AUTHOR : SAYYED NUZAT

DATE: May 10, 2024

In recent years, the world has witnessed a significant shift towards digital payments, and India is no exception. With the rapid advancement of technology and the increasing acceptance of cryptocurrencies, stablecoin payment solutions have emerged as a reliable alternative to traditional banking methods. In this article, we delve into the realm of stablecoin payment solutions in India, exploring their significance, adoption, benefits, challenges, and future outlook.

Introduction to Stablecoin Payment Solutions

What are stablecoins?

Stablecoins are a type of cryptocurrency designed to minimize price volatility by pegging their value to a stable asset, such as fiat currency (e.g., USD, INR), other cryptocurrencies, or commodities like gold[1].

Importance of stablecoin payment solutions

Stablecoin payment solutions[2] offer a stable and efficient medium of exchange, making them ideal for everyday transactions, remittances, and cross-border payments[3]. They bridge the gap between traditional finance and the decentralized world of cryptocurrencies[4], offering a seamless experience to users.

The Current Payment Landscape in India

India has witnessed a dramatic shift towards digital payments[5] in recent years, driven by factors such as government initiatives (e.g., Digital India), increasing smartphone penetration, and the rise of digital payment platforms like Paytm, PhonePe, and Google Pay. However, traditional banking methods still face challenges such as high transaction fees, long processing times, and limited accessibility, especially in rural areas.

Stablecoin Adoption in India

Despite regulatory uncertainties surrounding cryptocurrencies, stablecoin adoption in India is on the rise. Factors such as inflationary pressures on the fiat currency, the need for faster and cheaper cross-border transactions, and growing interest from businesses and consumers contribute to this trend. However, regulatory clarity remains crucial for the widespread adoption of stablecoin payment solutions in India.

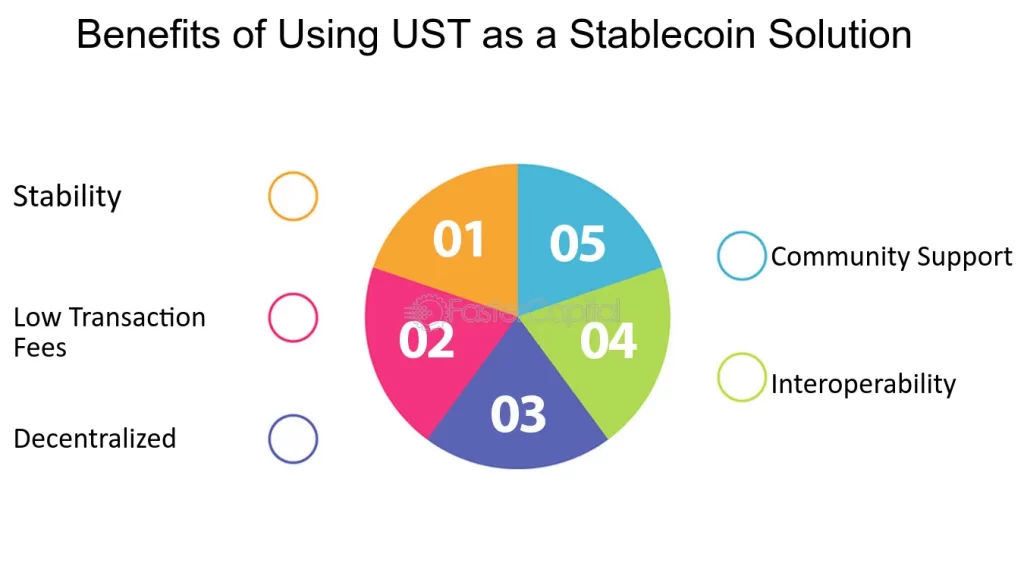

Benefits of Stablecoin Payment Solutions

Stablecoin payment solutions offer several advantages over traditional payment methods:

- Stability: Unlike volatile cryptocurrencies, stablecoins maintain a stable value, making them suitable for everyday transactions.

- Speed: Transactions with stablecoins are processed faster compared to traditional banking systems, enabling quick settlements.

- Lower transaction costs: Stablecoin transactions typically involve lower fees compared to traditional banking and remittance services.

- Accessibility: Stablecoin payment solutions are accessible to anyone with an internet connection, offering financial inclusion to underserved populations.

Popular Stablecoins in India

Several stablecoins are gaining traction in the Indian market, including Tether (USDT), USD Coin (USDC), and Dai (DAI). These stablecoins are widely used for various purposes, including trading, remittances, and as a store of value.

How Stablecoin Payments Work

Stablecoin payments rely on blockchain technology and smart contracts to facilitate secure and transparent transactions. Blockchain ensures immutability and decentralization, while smart contracts automate the execution of agreements, eliminating the need for intermediaries.

Use Cases of Stablecoin Payments in India

Stablecoin payments find applications across various sectors in India:

- Remittances: Workers abroad can send money back home instantly and at a lower cost using stablecoin payment solutions.

- E-commerce: Online merchants can accept stablecoins as payment, enabling seamless transactions for both domestic and international customers.

- Cross-border transactions: Businesses can leverage stablecoins to facilitate cross-border trade without the need for traditional banking channels, reducing costs and settlement times.

Challenges and Risks

Despite their potential, stablecoin payment solutions face several challenges and risks in India:

- Regulatory uncertainty: The regulatory landscape surrounding cryptocurrencies in India is still evolving, leading to uncertainty among businesses and investors.

- Volatility: While stablecoins aim to maintain a stable value, they are not immune to market fluctuations, posing risks to users.

- Security concerns: As with any digital asset, stablecoins are susceptible to hacking, theft, and other cybersecurity risks, highlighting the importance of robust security measures.

Future Outlook

The future of stablecoin payment solutions in India looks promising, with the potential for widespread adoption and innovation. As regulatory clarity improves and infrastructure matures, stablecoins are poised to play a significant role in shaping the future of finance in India, offering efficiency, transparency, and financial inclusion.

Conclusion

Stablecoin payment solutions represent a paradigm shift in the way we transact, offering stability, speed, and accessibility to users in India and beyond. While challenges remain, the potential benefits of stablecoins far outweigh the risks, paving the way for a more inclusive and efficient financial system.

FAQs

- Are stablecoins legal in India?

- As of now, the regulatory status of stablecoins in India is unclear. However, discussions are ongoing, and regulatory clarity is expected in the near future.

- Can stablecoins be used for investment purposes?

- While stablecoins primarily serve transactional purposes, some users may utilize them as stores of value or for trading. However, it’s essential to understand the risks associated with cryptocurrencies.

- What sets stablecoins apart from conventional cryptocurrencies such as Bitcoin?

- Unlike Bitcoin and other volatile cryptocurrencies, stablecoins aim to maintain a stable value by pegging it to a stable asset, such as fiat currency or commodities.

- Are stablecoin transactions traceable?

- Yes, stablecoin transactions are recorded on a blockchain, making them traceable and transparent. However, the identities of the parties involved may remain pseudonymous, depending on the platform used.

- What role do stablecoins play in financial inclusion?

- Stablecoin payment solutions offer financial inclusion by providing access to financial services to underserved populations, including those without access to traditional banking services.