AUTHOR- ELIZA FERNZ

DATE-26-8-2024

INTRODUCTION

In recent years, the financial world has witnessed a seismic(1) shift with the advent of digital currencies. India, a country traditionally known for its rich history in trade and finance, is now at the forefront of this digital revolution. Indian Digital Coin Services (IDCS)(1) have emerged as a significant player in this transformation, reshaping how individuals and businesses engage with money.

Understanding Indian Digital Coin Services

Indian Digital Coin Services (IDCS) encompass a range of financial services and technologies related to digital currencies, including cryptocurrencies like Bitcoin and Ethereum(2), as well as digital representations of traditional currencies known as Central Bank Digital Currencies (CBDCs). The primary objective of IDCS is to simplify and secure transactions, offer innovative financial solutions, and drive financial inclusion across the country.

The Growing Popularity of Digital Coins in India

India has seen a rapid rise in the adoption of digital coins, driven by several factors:

- Tech-Savvy Population: India’s young, tech-savvy population is increasingly open to digital innovations. The widespread use of smartphones(3) and the internet has created a fertile ground for the growth of digital currencies.

- Financial Inclusion: Digital coins offer a promising solution to financial exclusion. They provide access to financial services for individuals who lack traditional banking facilities, particularly in rural areas.

- Government Initiatives: The Indian government has shown interest in leveraging(4) blockchain technology and digital currencies to enhance the efficiency of financial transactions and reduce corruption. The Reserve Bank of India (RBI) is exploring the implementation of a Central Bank Digital Currency (CBDC) to modernize the financial system.

- Investment Opportunities: With the rise of digital currencies, many Indians are looking at them as investment opportunities. The potential for high returns, coupled with the increasing acceptance of cryptocurrencies globally, has fueled interest in the sector.

Key Services Offered by IDCS

Indian digital coin services are diverse, catering to various needs:

- Cryptocurrency Exchanges: These platforms allow users to buy, sell, and trade cryptocurrencies. They play a crucial role in the liquidity and accessibility(5) of digital assets.

- Digital Wallets: Digital wallets provide a secure way to store and manage digital coins. They enable users to perform transactions seamlessly and keep track of their holdings.

- Payment Solutions: Some IDCS companies offer payment solutions that integrate digital coins into everyday transactions. This includes online payments, merchant services, and even cross-border transfers.

- Investment Platforms: These platforms provide opportunities for users to invest in digital currencies and related financial products. They often include features like portfolio management and market analysis tools.

- Educational Resources: To help users navigate the complex world of digital currencies, many IDCS organizations offer educational resources, including webinars, tutorials, and guides on best practices.

Challenges and Opportunities

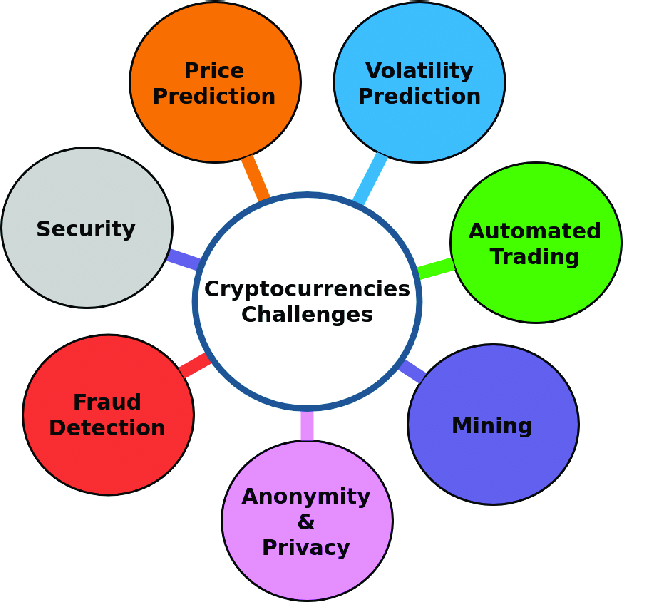

While the growth of Indian digital coin services presents numerous opportunities, there are also challenges to address:

- Regulatory Uncertainty: The regulatory environment for digital currencies in India is still evolving. Uncertainty around regulations can impact market stability and investor confidence.

- Security Concerns: As digital currencies grow in popularity, so do the risks associated with them. Ensuring robust security measures to protect users from fraud and cyberattacks is crucial.

- Technical Barriers: The technical complexities of digital currencies and blockchain technology can be daunting for new users. Simplifying these technologies and making them more user-friendly is essential for widespread adoption.

- Market Volatility: The volatility of digital currencies can pose risks for investors and users. Understanding and managing these risks is a key challenge for the sector.

CONCLUSION

In conclusion, Indian Digital Coin Services represents a transformative force in India’s financial landscape, leveraging cutting-edge technology to deliver secure and efficient digital currency solutions. By simplifying transactions and enhancing accessibility, the service addresses the growing demand for modern financial tools, fostering greater financial inclusion and innovation. Its commitment to robust security measures and user-friendly platforms ensures a reliable and forward-thinking approach to digital finance, positioning it as a key player in shaping the future of India’s economic interactions.

FAQS

1. What do Indian digital coin services offer? Indian Digital Coin Services delivers cutting-edge digital currency solutions, including secure transaction platforms, investment options, and financial management tools designed specifically for the Indian market.

2. How do I begin using Indian Digital Coin Services? To start, visit our website or download our mobile app, create a new account, complete the verification process, and follow the simple steps to link your payment methods and explore our offerings.