AUTHOR : SAYYED NUZAT

DATE : APRIL 25, 2024

In today’s digital age, where transactions are increasingly conducted online, the need for secure, efficient, and cost-effective payment solutions has never been greater. Traditional payment systems, while widely used, often come with inherent vulnerabilities and limitations. However, with the advent of blockchain technology, a new era of payment processing has emerged, promising enhanced security, transparency, and decentralization. In this article, we delve into the world of blockchain payment processors, exploring their significance, features, implementation, and future prospects.

Understanding Blockchain Technology

What is Blockchain?

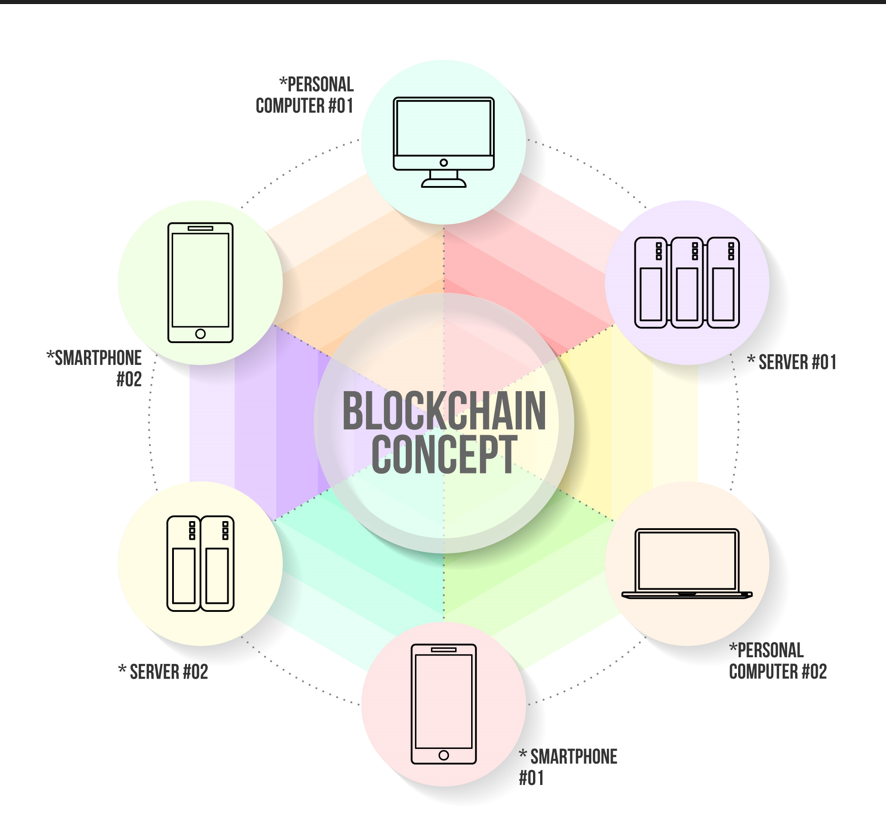

Blockchain functions as a decentralized ledger system, meticulously documenting transactions across numerous computers with both security and transparency at the forefront. Each individual transaction, commonly referred to as a “block,” is intricately connected through cryptographic means to its predecessor, thereby constructing an unbroken sequence of interconnected blocks.

How Does Blockchain Work?

Transactions are validated and added to the blockchain through a consensus mechanism, such as Proof of Work or Proof of Stake. Once inscribed, transactions become immutable entities, signifying their incapacity for alteration or removal from the ledger.

The Need for Blockchain Payment Processors

Security Concerns in Traditional Payment Systems

Traditional payment systems are susceptible to fraud, hacking, and data breaches, posing risks to both consumers and merchants. Blockchain offers a decentralized and tamper-proof solution to mitigate these risks.

Advantages of Blockchain in Payments

Blockchain technology eliminates the need for intermediaries, reduces transaction costs, and ensures faster settlement times. Moreover, the transparent nature of blockchain[1] enhances trust and accountability in the payment process.

