Author : Nuzzu.S

Date : september 1, 2024

Introduction

Cryptocurrency has taken the financial world by storm, and India is no exception. As more Indians delve into the world of digital currencies , understanding how to report cryptocurrency earnings becomes crucial. Not only is it important to stay on the right side of the law, but proper reporting also ensures financial transparency and compliance with the tax authorities.

Overview of Cryptocurrency in India

Cryptocurrency in India has seen significant evolution over the past decade. From being a niche interest among tech enthusiasts, it has grown into a popular investment choice for the general public. The Indian government’s stance on cryptocurrency[1] has shifted over the years, with ongoing discussions about its regulation and taxation. Understanding the current regulatory framework is essential for anyone involved in crypto trading or investments.

Why Reporting Cryptocurrency Earnings is Crucial

Failing to report your cryptocurrency earnings can lead to severe legal consequences, including penalties and fines. Moreover, in a country like India, where financial transparency[2] is increasingly emphasized, non-reporting could also lead to complications in financial audits. Reporting your earnings not only keeps you compliant with the law but also helps in maintaining a clear financial record.

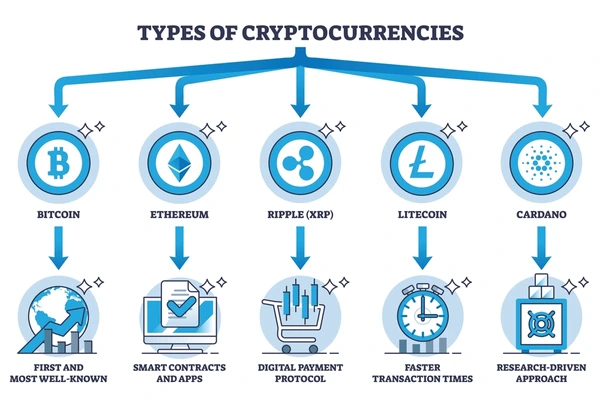

Types of Cryptocurrency Earnings

Cryptocurrency earnings can come in various forms, each with its own set of tax implications:

- Capital Gains from Trading: This includes profits made from buying and selling cryptocurrencies.

- Earnings from Mining: Cryptocurrency miners earn digital coins as a reward for solving complex mathematical problems.

- Staking and Interest Income: Some cryptocurrencies offer staking rewards or interest for holding certain digital assets.

- Airdrops and Forks: These are often received as a form of promotional activity or through a blockchain split.

Taxation on Cryptocurrency Earnings

The Indian government has begun to outline tax laws specifically for cryptocurrency. It’s important to understand how these laws apply to your specific situation. Depending on the type of earnings, different tax treatments may apply.

Capital Gains Tax on Cryptocurrency

Cryptocurrency earnings are generally treated as capital gains. These can be classified as short-term or long-term, depending on the holding period.[3] Short-term capital gains are taxed at a higher rate compared to long-term gains. Calculating your capital gains tax involves subtracting the cost of acquisition from the sale proceeds.

Income Tax on Cryptocurrency Earnings

For those earning cryptocurrency through mining or staking, these earnings are considered income and are subject to income tax. Similarly, if you’re paid in cryptocurrency for services rendered, this too is treated as income and taxed accordingly.

Reporting Cryptocurrency Earnings on ITR

When it comes to reporting cryptocurrency earnings, selecting the correct Income Tax Return (ITR) form is the first step. Typically, ITR-2 or ITR-3 is required, depending on the nature of your income. The process involves declaring your earnings under the appropriate section and providing necessary documentation, such as a proof of purchase.

Common Mistakes to Avoid When Reporting Cryptocurrency Earnings

Reporting cryptocurrency earnings can be complex, and there are several common pitfalls to avoid:

- Misclassification of Income: Ensure that you categorize your earnings correctly—whether as capital gains or income.

- Failure to Report Small Transactions: Even small transactions need to be reported to avoid discrepancies.

- Ignoring International Transactions: If you’ve transacted with foreign exchanges, these need to be reported as well.

