Author : Nuzzu.S

Date : August 30, 2024

Introduction

Cryptocurrency[1] has taken the world by storm, and India is no exception. As more Indians dive into the world of digital currencies[2], understanding the concept of volatility becomes crucial. Volatility in cryptocurrency can be both a blessing and a curse, depending on how you navigate[3] it. In this article, we will break down what cryptocurrency volatility[1] is, why it’s particularly significant in the Indian market, and how you can manage it to your advantage.

What is cryptocurrency volatility?

Definition of Volatility in Finance

Volatility[4] refers to the degree of variation in the price of a financial instrument over time. In simpler terms, it’s the amount of uncertainty or risk related to the size of changes or regulations[5] in an asset’s value. In the world of finance, higher volatility often means that an asset’s price can change dramatically in a short period of time, either positively or negatively.

Volatility in the Cryptocurrency Market

In the cryptocurrency market[2], volatility is a common phenomenon. Unlike traditional financial markets, where prices are influenced by established factors such as company performance or economic[3] indicators, cryptocurrency prices can swing wildly due to a myriad of factors, making the market notoriously unpredictable.

Factors Contributing to High Volatility

Market Speculation

Cryptocurrency markets are heavily driven by speculation. Unlike stocks, which are backed by a company’s assets and earnings, cryptocurrencies[4] often rely on market perception. This speculation can cause significant price swings as traders react to market rumors, news, or even social media trends[5].

Regulatory News

Government regulations, or even the hint of new regulations, can have a massive impact on cryptocurrency prices. In India, the government’s stance on cryptocurrency has been fluctuating, with talks of both banning and regulating the market. This uncertainty adds to the volatility as investors react to the potential for legal changes.

Technological Developments

The technology behind cryptocurrencies is still evolving. Major upgrades or changes in a blockchain network can affect a cryptocurrency’s price. For instance, when a new feature is added or a security flaw is fixed, the value of the related cryptocurrency can spike or plummet, contributing to volatility[3].

The Rise of Cryptocurrency in India

Growing Popularity Among Investors

Cryptocurrency has gained significant traction in India over the past few years. With the rise of digital platforms, more Indians are investing in cryptocurrencies like Bitcoin and Ethereum. The lure of high returns in a relatively short period has attracted a broad spectrum of investors, from tech-savvy millennials to seasoned market players.

Government’s Stance on Cryptocurrency

The Indian government’s approach to cryptocurrency has been a topic of debate. While there have been discussions around banning it, there have also been talks about regulating the market to protect investors. This uncertain regulatory environment contributes to the volatility of cryptocurrencies in India, as investors are left guessing about the future.

Major Cryptocurrencies in India

Bitcoin

Bitcoin remains the most popular cryptocurrency in India. It is often seen as a store of value and a hedge against inflation. However, its price volatility is a double-edged sword, offering both opportunities and risks for investors.

Ethereum

Ethereum is another leading cryptocurrency in the Indian market. Known for its smart contract functionality, Ethereum’s price is also subject to significant volatility, influenced by technological developments and global market trends.

Others (Ripple, Litecoin, etc.)

Apart from Bitcoin and Ethereum, other cryptocurrencies like Ripple (XRP) and Litecoin have also found a place in the Indian market. Each of these has its own unique factors that drive their volatility, from market demand to technological upgrades.

Factors Driving Cryptocurrency Volatility in India

Global Market Influences

Cryptocurrencies are global assets, meaning that events in any part of the world can affect their prices. For instance, if a major cryptocurrency exchange in the US gets hacked or if a country like China imposes new restrictions on crypto trading, the effects are felt in India almost instantly.

Domestic Regulatory Environment

India’s regulatory environment plays a crucial role in driving cryptocurrency volatility. Statements from government officials, proposed bills, and actual legislation all contribute to how investors perceive the future of cryptocurrency in India, leading to price fluctuations.

Investor Sentiment and Market Behavior

In India, as in other parts of the world, cryptocurrency markets are heavily influenced by investor sentiment. Fear, uncertainty, and doubt (often abbreviated as FUD) can cause panic selling, while positive news can lead to buying frenzies. This emotional aspect of trading contributes significantly to volatility.

