AUTHOR : SAYYED NUZAT

DATE : MAY 11, 2024

Decentralized payment systems are revolutionizing the way financial transactions are conducted globally, and India is no exception. Traditionally, payment systems in India have been centralized, controlled by financial institutions, and regulated by the government. However, with the advent of blockchain technology and the rise of decentralized finance (DeFi), there has been a paradigm shift towards more transparent, secure, and efficient payment solutions.

Introduction to Decentralized Payment Systems

In India, the concept of decentralized payment systems is gaining momentum due to its potential to address several challenges inherent in centralized systems. These challenges include issues of centralization, security concerns, and lack of transparency.

Challenges with Centralized Payment Systems

Centralized payment systems[1] rely on intermediaries such as banks and payment gateways to facilitate transactions[2]. While these systems have served their purpose, they are not without flaws. One of the primary issues is centralization[3], where a single point of control can lead to vulnerabilities and security breaches. Moreover, centralized systems[4] are often opaque, making it difficult for users to track their transactions and understand the fees involved.

Understanding Decentralized Payment Systems

Decentralized payment systems, on the other hand, operate on a peer-to-peer[5] network, eliminating the need for intermediaries. These systems leverage blockchain technology to record and verify transactions in a transparent and immutable manner. By decentralizing control, they offer greater security, transparency, and efficiency.

Blockchain Technology in Decentralized Payment Systems

Blockchain technology serves as the backbone of decentralized payment systems, providing a secure and tamper-proof ledger to record transactions.This ensures the integrity of the system and eliminates the risk of fraud or manipulation.

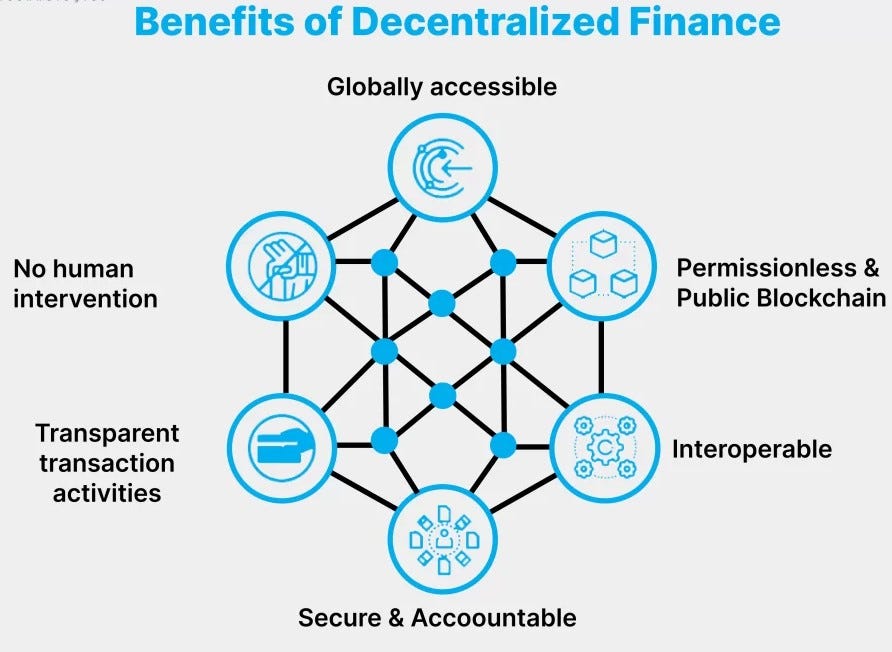

Decentralized Finance (DeFi)

Decentralized finance (DeFi) is a subset of decentralized payment systems that aims to recreate traditional financial services using blockchain technology. In India, the DeFi ecosystem is witnessing rapid growth, with platforms offering a range of services such as lending, borrowing, and trading without the need for intermediaries.

Benefits of Decentralized Payment Systems

The adoption of decentralized payment systems in India offers several benefits. Firstly, it enhances security by eliminating single points of failure and reducing the risk of cyber attacks. Secondly, it promotes transparency and accountability by providing a clear audit trail of transactions. Finally, decentralized systems are often more cost-effective and offer faster transaction speeds compared to traditional payment systems.

Adoption of Decentralized Payment Systems in India

While decentralized payment systems hold immense promise, their adoption in India is still in its early stages. Regulatory challenges and concerns around security and scalability remain significant barriers to widespread adoption. However, with increasing awareness and technological advancements, the future looks promising for decentralized payment systems in India.

Future Outlook

Looking ahead, decentralized payment systems have the potential to revolutionize the Indian financial landscape. By promoting financial inclusion and empowering individuals with greater control over their finances, these systems can drive economic growth and prosperity. As technology continues to evolve, we can expect to see further innovation in the decentralized finance space, paving the way for a more inclusive and equitable financial system.

Conclusion

In conclusion, decentralized payment systems offer a promising alternative to traditional centralized systems in India. By leveraging blockchain technology and embracing principles of decentralization, these systems can address the shortcomings of existing payment infrastructure and pave the way for a more secure, transparent, and efficient financial ecosystem.

FAQs

- Are decentralized payment systems legal in India?

- While there are no explicit regulations governing decentralized payment systems in India, users should exercise caution and stay informed about the evolving regulatory landscape.

- How do decentralized payment systems ensure security?

- Decentralized payment systems leverage cryptography and distributed consensus mechanisms to secure transactions and protect user data from unauthorized access.

- What are some popular decentralized payment platforms in India?

- Currently, there are several emerging decentralized payment platforms in India, including Matic Network, InstaDApp, and WazirX.

- Can decentralized payment systems be scaled to accommodate a large number of transactions?

- Scalability is a key challenge for decentralized payment systems, but ongoing research and development efforts are focused on improving network throughput and efficiency.

- What role do smart contracts play in decentralized payment systems?

- Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In decentralized payment systems, smart contracts automate and enforce transactions without the need for intermediaries.