AUTHOR : SAYYED NUZAT

DATE : MAY 14, 2024

Introduction to Peer-to-peer Cryptocurrency Payments

In recent years, peer-to-peer (P2P) cryptocurrency payments have gained traction globally as an alternative to traditional banking systems. P2P transactions involve the direct exchange of digital currencies between individuals without the need for intermediaries like banks or payment processors.

Cryptocurrency, an innovative digital or virtual currency safeguarded by cryptographic techniques, has swiftly risen as a transformative factor within the realm of finance. Its decentralized nature and cryptographic security make it an attractive option for conducting transactions.

The Rise of Cryptocurrency in India

India, despite initial skepticism and regulatory uncertainty, has witnessed a surge in cryptocurrency adoption. The journey of cryptocurrencies in India has been marked by both enthusiasm[1] and regulatory challenges.

Historically, India has had a cautious approach towards cryptocurrencies[2], with the Reserve Bank of India (RBI) imposing restrictions on banks’ dealings with crypto businesses. However, despite regulatory[3] hurdles, cryptocurrency trading and investment[4] have gained popularity among Indian investors.

Challenges and Opportunities

The integration of cryptocurrencies into India’s financial ecosystem[5] presents both challenges and opportunities. Regulatory uncertainty, security concerns, and the risk of financial crimes are significant hurdles that need to be addressed.

However, peer-to-peer cryptocurrency payments also offer opportunities for financial inclusion, especially in a country like India with a large unbanked population. P2P platforms can provide individuals with access to financial services, irrespective of their geographical location or economic status.

Peer-to-peer Platforms in India

Several P2P platforms have emerged in India, facilitating the buying, selling, and trading of cryptocurrencies among individuals. These platforms connect buyers and sellers directly, offering a decentralized marketplace for transactions.

Popular platforms like WazirX, CoinDCX, and LocalBitcoins have gained prominence in the Indian market, providing users with a seamless and secure environment for trading cryptocurrencies.

Benefits of Peer-to-peer Cryptocurrency Payments

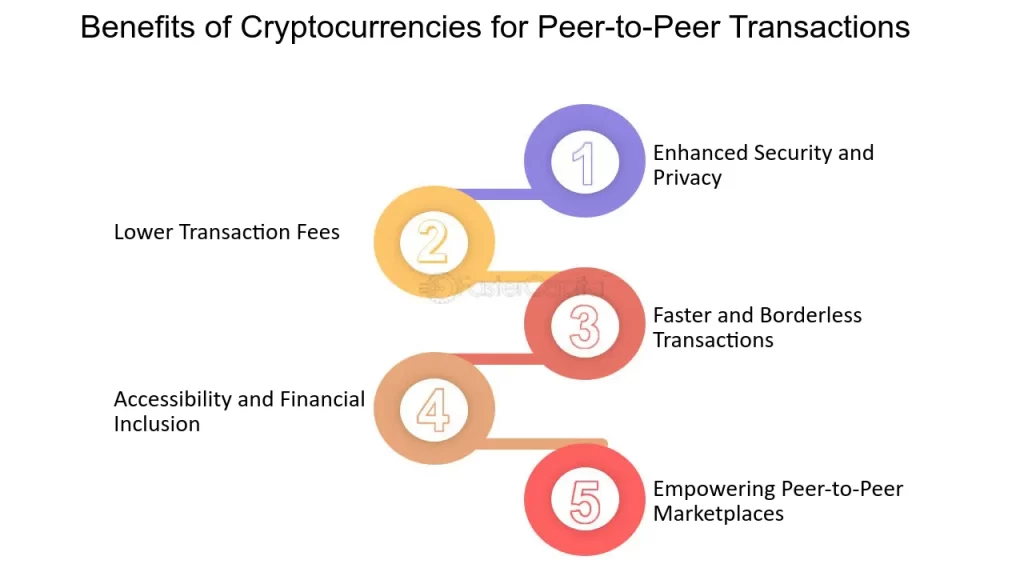

P2P cryptocurrency payments offer several advantages over traditional banking systems:

- Lower transaction fees: P2P transactions typically involve lower fees compared to traditional banking channels.

- Decentralization and autonomy: Users have full control over their funds without relying on intermediaries.

- Global accessibility: Cryptocurrency transactions can be conducted across borders without restrictions, enabling global financial inclusion.

Risks and Considerations

Despite the benefits, peer-to-peer cryptocurrency payments come with their fair share of risks.

- Volatility of cryptocurrency prices: The volatile nature of cryptocurrencies can result in significant price fluctuations, posing risks to investors.

- Legal implications: Regulatory uncertainty and evolving legal frameworks can impact the legality of cryptocurrency transactions.

- Scams and frauds: Users need to exercise caution to avoid falling victim to scams and fraudulent activities prevalent in the crypto space.

How to Use Peer-to-peer Platforms Safely

To mitigate risks associated with P2P cryptocurrency transactions, users should follow these safety measures:

- Conduct transactions on reputable platforms with robust security measures.

- Verify counterparties and conduct due diligence before engaging in transactions.

- Use secure payment methods and avoid sharing sensitive information with unknown parties.

Future Outlook

The future of peer-to-peer cryptocurrency payments in India depends on regulatory developments, technological advancements, and market dynamics. With growing interest and adoption, P2P platforms have the potential to reshape India’s financial landscape.

Conclusion

Peer-to-peer cryptocurrency payments represent a paradigm shift in the way financial transactions are conducted. Despite regulatory challenges and security concerns, the popularity of P2P platforms continues to rise, offering individuals greater autonomy and financial inclusion. As India navigates the evolving cryptocurrency landscape, fostering innovation while addressing regulatory concerns will be crucial for unlocking the full potential of peer-to-peer payments.

FAQs

- Are peer-to-peer cryptocurrency transactions legal in India?

- The legality of cryptocurrency transactions in India remains a grey area, with regulatory clarity still lacking. However, individuals continue to trade cryptocurrencies through P2P platforms.

- How can I ensure the security of P2P cryptocurrency transactions?

- Users should conduct transactions on reputable platforms, verify counterparties, and also employ secure payment methods to mitigate security risks.

- What are the advantages of using P2P platforms for cryptocurrency transactions?

- P2P platforms offer lower transaction fees, decentralized control over funds, and global accessibility, making them an attractive option for users.

- What role do regulatory developments play in the future of P2P cryptocurrency payments in India?

- Regulatory clarity and favorable frameworks will be instrumental in shaping the future of P2P cryptocurrency payments in India, fostering innovation and investor confidence.

- Are there any risks associated with P2P cryptocurrency transactions?

- Yes, risks such as price volatility, legal uncertainties, and the potential for scams and frauds are inherent in P2P cryptocurrency transactions.