Impact of Volatility on Indian Investors

Profit Potential vs. Risk

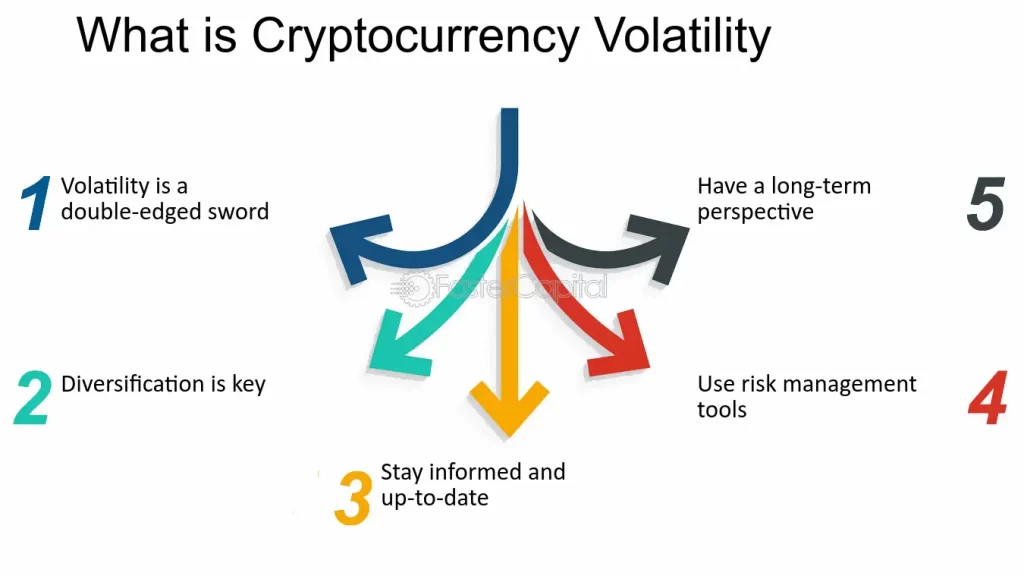

Volatility is a double-edged sword. On one hand, it offers the potential for significant profits; on the other, it presents substantial risks. Indian investors need to weigh these factors carefully, especially those new to the cryptocurrency market.

Impact on Long-Term Investment Strategies

For long-term investors, cryptocurrency volatility can be challenging. The dramatic price swings can test the patience and resolve of even the most seasoned investors. However, those who understand the market’s ebbs and flows may find opportunities for long-term gains.

The Role of Media in Shaping Market Perception

Media coverage plays a pivotal role in shaping investor sentiment. In India, news channels, social media platforms, and online forums are abuzz with cryptocurrency discussions, which can amplify both positive and negative market trends, further driving volatility.

Strategies to Manage Cryptocurrency Volatility

Diversification

One of the most effective ways to manage volatility is through diversification. By spreading investments across different cryptocurrencies and asset classes, Indian investors can reduce their exposure to the risks associated with any single cryptocurrency’s price movements.

Hedging Techniques

Hedging involves taking a position in one market to offset potential losses in another. For instance, Indian investors can use futures contracts or options to hedge their cryptocurrency investments against adverse price movements.

Staying Informed

In the fast-paced world of cryptocurrency, staying informed is key. Indian investors should regularly follow news updates, market trends, and regulatory developments to make informed decisions and manage volatility effectively.

The Future of Cryptocurrency in India

Potential for Growth

Despite the challenges, the future of cryptocurrency in India looks promising. As more people adopt digital currencies, the market is likely to grow, potentially reducing volatility as it matures.

Possible Regulatory Changes

Regulation will play a crucial role in shaping the future of cryptocurrency in India. Clear and consistent policies could help stabilize the market, making it more attractive to both domestic and international investors.

Predictions for Volatility Trends

While it’s impossible to predict the exact nature of future volatility, it’s likely that the cryptocurrency market in India will continue to experience fluctuations. However, as the market matures and more players enter, we may see a gradual reduction in extreme volatility.

Conclusion

Cryptocurrency volatility in India is a complex and multifaceted issue. While it offers significant profit potential, it also presents substantial risks. Indian investors must navigate this landscape with caution, employing strategies like diversification, hedging, and staying informed to manage volatility effectively. As the market continues to evolve, understanding and adapting to these changes will be key to success.

FAQs

What causes cryptocurrency volatility?

Cryptocurrency volatility is caused by a variety of factors, including market speculation, regulatory news, technological developments, and investor sentiment. These factors can lead to dramatic price swings in a short period of time.

How can I protect my investments from volatility?

To protect your investments from volatility, consider diversifying your portfolio, using hedging techniques, and staying informed about market trends and regulatory developments.

Is cryptocurrency a good investment in India?

Cryptocurrency can be a good investment in India for those willing to accept the risks associated with its volatility. However, it’s essential to do thorough research and consider your risk tolerance before investing.

What role does the Indian government play in cryptocurrency regulation?

The Indian government plays a significant role in cryptocurrency regulation. Its stance on the market can influence investor sentiment and market behavior, contributing to volatility.

How does global news affect cryptocurrency prices in India?

Global news can have a significant impact on cryptocurrency prices in India. Events such as regulatory changes in other countries, technological advancements, or major security breaches can cause prices to fluctuate rapidly.