AUTHOR : SAYYED NUZAT

DATE : May 3, 2024

In recent years, the landscape of financial transactions in India has witnessed a significant transformation with the advent of cryptocurrency payment processing. As the world becomes increasingly digital, the demand for alternative payment methods has surged, leading to the emergence of cryptocurrencies as a viable option. In this article, we delve into the intricacies of crypto payment processing in India, exploring its benefits, challenges, and future prospects.

Introduction to Crypto Payment Processing

Crypto payment processing refers to the use of cryptocurrencies such as Bitcoin, Ethereum, and Ripple for facilitating transactions. Unlike traditional fiat[1] currencies, cryptocurrencies operate on decentralized networks based on blockchain technology, offering a secure and transparent means of conducting financial transactions.

Current Scenario of Crypto in India

The legal status of cryptocurrencies in India has been a topic of debate and contention. While the Reserve Bank of India (RBI) has expressed concerns about the risks associated with cryptocurrencies, there is no blanket ban on their usage. Despite regulatory uncertainties, an increasing number of businesses in India are starting to accept cryptocurrencies[2] as a form of payment.

Benefits of Crypto Payment Processing

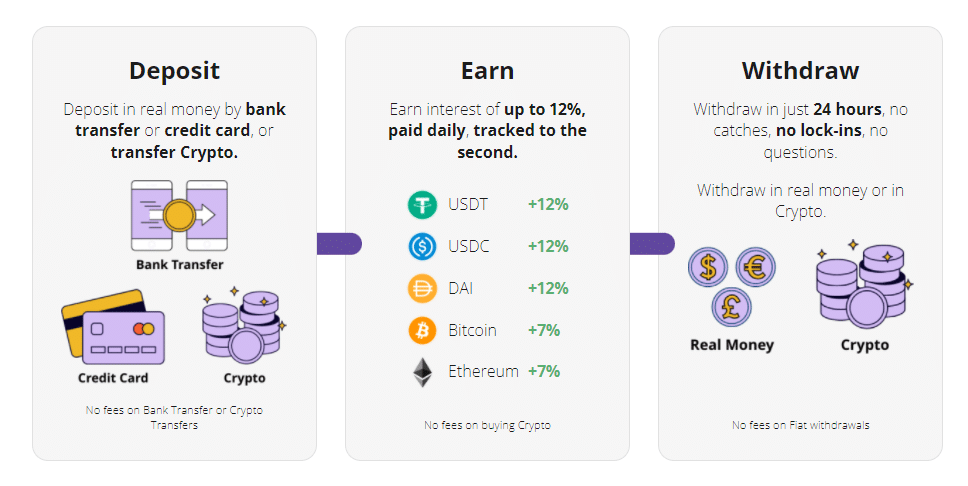

One of the key advantages of cryptographic payment processing is enhanced security and transparency. Transactions conducted on blockchain networks are encrypted and immutable, minimizing the risk of fraud[3] and unauthorized access. Additionally, crypto transactions typically incur lower fees compared to traditional payment methods, making them cost-effective for both businesses and consumers. Furthermore, cryptocurrencies offer global accessibility, allowing users to transact across borders without the need for intermediaries.

Challenges of Crypto Payment Processing in India

However, the adoption of crypto payment[4] processing in India faces several challenges. Regulatory uncertainty remains a major impediment, with the government yet to formulate a clear framework for the regulation of cryptocurrencies. Moreover, there is a lack of awareness and understanding among the general population about the benefits and risks of using cryptocurrencies. Additionally, the inherent volatility of cryptocurrencies poses a challenge for businesses looking to integrate them into their payment systems.

Popular Cryptocurrencies Used for Payment Processing

Several cryptocurrencies are commonly used for payment processing[5] in India, including Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). These cryptocurrencies offer different features and functionalities, catering to diverse user preferences and requirements.

