AUTHOR : EMILY

DATE : 24/08/2024

Introduction

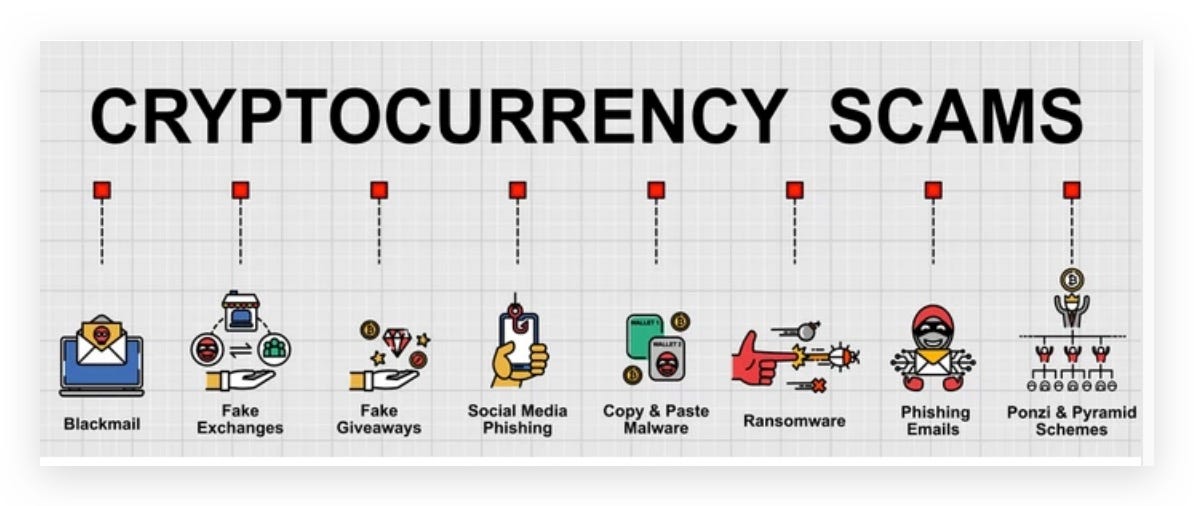

Cryptocurrency[1] has taken the world by storm, and India is no exception. As more Indians venture into digital assets, there’s been a significant increase in crypto-related scams across[2] the country. With limited awareness and the allure of quick returns, many individuals have fallen prey to fraudulent schemes. Understanding these scams is crucial to protecting your investments and avoid[3] becoming a victim. In this blog, we’ll explore some of the most common cryptocurrency scams in India, how they work, and what you can do to safeguard your assets.

1. Ponzi Schemes and Multi-Level Marketing (MLM) Scams

Ponzi schemes[4] and MLM scams are among the most prevalent types of fraud in the cryptocurrency world. These scams promise high returns with little to no risk, attracting investors who are eager to make quick profits. In such schemes, the returns are paid out to earlier investors using the funds contributed by new participants. The cycle continues until the scam collapses when the flow of new money dries up.

Example: Gain Bitcoin[5], one of the biggest Ponzi schemes in India, lured investors with the promise of huge returns. The scam ran for years before collapsing, leading to losses for thousands of investors.

2. Fake Initial Coin Offerings (ICOs) and Token Sales

Initial Coin Offerings (ICOs) were a popular way for blockchain projects to raise funds. However, scammers exploited this trend by launching fake ICOs or selling worthless tokens. In these scams, fraudsters create a fictitious cryptocurrency project, complete with a website, whitepaper, and marketing campaigns. They then ask investors to buy tokens in exchange for established cryptocurrencies like Bitcoin or Ethereum.

Example: In 2018, India witnessed several fraudulent ICOs that promised returns and exclusive benefits. Many investors ended up losing their funds as the projects turned out to be scams with no real product or utility.

3. Phishing Attacks

Phishing is one of the most common scams in the digital space, and it has found its way into the world of cryptocurrencies. In a phishing attack, scammers create fake websites or send emails that appear to be from legitimate exchanges, wallets, or service providers[1]. The goal is to trick users into revealing their private keys, seed phrases, or login credentials.

Example: Many Indian users have reported receiving emails or messages that appear to be from popular crypto exchanges like WazirX or CoinDCX. These emails often contain a link to a fake website designed to steal login credentials or prompt users to download malware.

4. Fake Cryptocurrency Exchanges

Scammers often set up fake cryptocurrency exchanges[2] that look almost identical to legitimate ones. These exchanges lure users with attractive rates, low fees, or exclusive offers. Once users deposit their funds, they are either unable to withdraw or the exchange simply shuts down, taking the funds with them.

Example: In India, several fake exchanges have surfaced that promise huge discounts on Bitcoin purchases. Investors deposit money only to find out that the exchange is fake, resulting in significant losses.

