AUTHOR : SAYYED NUZAT

DATE: April 26, 2024

In today’s rapidly evolving digital landscape, where online transactions have become the norm, ensuring the security of your payments is paramount. With the emergence of cryptocurrencies, individuals and businesses now have access to a secure and efficient alternative to traditional payment methods. In this article, we delve into the realm of secure crypto payments, exploring their benefits, security measures, and future outlook.

Introduction to Secure Crypto Payments

In an era where cyber threats loom large, the need for secure transactions has never been more critical. Cryptocurrencies offer a decentralized and encrypted means of conducting financial transactions, eliminating the need for intermediaries such as banks. In essence, cryptocurrency embodies a digital or virtual currency format, leveraging cryptography for security measures and functioning within decentralized networks grounded in blockchain technology.

Risks Associated with Traditional Payment Methods

Traditional payment methods, such as credit cards[1] and bank transfers, are susceptible to various risks, including hacking, identity theft, and fraud. Instances of data breaches in banking systems have become increasingly common, exposing sensitive customer information to malicious actors.

Benefits of Crypto Payments

Cryptocurrencies offer several advantages over traditional payment methods. Firstly, they operate on decentralized networks, which means there is no central authority controlling transactions. This decentralization[2] ensures transparency and reduces the risk of fraud. Additionally, crypto payments typically have lower transaction fees and faster processing times compared to traditional banking systems.

Security Measures in Crypto Transactions

Security is a cornerstone of cryptocurrency transactions. Transactions are secured using cryptographic techniques, making them highly resistant to tampering and fraud. Blockchain technology, the underlying technology behind most cryptocurrencies, ensures that transactions[3] are recorded in a secure and immutable ledger. Moreover, users can enhance security further by employing measures such as two-factor authentication and using multi-signature wallets.

Popular Cryptocurrencies for Secure Payments

Bitcoin, Ethereum[4], and Ripple are among the most popular cryptocurrencies used for secure payments. Bitcoin, often referred to as digital gold, pioneered the concept of decentralized digital currency. Ethereum, on the other hand, introduced smart contract functionality, enabling developers to create decentralized applications (DApps). Ripple, with its focus on facilitating cross-border payments, has gained traction among financial institutions seeking efficient and cost-effective remittance solutions.

Tips for Secure Crypto Payments

When venturing into the world of crypto payments, it’s essential to exercise caution and adhere to best practices. Conduct thorough research before investing in any cryptocurrency, and only use reputable exchanges and wallets. Safeguard your private keys, as they are essential for accessing and managing your cryptocurrency holdings.

Regulatory Environment and Compliance

The regulatory environment pertaining to cryptocurrencies exhibits diversity across nations, with nuances and adaptations specific to each country’s legal framework. Governments worldwide are increasingly recognizing the need for regulatory oversight to prevent illicit activities such as money laundering and terrorist financing. Compliance with KYC and AML regulations is crucial for cryptocurrency exchanges and businesses operating in the crypto space.

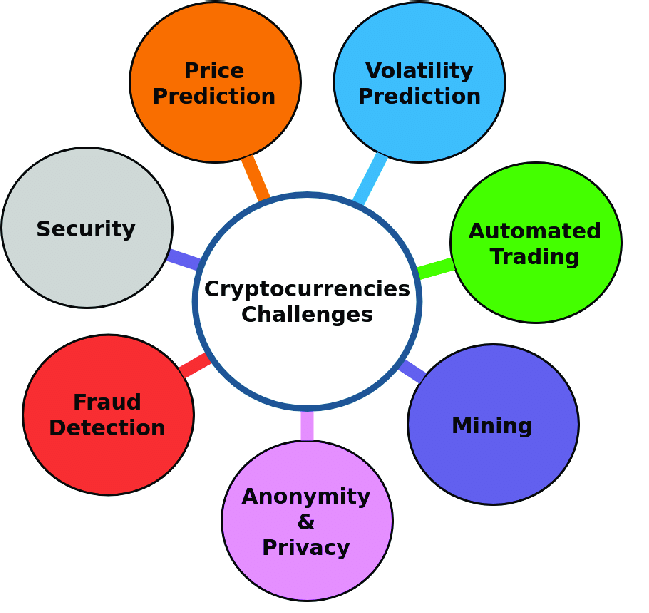

Challenges and Limitations

Despite their numerous advantages, cryptocurrencies face challenges such as price volatility and limited acceptance in mainstream commerce. The volatile nature of cryptocurrency prices can deter some users from adopting them for everyday transactions. Moreover, the lack of widespread acceptance among businesses poses a hurdle to mainstream adoption.

Future Outlook

Despite the challenges, the future looks promising for secure crypto payments. Advancements in security technology, such as zero-knowledge proofs and homomorphic encryption, hold the potential to further enhance the security and privacy of cryptocurrency transactions. Additionally, as awareness and understanding of cryptocurrencies grow, we can expect to see increased acceptance and integration into mainstream commerce.

Conclusion

In conclusion, secure crypto payments offer a compelling alternative to traditional payment methods with their decentralized nature and robust security features. While cryptocurrencies present exciting opportunities, it’s essential to approach them with caution and diligence[5]. By adhering to best practices and staying informed, individuals and businesses can harness the benefits of crypto payments while safeguarding their financial transactions in the digital age.

FAQs

- Are crypto payments safe?

- Cryptocurrency transactions are secured using cryptographic techniques and blockchain technology, making them highly resistant to fraud and tampering.

- What are the risks of using cryptocurrencies?

- The risks associated with cryptocurrencies include price volatility, hacking, and regulatory uncertainty.

- How can I secure my cryptocurrency holdings?

- Secure your cryptocurrency holdings by using reputable exchanges and wallets, safeguarding your private keys, and implementing additional security measures such as two-factor authentication.

- Are cryptocurrencies legal?

- The legality of cryptocurrencies varies from country to country. While certain nations have welcomed their presence, others have enacted limitations or outright prohibitions on cryptocurrencies.

- What is the future of crypto payments?

- The future of crypto payments looks promising, with advancements in security technology and growing acceptance among businesses and consumers.