AUTHOR : SAYYED NUZAT

DATE: May 5, 2024

Introduction to Crypto Payment Gateways

In recent years, the adoption of cryptocurrencies has been on the rise globally, and India is no exception. As businesses and consumers increasingly embrace digital transactions, the need for efficient payment solutions has become paramount. This has led to the emergence of crypto payment gateways, which offer a secure and seamless way to send and receive digital currencies.

The Growth of Cryptocurrency in India

Despite regulatory uncertainties, the popularity of cryptocurrencies in India has been steadily growing. With a large population and a tech-savvy youth demographic, India presents fertile ground for the expansion of digital currencies. However, the regulatory environment surrounding cryptocurrencies remains unclear, posing challenges for businesses and investors.

Why India Needs Crypto Payment Gateways

In India, traditional payment methods often come with high transaction fees and long processing times. Moreover, the reliance on centralized financial institutions[1] can lead to censorship[2] and restrictions. Crypto payment gateways offer a decentralized alternative that provides greater freedom and efficiency in conducting transactions.

Key Features of Crypto Payment Gateways

One of the key features of crypto payment gateways is their focus on security. By leveraging blockchain technology, these gateways ensure that transactions are secure and tamper-proof. Additionally, crypto payments are processed instantly, eliminating the need for lengthy verification processes. Furthermore, transaction fees are typically lower compared to traditional payment methods, making them more cost-effective for businesses.

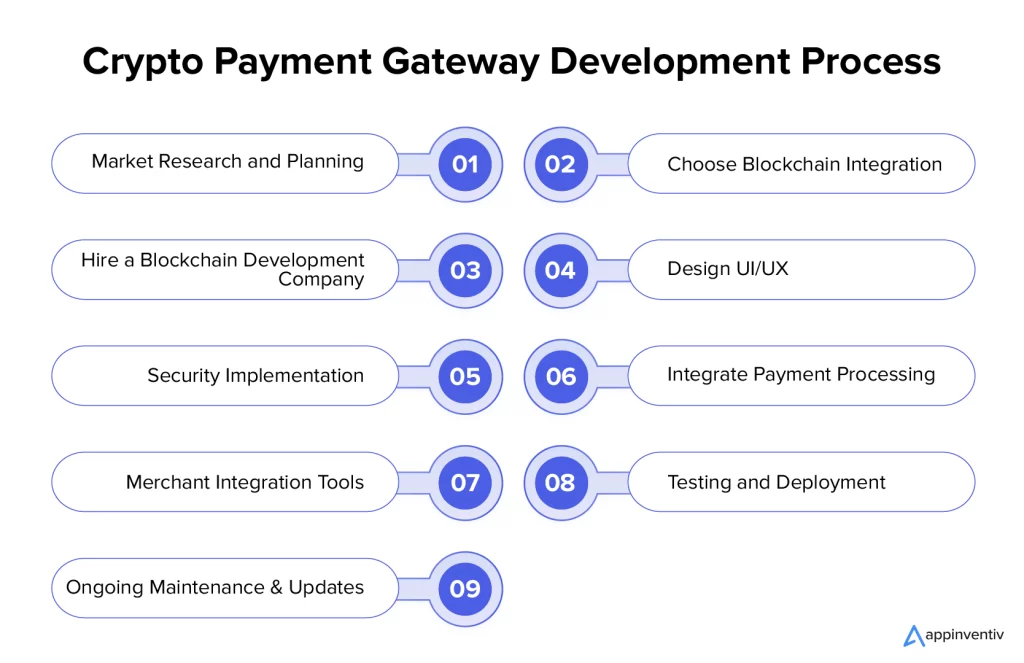

Steps to Develop a Crypto Payment Gateway

Creating a crypto payment gateway necessitates meticulous[3] strategizing and precise implementation. It begins with thorough research into the market demand and regulatory landscape. Collaborating with experienced blockchain developers is essential for building a robust and scalable platform. Furthermore, ensuring compliance with existing regulations is crucial to avoid legal complications.

Use Cases of Crypto Payment Gateways in India

Crypto payment gateways have a wide range of applications in India. They can be integrated into e-commerce platforms, allowing merchants to accept digital currencies as payment for goods and services. Additionally, crypto remittance services enable users to send money across borders quickly and inexpensively. Moreover, freelancers[4] can benefit from crypto payments, as they provide a hassle-free way to receive payments from clients worldwide.

Challenges and Risks

Despite their potential, crypto payment gateways face several challenges and risks in India. The regulatory uncertainty surrounding cryptocurrencies creates a level of unpredictability for businesses operating in this space. Moreover, security concerns such as hacking and fraud remain prevalent. Additionally, the volatile nature of cryptocurrencies[5] poses risks for both businesses and consumers.

Future Outlook

Despite these challenges, the future outlook for crypto payment gateways in India is promising. As regulatory clarity improves and awareness of cryptocurrencies grows, the demand for crypto payment solutions is expected to increase. Moreover, crypto payment gateways have the potential to play a significant role in financial inclusion, providing access to financial services for underserved populations.

Conclusion

In conclusion, the development of crypto payment gateways represents a significant step forward in India’s digital economy. By offering a secure, efficient, and cost-effective alternative to traditional payment methods, crypto payment gateways have the potential to revolutionize the way transactions are conducted. With the right regulatory framework and technological infrastructure in place, India can capitalize on the opportunities presented by cryptocurrencies and propel its economy into the digital age.

FAQs

- Are crypto payment gateways legal in India?

- The legality of crypto payment gateways in India remains a gray area due to regulatory uncertainties. However, many businesses are operating in this space, albeit with caution.

- How secure are cryptographic payment gateways?

- Crypto payment gateways leverage blockchain technology to ensure the security of transactions.

Nevertheless, it’s essential for users to remain cautious and implement optimal security measures to protect their digital holdings.

- Crypto payment gateways leverage blockchain technology to ensure the security of transactions.

- What are the advantages of using crypto payment gateways for businesses?

- Crypto payment gateways offer lower transaction fees, faster processing times, and greater security compared to traditional payment methods. They also enable businesses to access new markets and customer bases.

- Can individuals use crypto payment gateways for personal transactions?

- Yes, individuals can use crypto payment gateways to send and receive digital currencies for personal transactions, such as remittances or online purchases.

- What is the future of crypto payment gateways in India?

- The future of crypto payment gateways in India depends largely on regulatory developments and market acceptance. With the right conditions in place, they have the potential to become a mainstream payment solution in the country.