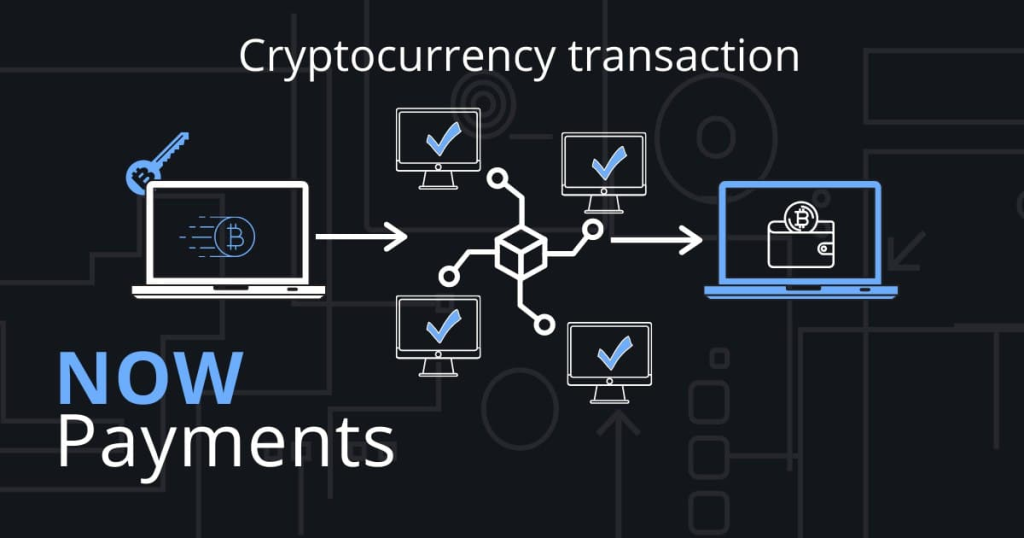

How to Keep Track of Your Cryptocurrency Transactions

Given the volatility and frequency of transactions in the crypto world, keeping accurate records is vital. Several tools and software are available that can help you track your transactions efficiently, ensuring you have all the necessary information at tax time.

Impact of the GST on Cryptocurrency Transactions

In addition to income and capital gains taxes[4], Goods and Services Tax (GST) may also apply to certain cryptocurrency transactions. This is particularly relevant for businesses dealing in digital assets. Reporting GST correctly is crucial to avoid penalties[5].

Challenges in Reporting Cryptocurrency Earnings

The biggest challenge in reporting cryptocurrency earnings lies in the lack of clear guidelines from tax authorities. The volatile nature of cryptocurrencies adds another layer of complexity, as the value of assets can fluctuate dramatically within short periods. Additionally, tracking numerous transactions across multiple exchanges can be daunting.

Case Studies: Real-World Examples

Learning from others can provide valuable insights. There have been several cases in India where individuals and businesses faced tax audits due to improper reporting of cryptocurrency earnings. Analyzing these cases can help you avoid similar pitfalls.

Future of Cryptocurrency Taxation in India

As the Indian government continues to refine its stance on cryptocurrency, future tax laws are expected to be more comprehensive. Staying informed and preparing for these changes will help ensure that you remain compliant in the years to come.

Conclusion

Reporting cryptocurrency earnings in India is not just a legal obligation but also a step towards financial transparency. As the regulatory landscape evolves, it’s important to stay updated and consult with tax professionals if needed. Ensuring accurate and timely reporting will not only keep you compliant but also contribute to the overall acceptance and integration of cryptocurrencies in India’s financial ecosystem.

FAQs

- What happens if I don’t report my cryptocurrency earnings?

Failure to report can lead to penalties, fines, and potential legal action. It may also complicate future financial audits. - Can I offset my crypto losses against gains?

Yes, under certain conditions, you can offset your cryptocurrency losses against gains, but it’s important to understand the specific rules that apply. - Is there a limit on how much cryptocurrency I can own?

Currently, there is no legal limit on cryptocurrency ownership in India, but all earnings must be reported for tax purposes. - How do I report cryptocurrency gifts?

Currency received as a gift is generally treated as income and must be reported in your ITR. - Are there any tax benefits for holding cryptocurrency long-term?

Long-term holdings may qualify for reduced capital gains tax rates, but this depends on the specific circumstances of your holdings.