AUTHOR : SAYYED NUZAT

DATE : MAY 9, 2024

In recent years, the world has witnessed a paradigm shift in the way financial transactions are conducted, with digital currencies like Bitcoin gaining prominence. This revolutionary technology has not only transformed the global financial landscape but also opened up new avenues for businesses and consumers alike. In India, the integration of Bitcoin as a payment method holds immense potential, albeit with its own set of challenges and opportunities.

Introduction to Bitcoin Payment Integration

Understanding Bitcoin

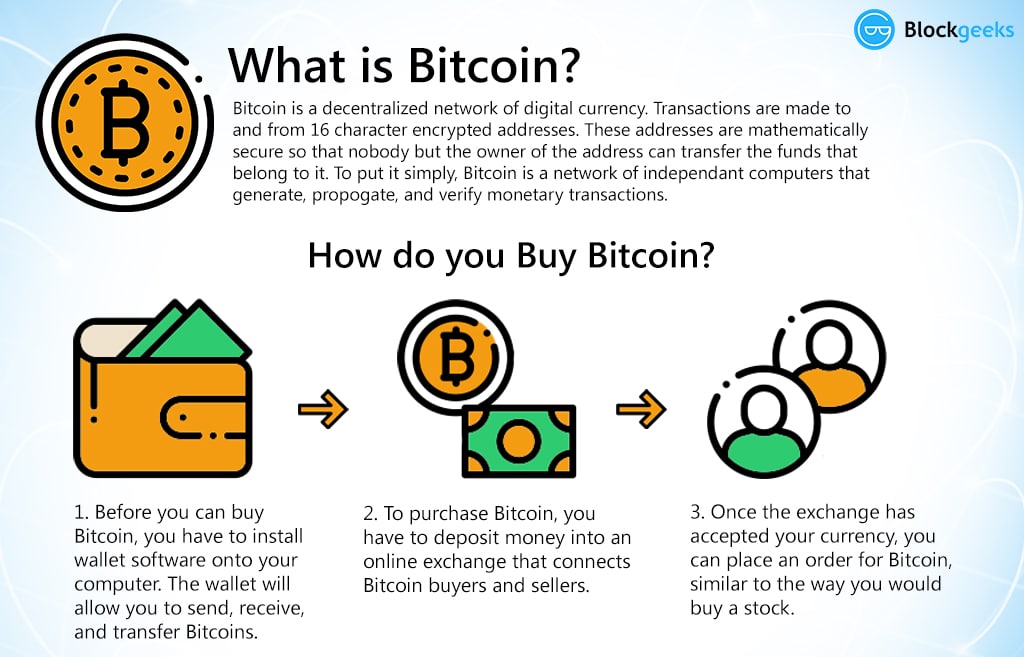

Bitcoin, frequently hailed as the “gold of the digital era,“ represents a decentralized form of currency that functions on a peer-to-peer network, eliminating the necessity for intermediaries such as financial institutions or governmental bodies.

Importance of Payment Integration

The integration of Bitcoin[1] into the existing payment infrastructure offers numerous advantages, including faster transactions[2], lower fees, and enhanced security.

Current Landscape of Payment Systems in India

Traditional Payment Methods

India has long relied on traditional payment[3] methods such as cash, checks, and bank transfers for conducting transactions.

Emergence of Digital Payment Systems

In recent years, digital payment[4] systems like UPI (Unified Payments Interface) and mobile wallets have gained widespread acceptance, paving the way for a cashless economy[5].

Benefits of Bitcoin Payment Integration

Cost-effectiveness

Bitcoin transactions typically involve lower processing fees compared to traditional payment methods, making them an attractive option for businesses looking to reduce transaction costs.

Global Accessibility

Bitcoin transcends geographical boundaries, allowing businesses to tap into a global customer base without the need for currency conversions or cross-border fees.

Security and Transparency

The blockchain technology underlying Bitcoin ensures secure and transparent transactions, minimizing the risk of fraud and unauthorized access.

Challenges and Regulatory Environment

Regulatory Uncertainty

The regulatory environment surrounding cryptocurrencies in India remains uncertain, with authorities grappling to define their legal status and framework.

Security Concerns

While Bitcoin offers robust security features, concerns persist regarding the vulnerability of digital wallets and the risk of cyberattacks.

Volatility of Bitcoin Prices

The volatile nature of Bitcoin prices poses a challenge for businesses and consumers alike, impacting its utility as a medium of exchange.

Adoption and Acceptance

Businesses Embracing Bitcoin Payments

Despite regulatory challenges, an increasing number of businesses in India are exploring Bitcoin payment integration as a means to attract tech-savvy customers and gain a competitive edge.