5. Pump and Dump Schemes

Pump and dump schemes are rampant in the cryptocurrency market, especially with lesser-known altcoins. In such a scheme, a group of people coordinate to artificially inflate the price of a specific cryptocurrency by buying large amounts of it. They also spread positive news and hype on social media or messaging platforms like Telegram.

Example: Several Indian crypto communities[3] on Telegram have been involved in pump and dump schemes targeting small-cap tokens. New investors often get caught in the trap, losing their funds in the process.

6. Fake Celebrity Endorsements

Another common scam involves the use of fake celebrity endorsements. Scammers create advertisements or social media posts claiming that famous personalities have invested in or endorse a particular cryptocurrency project. They may even use doctored images or videos to make their claims appear legitimate.

Example: In India, scams have been reported where fake ads featuring Bollywood actors and cricketers promoted fraudulent crypto projects, convincing many to invest based on false endorsements.

7. Rug Pull Scams in Decentralized Finance (DeFi)

Decentralized Finance[4] (DeFi) has gained immense popularity, but it has also become a breeding ground for scams. A rug pull occurs when the developers of a DeFi project suddenly withdraw all liquidity, leaving investors with worthless tokens. These projects are often launched quickly with little oversight, making it easy for scammers to exit once they’ve gathered enough funds.

Example: In recent years, several rug-pull incidents have been reported in India where DeFi projects disappeared overnight, leaving investors with massive losses.

8. Fake Mining Operations and Cloud Mining Scams

Mining scams are another common type of cryptocurrency fraud in India. Scammers set up fake cloud mining operations, promising users a share of the profits in exchange for an upfront investment. They claim that users can earn passive income by investing in mining equipment or cloud mining services.

Example: Several Indian platforms have promised high returns from cloud mining contracts, only to shut down after collecting a substantial amount from investors.

How to Protect Yourself from Cryptocurrency Scams

While the crypto space is full of opportunities, it’s essential to be cautious. Here are some strategies to safeguard yourself against scams:

- Research Thoroughly: Always conduct detailed research before investing in any cryptocurrency project or platform. Verify the legitimacy of websites, whitepapers, and team members.

- Avoid unrealistic promises: If an investment opportunity[5] seems too good to be true, it probably is. Be wary of promises of guaranteed high returns with little to no risk.

- Use Reputable Exchanges: Stick to well-known and regulated exchanges when buying or trading cryptocurrencies. Avoid unknown platforms that offer overly attractive rates.

- Secure Your Wallets: Use hardware wallets or trusted software wallets to store your cryptocurrencies. Keep your private keys and seed phrases confidential and never disclose them to anyone.

- Verify Sources: Double-check URLs, email addresses, and social media profiles to ensure they are legitimate before entering any sensitive information.

- Be cautious with social media. Scammers often use social media platforms to promote fraudulent schemes. Don’t rely solely on social media for investment advice.

- Stay Updated: Keep yourself informed about the latest trends and scams in the cryptocurrency world by following reliable news sources and online communities.

Conclusion

Cryptocurrency scams in India are on the rise, targeting both new and experienced investors. By understanding the common types of fraud and exercising caution, you can significantly reduce the risk of falling victim to these schemes. Always prioritize security and research before making any investments in the cryptocurrency space. With the right knowledge and vigilance, you can navigate the world of digital assets safely and make informed decisions.

Common Cryptocurrency Scams in India: FAQs

1. What are the most common cryptocurrency scams in India?

The most common cryptocurrency scams in India include Ponzi schemes, fake initial coin offerings (ICOs), phishing attacks, fake exchanges, pump and dump schemes, fake celebrity endorsements, rug pulls in DeFi projects, and cloud mining scams.

2. How can I identify a Ponzi scheme or MLM scam?

Ponzi schemes typically guarantee high returns with minimal or no risk. If a platform heavily focuses on recruitment, offers guaranteed profits, or requires continuous reinvestment to earn rewards, it could be a Ponzi scheme.

3. What should I do to avoid falling for phishing scams?

Always verify the URL of websites you visit and avoid clicking on links from unknown emails or messages. Use official apps and double-check any communication that asks for your login credentials or private keys.

4. Are fake cryptocurrency exchanges common in India?

Yes, fake exchanges are increasingly common in India. These exchanges often offer attractive rates but disappear once they’ve collected deposits. Always use well-known, reputable exchanges with positive reviews.

5. What is a pump and dump scheme, and how can I avoid it?

In a pump-and-dump scheme, fraudsters drive up the price of a cryptocurrency through exaggerated promotion and then offload their assets, leading to a sharp price decline. Avoid investing in lesser-known or new coins without doing thorough research.