AUTHOR : EMILY

DATE : 26/08/2024

As cryptocurrency adoption continues to grow worldwide, India is not far behind in embracing the digital revolution. With the increasing popularity of cryptocurrencies like Bitcoin[1], Ethereum, and various altcoins, businesses and individuals alike are exploring ways to integrate digital currencies into. One of the most significant developments in this space is the emergence of cryptocurrency payment providers[2]. These platforms enable merchants[3] to accept payments in cryptocurrencies, allowing for seamless transactions and expanding the reach of digital assets in the Indian market.

The Rise of Cryptocurrency Payments in India

The Indian cryptocurrency market has seen rapid growth over the past few years. Despite regulatory[4] uncertainties, millions of Indians are investing in and using cryptocurrencies. As a result, there is a growing demand for payment solutions that facilitate the use of digital currencies[5] in everyday transactions. Cryptocurrency payment providers have stepped in to fill this gap, offering platforms that allow merchants to accept payments in various cryptocurrencies and convert them into local currency.

Top Cryptocurrency Payment Providers in India

Here are some of the leading cryptocurrency payment providers in India, each offering unique features and services tailored to the Indian market.

1. WazirX

WazirX is one of the most popular cryptocurrency exchanges in India, and it also offers a payment gateway service that allows merchants to accept payments in cryptocurrencies. With WazirX Pay, businesses can accept Bitcoin, Ethereum, Ripple, and other major cryptocurrencies. The platform is known for its user-friendly interface and robust security features, making it a preferred choice for many Indian businesses.

- Key Features:

- Supports multiple cryptocurrencies.

- Seamless integration with existing e-commerce platforms.

- Instant conversion of cryptocurrency to INR.

- Secure transactions[1] with industry-standard encryption.

- Why Choose WazirX? WazirX is ideal for businesses looking for a reliable and well-established platform with strong security measures. Its reputation in the Indian market makes it a trusted choice for merchants and customers alike.

2. Unocoin

Unocoin is another major player in the Indian cryptocurrency market, offering a comprehensive payment gateway service. Unocoin’s payment solution allows merchants to accept Bitcoin payments directly on their websites or mobile apps. The platform also provides instant conversion to INR, minimizing the risk of cryptocurrency price volatility.

- Key Features:

- Accepts Bitcoin payments with instant INR conversion.

- Integration with popular e-commerce platforms[2].

- User-friendly API for developers.

- Strong focus on security and compliance with Indian regulations.

- Why Choose Unocoin? Unocoin is a great option for businesses that want to start accepting Bitcoin payments without worrying about price fluctuations. Its focus on security and compliance makes it a reliable choice for Indian merchants.

3. Coin Payments

Coin Payments is a global cryptocurrency payment gateway that has made significant inroads into the Indian market. The platform supports over 2,000 cryptocurrencies, making it one of the most versatile payment providers available. Coin Payments offers a range of services, including payment processing, multi-currency wallets, and integration with various e-commerce platforms.

- Key Features:

- Supports a wide range of cryptocurrencies.

- Multi-currency wallets for businesses and individuals.

- Connecting seamlessly with widely-used e-commerce platforms such as Shopify, WooCommerce, and Magento.

- Low transaction fees and quick settlement times.

- Why Choose Coin Payments? Coin Payments is perfect for businesses that want to offer their customers a wide range of cryptocurrency payment[3] options. Its extensive support for various digital currencies and low transaction fees make it a cost-effective solution for Indian merchants.

4. BitPay

BitPay is a well-known global cryptocurrency payment provider that has also gained popularity in India. The platform allows businesses to accept payments in Bitcoin and Bitcoin Cash, with the option to convert them into INR or other fiat currencies. BitPay is known for its security features and easy integration with existing payment systems.

- Key Features:

- Accepts Bitcoin and Bitcoin Cash payments.

- Integration with popular e-commerce platforms and payment processors.

- Multi-signature wallets for added security.

- Instant conversion to INR with bank settlements.

- Why choose BitPay? BitPay is an excellent choice for businesses looking for a secure and easy-to-use payment gateway with global reach. Its focus on security and compliance with international standards makes it a trusted option for Indian businesses.

5. ZebPay

ZebPay is one of India’s oldest and most trusted cryptocurrency exchanges. In addition to its exchange services, ZebPay offers a payment gateway[4] that allows merchants to accept Bitcoin payments. The platform is known for its simplicity and ease of use, making it a popular choice among small and medium-sized businesses in India.

- Key Features:

- Simple and user-friendly interface.

- Instant INR conversion.

- Integration with websites and mobile apps.

- Strong security features, including two-factor authentication.

- Why Choose ZebPay? ZebPay is ideal for small and medium-sized businesses looking for a straightforward and reliable cryptocurrency payment solution. Its long-standing presence in the Indian market adds to its credibility.

6. Instamojo

Instamojo is a popular online payment gateway in India that has recently ventured into the cryptocurrency space. The platform now allows businesses to accept Bitcoin payments alongside traditional payment methods. Instamojo’s user-friendly interface and wide reach among Indian merchants make it an attractive option for businesses looking to diversify their payment options.

- Key Features:

- Why Choose Instagram? Instamojo is a great choice for businesses that want to offer cryptocurrency payments without switching from their existing payment gateway provider. Its seamless integration with traditional payment methods makes it easy for businesses to manage all transactions in one place.

