AUTHOR : SAYYED NUZAT

DATE : MAY 2, 2024

In today’s digital age, the concept of decentralization has gained significant traction, especially in the realm of financial transactions. As the world moves towards greater transparency, security, and accessibility, decentralized payment gateways have emerged as a viable alternative to traditional banking systems. In the context of India, a country with a burgeoning digital economy, the need for decentralized payment solutions has never been more pronounced.

What is a Payment Gateway?

Before delving into decentralized transaction portals, it’s essential to understand the concept of a payment gateway itself. A payment gateway is a technology that facilitates online transactions by securely transferring information between a merchant’s website and the issuing bank to authorize payments.

Understanding Decentralization in Payments

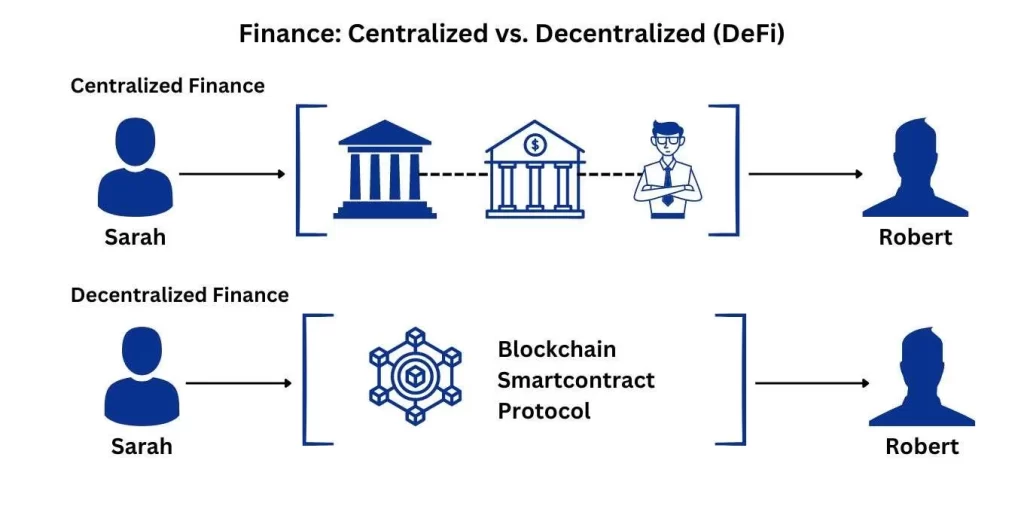

Decentralization, on the other hand, refers to the distribution of power and control away from a central authority. In the context of payment gateways, decentralization involves removing intermediaries like banks and financial institutions from the transaction process, thereby creating a more peer-to-peer system.

The Need for Decentralized Payment Gateways in India

India, with its vast population and rapidly growing digital ecosystem[1], faces several challenges with traditional payment gateways. These challenges include high transaction fees, lengthy processing times, and security concerns. Additionally, regulatory issues often hinder innovation in the payment space, making it difficult for startups and small businesses to thrive.

Benefits of Decentralized Payment Gateways

Decentralized payment gateways offer several advantages over their centralized counterparts. Firstly, they provide greater transparency and security, as transactions are recorded on a public ledger, making them immutable and resistant to tampering. Secondly, decentralized systems[2] typically have lower transaction fees, as they eliminate the need for intermediaries. Finally, decentralized transaction portals offer global accessibility, allowing users to send and receive funds across borders without the need for traditional banking infrastructure.

Key Players in the Decentralized Payment Gateway Market in India

Several players are currently operating in the decentralized payment gateway space in India. These include both established companies leveraging blockchain technology and innovative startups developing new solutions tailored to the Indian market. From cryptocurrency exchanges offering peer-to-peer transactions to decentralized finance[3] (DeFi) platforms enabling lending and borrowing, the ecosystem is diverse and rapidly evolving.

Adoption and Acceptance of Decentralized Payment Gateways in India

While the adoption of decentralized transaction portals is on the rise in India, several challenges remain. One major obstacle is the lack of awareness and understanding among the general population, who may be hesitant to embrace unfamiliar technologies. Additionally, regulatory uncertainty and concerns about security and stability continue to hamper widespread acceptance.

Regulatory Landscape and Future Outlook

The Indian government[4] has yet to formulate a clear stance on decentralized payments, leading to uncertainty within the industry. While some regulators have expressed caution about the potential risks associated with cryptocurrencies and blockchain technology, others see them as catalysts for innovation[5] and financial inclusion. Moving forward, it will be essential for policymakers to strike a balance between fostering innovation and protecting consumers’ interests.

Conclusion

Decentralized payment gateways hold immense promise for revolutionizing the way financial transactions are conducted in India. By offering greater transparency, security, and accessibility, these innovative solutions have the potential to empower millions of individuals and businesses across the country. However, realizing this potential will require collaboration between industry stakeholders, regulators, and policymakers to create a supportive environment for innovation and adoption.

FAQs

- Are decentralized payment gateways legal in India?

- As of now, there is no clear regulatory framework governing decentralized payments in India. However, several startups are operating in the space, leveraging existing regulations or operating in a legal gray area.

- How do decentralized transaction portals differ from traditional transaction portals?

- Traditional payment gateways rely on intermediaries like banks to facilitate transactions, whereas decentralized gateways use blockchain technology to enable peer-to-peer transactions without intermediaries.

- Are decentralized payment gateways more secure than traditional portals?

- Decentralized payment gateways offer enhanced security through encryption and distributed ledger technology, making transactions more resistant to fraud and tampering.

- What are the major challenges facing the adoption of decentralized transaction portals in India?

- Lack of awareness, regulatory uncertainty, and concerns about security and stability are among the main challenges hindering the widespread adoption of decentralized payment gateways in India.

- What is the future outlook for decentralized payment gateways in India?

- The future looks promising, with growing interest from both consumers and businesses in the benefits offered by decentralized payment solutions. However, regulatory clarity and infrastructure development will be key factors shaping the industry’s growth trajectory.