Consumer Perspectives and Adoption Rates

Consumer adoption of Bitcoin payments in India remains relatively low due to factors such as lack of awareness, regulatory uncertainties, and price volatility.

Technical Aspects of Integration

API Integration

Integrating Bitcoin payments into existing e-commerce platforms and websites typically involves leveraging APIs (application programming interfaces) provided by payment gateway providers.

Wallet Setup and Management

Businesses need to set up secure Bitcoin wallets to send, receive, and store digital currencies, ensuring compliance with regulatory requirements and best practices.

Steps to Integrate Bitcoin Payments

Choosing a Payment Gateway

Selecting the right payment gateway is crucial for seamless Bitcoin integration, considering factors such as transaction fees, security features, and customer support.

Setting Up Merchant Accounts

Businesses need to create merchant accounts with payment gateway providers and undergo verification procedures to start accepting Bitcoin payments.

Case Studies of Successful Integrations

Companies Leading the Way

Several pioneering companies in India have successfully integrated Bitcoin payments into their business models, demonstrating the feasibility and benefits of embracing digital currencies.

Impact on Revenue and Growth

Businesses that have adopted Bitcoin payments have reported increased revenue streams, expanded customer bases, and enhanced brand visibility.

Future Trends and Predictions

Evolution of Payment Technologies

As technology continues to evolve, we can expect to see further innovations in payment systems, including the integration of cryptocurrencies like Bitcoin into mainstream commerce.

Regulatory Developments

The regulatory landscape governing cryptocurrencies in India is likely to evolve, with policymakers working towards creating a conducive environment for digital innovation while addressing concerns around security and consumer protection.

Security Measures and Best Practices

Two-Factor Authentication

Furthermore, implementing robust security measures, such as two-factor authentication, can help mitigate the risk of unauthorized access and protect sensitive customer data.

Regular Audits and Updates

Businesses should conduct regular security audits and updates to identify and address vulnerabilities in their payment systems, ensuring compliance with industry standards and regulations.

Educational Initiatives and Awareness Campaigns

Promoting Understanding of Bitcoin

Educational initiatives aimed at increasing awareness and understanding of Bitcoin can help dispel misconceptions and foster trust among consumers and businesses.

Mitigating Risks for Users and Businesses

By educating users about the risks and best practices associated with Bitcoin transactions, businesses can build confidence and also encourage the adoption of digital currencies.

Impact on the Indian Economy

Enhancing Financial Inclusion

Bitcoin payment integration has the potential to enhance financial inclusion by providing underserved communities with access to secure and affordable financial services.

Encouraging Innovation in Fintech

The adoption of Bitcoin and blockchain technology is driving innovation in the fintech sector, leading to the development of innovative products and also services that cater to diverse customer needs.

Comparison with Other Payment Systems

Bitcoin vs. Traditional Banking

Unlike traditional banking systems, which rely on centralized intermediaries, Bitcoin operates on a decentralized network, offering greater autonomy and control over financial transactions.

Bitcoin vs. Cryptocurrencies

While Bitcoin remains the most well-known and widely accepted cryptocurrency, there are numerous other digital currencies with varying features and use cases.

Addressing Common Concerns and Misconceptions

Legal Status of Bitcoin in India

The legal status of Bitcoin in India remains ambiguous, with regulators yet to provide clear guidelines on its usage and taxation.

Risks of Price Volatility

The volatile nature of Bitcoin prices poses risks for investors and businesses, requiring caution and also risk management strategies to mitigate potential losses.

Conclusion

In conclusion, the integration of Bitcoin payments in India presents both opportunities and challenges for businesses and consumers. While regulatory uncertainties and security concerns persist, the benefits of cost-effectiveness, global accessibility, and security are driving adoption and acceptance.

FAQs

- Is Bitcoin legal in India?

- The legal status of Bitcoin in India is currently unclear, with regulators yet to provide comprehensive guidelines on its usage and taxation.

- What are the advantages of Bitcoin payments for businesses?

- Bitcoin payments offer advantages such as lower transaction fees, global accessibility, and enhanced security compared to traditional payment methods.

- How can businesses integrate Bitcoin payments into their operations?

- Businesses can integrate Bitcoin payments by choosing a payment gateway provider, setting up merchant accounts, and implementing secure wallet management practices.

- What are the risks associated with Bitcoin payments?

- Risks associated with Bitcoin payments include price volatility, regulatory uncertainties, and security vulnerabilities.

- What is the future outlook for Bitcoin payment integration in India?

- Despite challenges, the future outlook for Bitcoin payment integration in India is optimistic, with growing adoption and acceptance paving the way for mainstream usage.