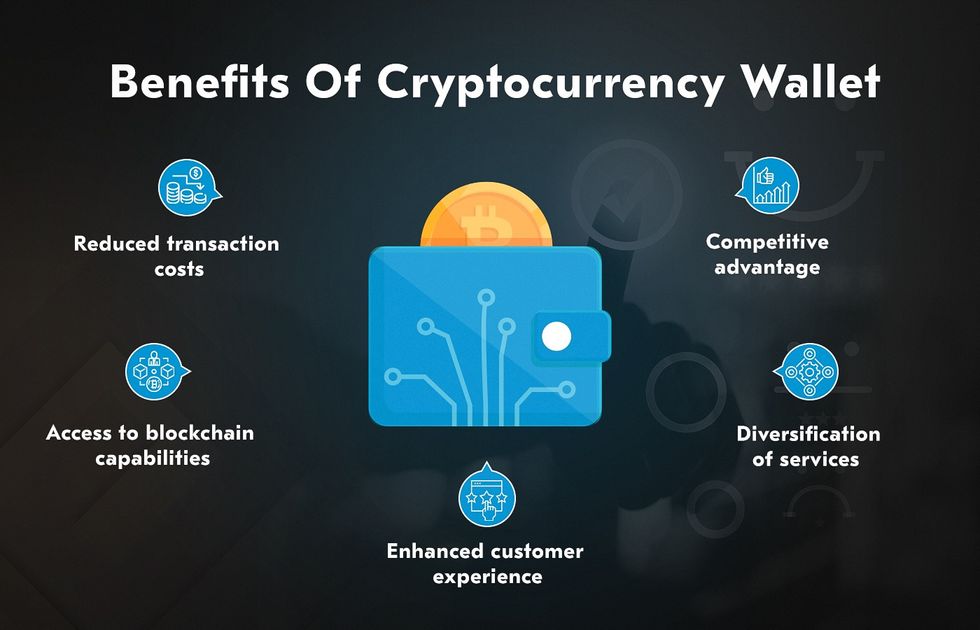

Benefits of Using Cryptocurrency Payment Providers

Cryptocurrency payment providers offer several benefits to businesses and customers in India, making them an essential part of the digital payment ecosystem.

- Increased Payment Flexibility: By accepting cryptocurrencies, businesses can offer their customers more payment options, catering to a broader audience and potentially increasing sales.

- Lower Transaction Fees: Cryptocurrency transactions typically have lower fees compared to traditional payment methods, such as credit cards or bank transfers. Businesses can achieve substantial cost reductions, particularly when dealing with large transaction volumes.

- Global Reach: Cryptocurrency payments are borderless, allowing Indian businesses to accept payments from customers worldwide without the hassle of currency conversions or international transaction fees.

- Security and Fraud Prevention: Cryptocurrency transactions[5] are secured by blockchain technology, making them highly resistant to fraud and chargebacks. This provides an added layer of security for both businesses and customers.

- Faster Settlement Times: Unlike traditional banking systems, which can take days to settle transactions, cryptocurrency payments are processed quickly, often within minutes. This improves cash flow for businesses and ensures timely payments.

Challenges and Considerations

While cryptocurrency payment providers offer numerous benefits, there are also some challenges and considerations to keep in mind:

- Regulatory Uncertainty: The regulatory environment for cryptocurrencies in India is still evolving. Businesses must stay informed about the latest regulations and ensure compliance to avoid potential legal issues.

- Price Volatility: Cryptocurrencies are known for their price volatility. While most payment providers offer instant conversion to INR, businesses should be aware of the potential risks associated with accepting cryptocurrencies.

- Technical Integration: Integrating cryptocurrency payment gateways into existing systems may require technical expertise. Businesses should ensure they have the necessary resources to implement and maintain these systems.

- Customer Education: As cryptocurrency adoption is still relatively new in India, businesses may need to educate their customers on how to use digital currencies for payments.

Conclusion

As India continues to embrace the digital revolution, cryptocurrency payment providers are playing a crucial role in shaping the future of payments. The platforms mentioned in this blog offer a range of features and services that make it easier for businesses to accept cryptocurrency payments, providing increased flexibility, lower transaction fees, and enhanced security.

FAQs

1. What are cryptocurrency payment providers? Cryptocurrency payment providers facilitate transactions and payments using digital currencies. They offer services such as processing payments, converting cryptocurrencies to fiat, and integrating with e-commerce platforms.

2. Why should I use a cryptocurrency payment provider in India? Using a cryptocurrency payment provider allows businesses to accept digital currencies, provides an additional payment option for customers, and can potentially lower transaction fees compared to traditional payment methods.

3. Which are the top cryptocurrency payment providers in India? Some of the leading cryptocurrency payment providers in India include CoinSwitch, WazirX, Unocoin, and Bitbns. These platforms offer various services for both individuals and businesses.

4. How do cryptocurrency payment providers work? These providers facilitate transactions by offering a secure gateway for processing payments in cryptocurrencies. They often include features like real-time conversion to fiat, payment tracking, and integration with existing payment systems.

5. Are cryptocurrency payment providers legal in India? Yes, cryptocurrency payment providers operate legally in India, though the regulatory environment is evolving. It’s important to ensure that the provider complies with current regulations and guidelines.