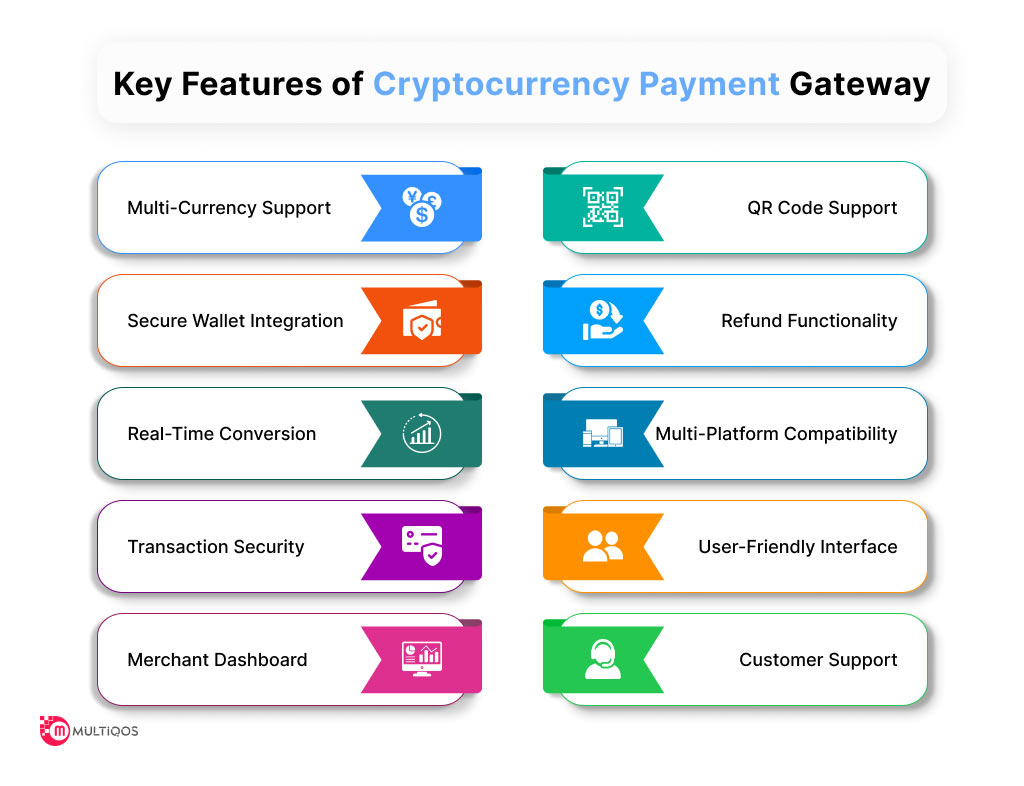

Key Features of Blockchain Payment Processors

Cryptocurrency payment gateways offer several unique features that distinguish them from traditional payment solutions.

Transparency and Immutability

Transactions on the blockchain are transparent and traceable, allowing for greater visibility into the payment process. Additionally, once recorded, transactions are immutable, preventing fraudulent activities.

Decentralization

Blockchain payment processors operate on a decentralized[2] network, removing the need for central authorities or intermediaries. This decentralization ensures greater resilience and security against system failures or malicious attacks.

Low Transaction Fees

Compared to traditional payment processors, blockchain-based solutions typically have lower transaction fees, making them more cost-effective for both merchants and consumers.

Popular Blockchain Payment Processors

Several blockchain payment processors[3] have gained prominence in the market, offering a range of services tailored to different needs.

BitPay

BitPay is one of the leading cryptocurrency payment gateways, enabling businesses to accept Bitcoin and other cryptocurrencies as payment.

Coinbase Commerce

Coinbase Commerce allows merchants to accept various cryptocurrencies directly into their Coinbase accounts, offering seamless integration and easy-to-use tools.

