reserve Bank of India (RBI) and the Payment Card Industry Data Security Standard (PCI DSS).Businesses utilizing token payment gateways must adhere to these regulations to ensure the security and integrity of online transactions, including compliance with data protection laws and industry standards for handling sensitive information.

Costs Associated with Token Payment Gateways

Customer Experience with Token Payment Gateways

The user experience of token payment gateways is crucial in driving adoption and customer satisfaction. Intuitive interfaces, seamless checkout processes, and robust security measures contribute to a positive experience for users, fostering trust and loyalty towards businesses.

Future Trends and Innovations

The future of token payment gateways in India looks promising, with ongoing advancements in tokenization technology and increasing adoption by businesses across various industries.Potential innovations include the integration of biometric authentication and decentralized tokenization solutions leveraging blockchain technology

Challenges and Limitations

While token payment gateways offer numerous benefits, they also present challenges. Specifically, these include scalability issues, integration complexities, and regulatory uncertainties. Consequently, addressing these challenges is crucial for optimizing the effectiveness of token payment systems.

Businesses must carefully evaluate these factors and implement robust strategies to mitigate risks and maximize the benefits of tokenization.

Comparison with Traditional Payment Gateways

Compared to traditional payment gateways, token payment gateways offer superior security, streamlined checkout processes, and enhanced protection against fraud. However, on the other hand, the suitability of each solution depends on the specific requirements and preferences of businesses. Therefore, evaluating these factors is essential for selecting the most appropriate payment gateway.

Token Payment Gateway Security

Token payment gateways employ state-of-the-art encryption protocols and security measures to safeguard sensitive payment information against unauthorized access and data breaches. These measures include tokenization, encryption, and multi-layered authentication mechanisms.

Adoption Rate in Various Industries

Token payment gateways are gaining traction across diverse industries in India, including e-commerce, fintech, and retail. The scalability, security, and convenience offered by tokenization make it an attractive solution for businesses seeking to enhance their payment infrastructure and also customer experience.

Educational Resources for Businesses

To facilitate the adoption of token payment gateways, several educational resources are available to businesses in India. Specifically, training programs, workshops, and online tutorials can help guide this transition. Therefore, leveraging these resources can significantly ease the implementation process and enhance overall adoption. These resources provide valuable insights into tokenization technology, regulatory compliance, and best practices for secure online payments.

Conclusion

Token payment gateways offer a secure, efficient, and convenient solution for processing online transactions in India. By replacing sensitive payment information with tokens, businesses can, therefore, enhance security, streamline checkout processes, and protect against fraud. Consequently, this fosters trust and confidence among consumers.

Unique FAQs:

- What is tokenization in the context of payment gateways? Tokenization involves, for instance, replacing sensitive payment information—such as credit card numbers or bank account details—with non-sensitive tokens. Consequently, this process enhances security during online transactions.

- How does tokenization differ from encryption? While encryption scrambles data to make it unreadable without the corresponding decryption key, tokenization substitutes sensitive data with non-sensitive tokens, reducing the risk of data theft and fraud.

- Are token payment gateways compatible with all e-commerce platforms? Most token payment gateways offer integration options for popular e-commerce platforms, including Shopify, WooCommerce, and also Magento, ensuring compatibility and seamless implementation for businesses.

- What measures are in place to ensure the security of token payment gateways? Moreover,Token payment gateways employ robust security measures such as encryption, tokenization, and multi-layered authentication to protect sensitive payment information