AUTHOR : SAYYED NUZAT

DATE : MAY 8, 2024

Blockchain technology has been making waves across various industries, and its application in the financial sector is particularly noteworthy. In India, where the digital payment landscape is rapidly evolving, blockchain payment gateways are emerging as a disruptive solution poised to revolutionize the way transactions are conducted.

Introduction to Blockchain Payment Gateway

Blockchain technology, the underlying innovation behind cryptocurrencies like Bitcoin, is essentially a decentralized and distributed ledger system. It records transactions across multiple computers in such a way that the ledger cannot be altered retroactively without the alteration of all subsequent blocks, ensuring transparency and security.

In India, the adoption of digital payment solutions has been on the rise, driven by factors such as government initiatives like Digital India and the increasing penetration of smartphones and internet connectivity. Nevertheless, conventional payment portals encounter obstacles like exorbitant transaction charges, apprehensions regarding security, and a deficiency in transparency.

Challenges in Traditional Payment Gateways

Traditional payment gateways often entail hefty transaction fees, especially for cross-border transactions, which can eat into businesses’ profit margins[1]. Moreover, security breaches and data privacy issues have raised concerns among consumers and businesses alike. The centralized nature of traditional gateways also leads to a lack of transparency, with opaque processes and delayed settlement times.

Blockchain Payment Gateway Solution

Blockchain payment gateways offer a compelling solution to these challenges by leveraging the inherent features of blockchain technology. These gateways facilitate peer-to-peer transactions[2] without the need for intermediaries, thereby reducing costs and increasing efficiency. Transactions are recorded on a distributed ledger that is immutable and transparent, providing a high level of security and accountability.

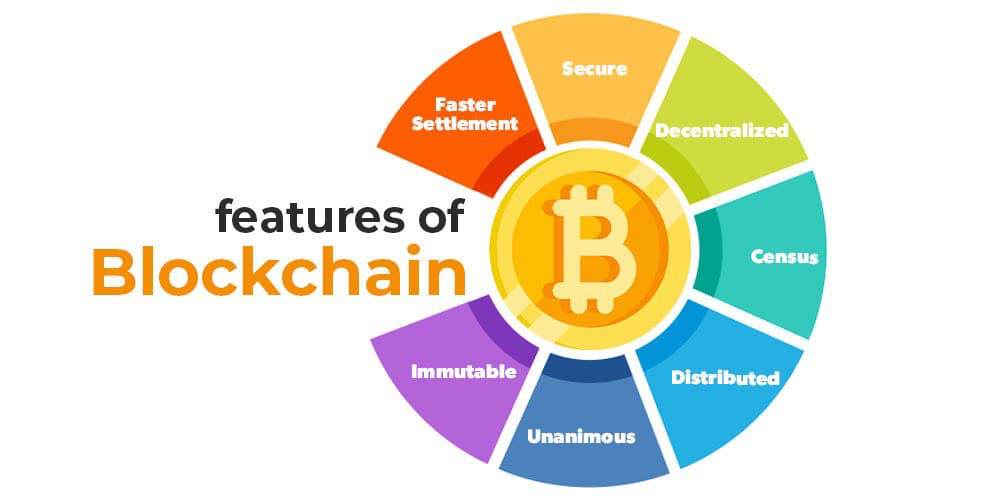

Features of Blockchain Payment Gateway

- Decentralization: Unlike traditional gateways that rely on centralized authorities, blockchain payment gateways operate on a decentralized[3] network of nodes, eliminating single points of failure and reducing the risk of fraud.

- Transparency and immutability: Every transaction on the blockchain is recorded in a transparent and tamper-proof manner, ensuring trust and accountability among transacting parties.

- Cost-effectiveness: With lower transaction fees and faster settlement times, blockchain payment gateways offer significant cost savings for businesses, especially in cross-border transactions.

- Enhanced security: The cryptographic algorithms used in blockchain technology ensure security.

Adoption and Impact in India

While blockchain payment gateways are still in the early stages of adoption in India, there is growing interest and investment in this space. Startups and established players alike are exploring blockchain-based solutions to streamline payments and enhance financial inclusion. However, regulatory clarity and infrastructure challenges remain key hurdles to widespread adoption.

Case Studies

Several companies in India are already leveraging blockchain payment gateways to facilitate seamless transactions and drive business growth. For instance, Company X has implemented a blockchain-based payment gateway to enable secure and transparent transactions for its e-commerce[4] platform.

Future Outlook

The future of blockchain payment gateways[5] in India looks promising, with continued innovation and investment expected to drive growth in this space. As regulatory frameworks evolve and infrastructure improves, blockchain technology has the potential to reshape the country’s financial landscape.

Conclusion

Blockchain payment gateways represent a paradigm shift in the way transactions are conducted, offering unparalleled security, transparency, and efficiency. As India embraces digital transformation, businesses stand to benefit from adopting blockchain-based solutions to streamline payments and enhance customer experiences.

FAQs

- What makes blockchain payment gateways more secure than traditional gateways?

- Blockchain payment gateways leverage cryptographic algorithms and decentralized networks to ensure secure and tamper-proof transactions, reducing the risk of fraud and data breaches.

- Are blockchain payment gateways cost-effective for businesses?

- Yes, blockchain payment gateways typically have lower transaction fees and faster settlement times compared to traditional gateways, resulting in significant cost savings for businesses, especially in cross-border transactions.

- How is regulatory uncertainty impacting the adoption of blockchain payment gateways in India?

- Regulatory uncertainty and a lack of clarity around blockchain technology’s legal framework pose challenges to widespread adoption in India. Clear and favorable regulations are essential to fostering innovation and investment in this space.

- Can blockchain payment gateways enhance financial inclusion in India?

- Yes, blockchain payment gateways have the potential to enhance financial inclusion by providing secure and transparent payment solutions to underserved populations, thereby reducing reliance on cash transactions and traditional banking systems.

- What are some key considerations for businesses looking to implement blockchain payment gateways?

- Businesses should assess factors such as regulatory compliance, scalability, interoperability, and user experience when considering the adoption of blockchain payment gateways.