AUTHOR : SAYYED NUZAT

DATE : MAY 4, 2024

Cryptocurrencies have been gaining immense popularity globally, and India is no exception. With the rise of digital currencies, the need for efficient payment gateways has become crucial. In this article, we delve into the world of crypto wallet payment gateways in India, exploring their significance, popular options, setup process, benefits, challenges, and future outlook.

Introduction to Crypto Wallet Payment Gateway

A crypto wallet payment gateway acts as a mediator between merchants and customers, facilitating transactions using cryptocurrencies such as Bitcoin, Ethereum, and others. It enables businesses to accept digital currency payments seamlessly, opening up new avenues for commerce.

Understanding the Need for Crypto Wallet Payment Gateway in India

India has witnessed a surge in cryptocurrency adoption in recent years. As more individuals and businesses embrace digital currencies[1], there is a need for efficient payment solutions. Traditional payment gateways often come with high transaction fees and lengthy processing times, whereas crypto wallet payment gateways offer a faster and more cost-effective alternative.

Popular Crypto Wallet Payment Gateways in India

Coinbase

Coinbase is one of the leading cryptocurrency exchanges globally, known for its user-friendly interface and robust security features. It offers a seamless payment gateway solution for merchants, allowing them to accept various cryptocurrencies with ease.

BitPay

BitPay is another prominent player in the crypto payment gateway space. It provides merchants with a simple yet powerful platform to accept Bitcoin and other digital currencies. With features like invoice tracking and multi-currency support, BitPay[2] caters to the diverse needs of businesses.

CoinSwitch Kuber

CoinSwitch Kuber is gaining popularity among Indian users for its intuitive interface and wide range of supported cryptocurrencies. It offers a hassle-free payment gateway solution, enabling businesses to accept payments in digital assets[3] effortlessly.

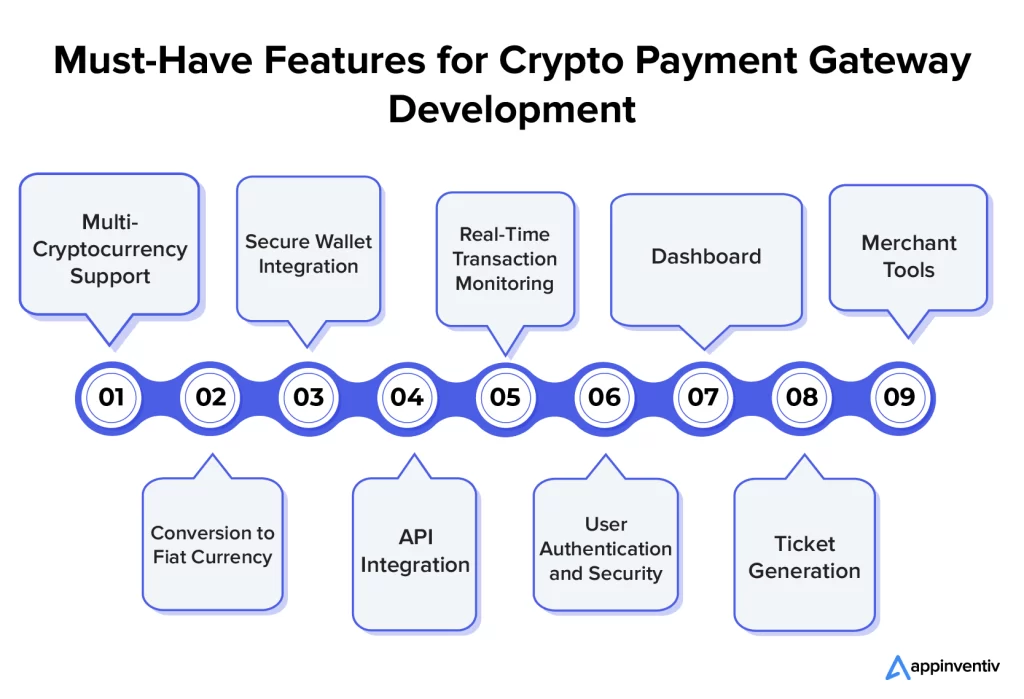

How to Set Up a Crypto Wallet Payment Gateway

Setting up a crypto wallet[4] payment gateway involves a few simple steps:

Creating an Account

Sign up for an account on your chosen platform and complete the verification process.

Linking Bank Accounts

Connect your bank account[5] to facilitate seamless fiat currency transactions.

Security Measures

Implement robust security measures such as two-factor authentication and cold storage to safeguard your digital assets.

Benefits of Using Crypto Wallet Payment Gateway

Lower Transaction Fees

Crypto wallet payment gateways typically have lower transaction fees compared to traditional payment methods, saving businesses money in the long run.

Faster Transactions

Transactions conducted through crypto wallet payment gateways are processed faster, enabling quicker settlements for merchants.

Global Access

Cryptocurrencies transcend geographical boundaries, providing businesses with access to a global customer base without the hassle of currency conversions.

Challenges and Concerns

While crypto wallet payment gateways offer numerous benefits, they also pose certain challenges and concerns:

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies in India is still evolving, leading to uncertainty among businesses and investors.

Security Risks

Security remains a major concern in the crypto space, with incidents of hacking and fraud posing risks to users’ funds.

Volatility

The inherent volatility of cryptocurrencies can pose challenges for businesses looking to hedge against price fluctuations.

Future Outlook of Crypto Wallet Payment Gateway in India

Despite the challenges, the future looks promising for crypto wallet payment gateways in India. As regulatory clarity improves and awareness grows, more businesses are likely to embrace digital currencies as a viable payment option.

Conclusion

Crypto wallet payment gateways offer a convenient and cost-effective solution for businesses seeking to accept digital currency payments. With the rise of cryptocurrency adoption in India, these gateways play a crucial role in driving the future of commerce. By understanding the benefits, challenges, and setup process, businesses can leverage crypto payments to enhance their operations and reach a broader audience.

FAQs

- Are crypto wallet payment gateways legal in India?

- While the regulatory landscape is still evolving, there are currently no specific laws prohibiting the use of crypto wallet payment gateways in India.

- Can I convert cryptocurrencies to fiat currency using these gateways?

- Yes, most crypto wallet payment gateways allow users to convert digital currencies into fiat currency for easy withdrawal to their bank accounts.

- Are crypto transactions on these gateways secure?

- Crypto wallet payment gateways employ various security measures such as encryption and two-factor authentication to ensure the safety of transactions.

- Do I need technical expertise to set up a crypto wallet payment gateway?

- No, most platforms offer user-friendly interfaces that make the setup process straightforward, even for non-technical users.

- What are the advantages of accepting crypto payments for businesses?

- Accepting crypto payments can lower transaction fees, speed up transactions, and provide access to a global customer base, among other benefits.