CoinGate

CoinGate supports over 50 cryptocurrencies and provides plugins for popular e-commerce platforms like WooCommerce and Magento, making it simple for businesses to accept digital payments.

Integrating Blockchain Payment Processors

Blockchain payment processors can be integrated into various platforms and industries to facilitate seamless transactions.

E-commerce Platforms

Integrating cryptocurrency payment gateways into e-commerce platforms allows merchants to accept cryptocurrencies as payment for goods and services[4], expanding their customer base and increasing sales.

Retail Stores

Blockchain payment processors can be used in retail stores to accept cryptocurrency payments through mobile apps or point-of-sale terminals, offering customers more payment options and flexibility.

Service Providers

Service providers, such as freelancers or consultants, can leverage cryptocurrency payment gateways to accept payments from clients worldwide, bypassing traditional banking systems and currency conversion fees.

Steps to Implement Blockchain Payment Processors

Implementing blockchain payment processors involves several key steps to ensure successful integration and operation.

Selecting the Right Processor

Choose a blockchain payment processor that aligns with your business needs, considering factors such as supported cryptocurrencies, integration options, and fees.

Integration Process

Integrate the selected payment processor into your existing systems or platforms, following the provided documentation and guidelines for seamless integration.

Testing and Deployment

Thoroughly test the payment processor to ensure compatibility, security[5], and functionality before deploying it live. Monitor transactions and performance to identify any issues and optimize the process as needed.

Challenges and Limitations

Despite the benefits of a cryptocurrency payment gateway, there are several challenges and limitations to consider.

Regulatory Hurdles

Regulatory uncertainty surrounding cryptocurrencies and blockchain technology can pose challenges for businesses seeking to adopt cryptocurrency payment gateways, particularly in terms of compliance and legal frameworks.

Volatility of Cryptocurrencies

The volatile nature of cryptocurrencies can introduce risks for merchants and consumers, impacting pricing, settlement times, and financial stability.

Scalability Issues

Blockchain networks face scalability issues, particularly during periods of high transaction volume, leading to delays and increased fees. Addressing scalability concerns is crucial for the widespread adoption of blockchain payment processors.

Future Outlook of Blockchain Payment Processors

Despite the challenges, the future outlook for cryptocurrency payment gateways remains promising, with potential growth opportunities and innovations on the horizon.

Potential Growth Opportunities

As blockchain technology continues to mature and gain acceptance, the demand for blockchain payment processors is expected to rise, particularly in industries such as e-commerce, fintech, and remittances.

Innovations in the Industry

Technological advancements, such as layer 2 solutions and interoperability protocols, are addressing scalability and usability issues, paving the way for a more efficient and user-friendly cryptocurrency payment gateway.

Conclusion

Blockchain payment processors represent a paradigm shift in the way we transact online, offering enhanced security, transparency, and efficiency compared to traditional payment systems. By leveraging the power of blockchain technology, businesses can streamline their payment processes, expand their customer base, and stay ahead in a rapidly evolving digital economy.

FAQs

- Are blockchain payment processors secure?

- Yes, blockchain payment processors offer enhanced security through decentralized networks and cryptographic algorithms, making them resistant to fraud and hacking.

- Can I accept multiple cryptocurrencies with a cryptocurrency payment gateway?

- Yes, many blockchain payment processors support multiple cryptocurrencies, allowing merchants to accept a wide range of digital assets.

- How long does it take to integrate a cryptocurrency payment gateway into my website?

- The integration process varies depending on the chosen processor and the complexity of your website. However, most processors offer easy-to-follow documentation and support to streamline the integration process.

- Are there any fees associated with using blockchain payment processors?

- While blockchain payment processors typically have lower transaction fees compared to traditional payment systems, there may be fees associated with currency conversion, withdrawals, or other additional services.

- What measures can I take to mitigate the risks of cryptocurrency volatility?

- To mitigate the risks of cryptocurrency volatility, consider implementing strategies such as hedging, diversification, or using stablecoins pegged to fiat currencies.