AYAKA SHAIKH

DATE : 15/02/2024

Introduction

In essence, crypto payment providers[1] are third-party services that facilitate the acceptance of cryptocurrencies[2] as payment for goods and services. They bridge the gap between merchants and customers by offering a secure and user-friendly platform for conducting transactions.

Why use crypto payment providers?

The adoption of crypto payment providers offers several advantages over traditional payment methods. [3]Firstly, they provide a decentralized[4] and borderless payment solution, eliminating the need for intermediaries such as banks. Additionally, transactions conducted through them are often faster and more cost-effective compared to traditional banking systems[5].

Popular Crypto Payment Providers

Coinbase Commerce

Coinbase[1] Commerce is a leading crypto payment provider that enables businesses to accept various cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. With its easy-to-use interface and seamless integration options, Coinbase Commerce has gained popularity among merchants worldwide.

BitPay

With features like instant conversion to fiat currency and support for multiple languages, BitPay has become a preferred choice for businesses looking[2] to embrace cryptocurrency payments.

CoinGate

CoinGate stands out for its wide range of supported cryptocurrencies and comprehensive[3] payment gateway solutions. From e-commerce plugins to API integrations, CoinGate caters to businesses of all sizes, making it easier for them to accept digital currency payments.

How Crypto Payment Providers Work

Crypto payment providers streamline the process of accepting cryptocurrency[4] payments through various mechanisms.

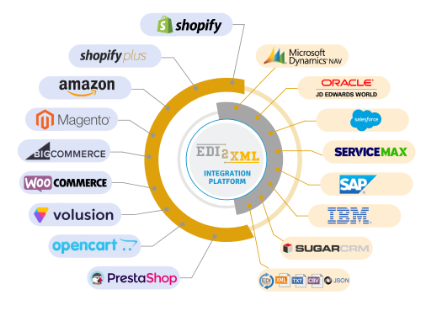

Integration with E-commerce Platforms

Most crypto payment providers offer plugins and APIs that seamlessly integrate with popular e-commerce platforms like Shopify, WooCommerce, and Magento. This integration allows merchants to accept cryptocurrency payments directly through their online stores.

Accepting Multiple Cryptocurrencies

One of the key features of crypto payment providers is their support for multiple cryptocurrencies. Whether it’s Bitcoin, Ethereum, or Ripple, merchants can offer their customers a wide range of payment options, enhancing convenience[5] and accessibility.

Conversion to Fiat Currency

To mitigate the volatility associated with cryptocurrencies, many payment providers offer instant conversion to fiat currency at the point of sale. This feature allows merchants to receive payments in their preferred currency, minimizing exposure to price fluctuations.

Benefits of Using Crypto Payment Providers

Lower Transaction Fees

typically charge lower transaction fees compared to traditional payment processors. This can result in significant cost savings for businesses, especially those operating on thin profit margins.

Global Accessibility

By embracing cryptocurrencies as a means of payment, businesses open the door to a worldwide clientele, unrestricted by the limitations of conventional banking structures.

Crypto payments are borderless and can be processed quickly, enabling seamless transactions across geographical boundaries.

Enhanced Security

Cryptocurrency transactions are encrypted and decentralized, offering a higher level of security compared to traditional payment methods. With features like immutable blockchain technology and multi-signature wallets, they prioritize the security and privacy of their users’ funds.

Volatility of Cryptocurrency Prices

The value of cryptocurrencies can fluctuate dramatically, posing a risk to both merchants and customers. To mitigate this risk, businesses may choose to convert cryptocurrency payments to fiat currency immediately or employ hedging strategies to manage price volatility.

Regulatory Compliance

The regulatory landscape surrounding cryptocurrencies is constantly evolving, with authorities around the world imposing varying levels of oversight and compliance requirements. Businesses must stay informed about the latest regulations and ensure compliance to avoid legal and financial repercussions.

Steps to Integrate Crypto Payment Providers

In today’s digital age, the integration of blockchain has become increasingly crucial for businesses looking to expand their payment options and cater to a growing audience of cryptocurrency users. This article will guide you through the steps involved in seamlessly integrating crypto payment providers into your business operations.

Case Studies of Successful Integration

Several businesses have successfully integrated it into their operations, resulting in increased sales and customer satisfaction. From small online retailers to multinational corporations, the adoption of cryptocurrencies has proven to be a strategic advantage in today’s digital economy.

Future Trends in Crypto Payment Providers

The future looks promising, with ongoing innovations and developments aimed at improving scalability, interoperability, and the user experience. As the adoption of cryptocurrencies continues to grow, we can expect to see more advanced payment solutions and integrations emerge in the market.

Conclusion

In conclusion, crypto payment providers play a crucial role in facilitating the mainstream adoption of cryptocurrencies as a viable form of payment. By offering businesses and individuals a secure, efficient, and cost-effective way to transact in digital assets, these providers are driving innovation and reshaping the future of finance.

FAQs

- Are secure? Yes, prioritize security and employ advanced encryption technologies to safeguard transactions and user funds.

- Can I accept multiple cryptocurrencies with a single payment provider? Many crypto payment providers support multiple cryptocurrencies, allowing businesses to offer their customers a wide range of payment options.

- How long does it take to integrate a crypto payment provider into my website? The integration process varies depending on the provider and your technical expertise, but it can typically be completed within a few hours to a few days.

- Do I need to convert cryptocurrency payments to fiat currency immediately? While some businesses choose to convert cryptocurrency payments to fiat currency immediately to mitigate price volatility, others may hold onto digital assets as part of their investment strategy.

- Are there any fees associated with using crypto payment providers? While some providers may charge transaction