How Crypto Payment Processing Works

Crypto payment processing relies on blockchain technology, which ensures the secure and transparent recording of transactions. Each transaction is verified and added to a decentralized ledger by network participants known as miners. Users store their cryptocurrencies in digital wallets, which are protected by cryptographic keys. When making a payment, users provide their wallet address to the recipient, who then verifies the transaction and processes it accordingly.

Major Players in the Indian Crypto Payment Processing Industry

In India, several companies specialize in crypto payment processing, offering services such as payment gateways, merchant solutions, and exchange platforms. These players play a crucial role in facilitating the adoption of cryptocurrencies among businesses and consumers.

Steps to Implement Crypto Payment Processing for Businesses

Businesses looking to implement crypto payment processing need to take several steps to ensure a smooth transition. This includes educating employees and customers about cryptocurrencies, integrating payment gateways that support crypto transactions, and ensuring compliance with regulatory requirements.

Case Studies: Successful Implementation of Crypto Payment Processing

Numerous businesses in India have successfully integrated crypto payment processing into their operations. E-commerce platforms, freelancers, and remittance services are among the sectors that have benefited from the adoption of cryptocurrencies, enabling faster, cheaper, and more secure transactions.

Future of Crypto Payment Processing in India

Despite the challenges, the future of crypto payment processing in India appears promising. With increasing adoption and acceptance, cryptocurrencies are poised to disrupt traditional banking systems and reshape the financial landscape. However, the extent of their impact will depend on regulatory developments and market dynamics.

Risks Associated with Crypto Payment Processing

It’s essential to acknowledge the risks associated with crypto payment processing, including security breaches, legal implications, and market fluctuations. Businesses and consumers alike need to exercise caution and implement robust security measures to mitigate these risks effectively.

Educational Resources for Crypto Payment Processing

For businesses interested in adopting crypto payment processing, there are various educational resources available, including online courses, industry forums, and consultancy services. These resources can help navigate the complexities of cryptocurrencies and make informed decisions.

Adoption of Crypto Payment Processing in Different Sectors

The adoption of crypto payment processing extends beyond traditional industries, with sectors such as retail, travel, and online gaming embracing cryptocurrencies as a means of payment. As awareness and acceptance grow, the scope for innovation and integration will continue to expand.

Consumer Perspective on Crypto Payments

From a consumer standpoint, trust, ease of use, and comparison with traditional payment methods are crucial factors influencing the adoption of crypto payments. Overcoming skepticism and building confidence in cryptocurrencies will be essential for driving widespread adoption.

Conclusion

In conclusion, crypto payment processing holds immense potential to revolutionize the way financial transactions are conducted in India. Despite the challenges and uncertainties, the benefits of cryptocurrencies in terms of security, transparency, and efficiency cannot be overlooked. As businesses and consumers alike embrace this technology, the future of crypto payment processing in India looks promising.

Unique FAQs

- Is it legal to use cryptocurrencies for payment processing in India?

- While there is no blanket ban on the use of cryptocurrencies, regulatory clarity is still lacking. Businesses should stay updated on the latest developments and ensure compliance with relevant regulations.

- How can businesses integrate crypto payment processing into their operations?

- Businesses can integrate crypto payment processing by partnering with payment processors that support cryptocurrency transactions, educating their employees and customers, and implementing robust security measures.

- What are the risks associated with crypto payment processing?

- Risks include security breaches, regulatory uncertainty, and market volatility. It’s essential for businesses to conduct thorough risk assessments and implement appropriate risk management strategies.

- Which industries are leading the adoption of crypto payment processing in India?

- E-commerce, freelancing, and remittance services are among the sectors leading the adoption of crypto payment processing in India, leveraging its benefits for faster, cheaper, and more secure transactions.

- What role do regulations play in the future of crypto payment processing in India?

- Regulations will play a crucial role in shaping the future of crypto payment processing in India. Clarity and consistency in regulatory frameworks are essential for fostering trust and confidence among businesses and consumers.