AUTRHOR : EMILY

Cryptocurrencies have become an exciting asset class, offering opportunities for growth, innovation, and financial inclusion. In India, interest in digital currencies[1] has grown exponentially, driven by technological advancements, increasing awareness, and supportive frameworks. For those considering investing in this space, it’s crucial to understand the best cryptocurrencies available in the Indian market. This blog provides[2] insights into some of the top cryptocurrencies you can consider for your portfolio in 2024.

1. Bitcoin (BTC)

Bitcoin[3] remains the dominant force in the cryptocurrency market, both globally and in India.

Introduced in 2009 by the elusive Satoshi Nakamoto, Bitcoin’s main allure stems from its role as the first cryptocurrency and its reputation as a digital store[4] of value. With a fixed supply of 21 million coins, Bitcoin is often compared to gold due to its scarcity and potential for appreciation over time.

Why Invest in Bitcoin?

- Proven Track Record: Bitcoin has weathered numerous market cycles[5], making it a safer bet for long-term investors.

- Liquidity: Bitcoin is the most liquid cryptocurrency, meaning you can buy and sell it easily in India on platforms like WazirX, CoinDCX, and ZebPay.

- Adoption: Many institutions, including Tesla and MicroStrategy, hold Bitcoin, contributing to its growing acceptance.

Investment Strategy

For those new to crypto investing, Bitcoin is an excellent starting point. Consider using the dollar-cost averaging (DCA) strategy, which involves buying small amounts regularly, minimizing the impact of volatility.

2. Ethereum (ETH)

Ethereum stands out for its smart contract functionality, which allows developers to build decentralized applications (dApps) and decentralized finance[1] (DeFi) platforms. Launched in 2015 by Vitalik Buterin, Ethereum has become the backbone of many crypto projects, driving innovations in areas like NFTs, DeFi, and DAOs.

Why Invest in Ethereum?

- Smart Contracts: Ethereum is the leading platform for smart contracts, which have revolutionized finance, gaming, and art.

- Network Upgrades: Ethereum’s shift to proof-of-stake (PoS) through Ethereum 2.0 has made it more energy-efficient and scalable.

- DeFi and NFT Ecosystem: Ethereum is the primary blockchain supporting DeFi projects and NFTs, which continue to see massive growth.

Investment Strategy

If you believe in the potential of decentralized applications[2] and the future of finance, investing in Ethereum can be lucrative. You can buy and hold ETH for the long term or stake your ETH to earn passive rewards.

3. Polygon (MATIC)

Polygon, previously recognized as Matic Network, is a blockchain project originating from India that focuses on delivering scalable solutions for the Ethereum network. As Ethereum struggles with high gas fees and network congestion, Polygon steps in with Layer 2 scaling solutions, making transactions faster and cheaper.

Why Invest in Polygon?

- Indian Roots: Founded by Indian developers, Polygon is a source of pride for the Indian crypto community.

- Scalability Solutions: Polygon’s technology[3] has been widely adopted by DeFi projects and gaming platforms, driving substantial growth.

- Partnerships and Adoption: Polygon has secured partnerships with major companies like Disney, Stripe, and Reddit.

Investment Strategy

Polygon’s growth potential lies in the expanding ecosystem of Ethereum Layer 2 solutions. If you’re bullish on Ethereum but concerned about scalability, MATIC can be a complementary investment.

4. Solana (SOL)

Solana is a powerful blockchain, celebrated for its fast speeds and low transaction fees. It has positioned itself as a competitor to Ethereum by offering similar functionalities with greater scalability. Solana’s ecosystem has grown rapidly, with projects ranging from DeFi applications[4] to NFTs.

Why Invest in Solana?

- Speed and Efficiency: Solana’s blockchain can handle 65,000 transactions per second (TPS), making it one of the fastest blockchains.

- Growing Ecosystem: Solana’s ecosystem includes leading NFT marketplaces, DeFi platforms, and gaming projects.

- Lower Fees: Solana’s low transaction costs make it an attractive platform for developers and users alike.

Investment Strategy

Solana’s rapid rise has positioned it as one of the most promising alternatives to Ethereum. For investors seeking exposure to emerging DeFi and NFT trends, SOL offers significant upside potential.

5. Cardano (ADA)

blockchain platform that focuses on sustainability, scalability, and academic rigor.

Cardano, established by Charles Hoskinson, a co-founder of Ethereum, utilizes a distinctive proof-of-stake consensus protocol named Ouroboros. The platform is known for its methodical approach, emphasizing peer-reviewed research and formal verification.

Why Invest in Card Ano?

- Scientific Approach: Cardano’s development is grounded in academic research, which enhances its credibility and long-term potential.

- Sustainability: Cardano’s PoS model is energy-efficient, aligning with global sustainability goals.

- Africa Initiative: Cardano has been actively involved in building decentralized solutions in developing regions, particularly Africa.

Investment Strategy

Cardano is ideal for long-term investors who value sustainability and scientific innovation. ADA’s growth will likely be gradual, making it a solid investment for patient investors.

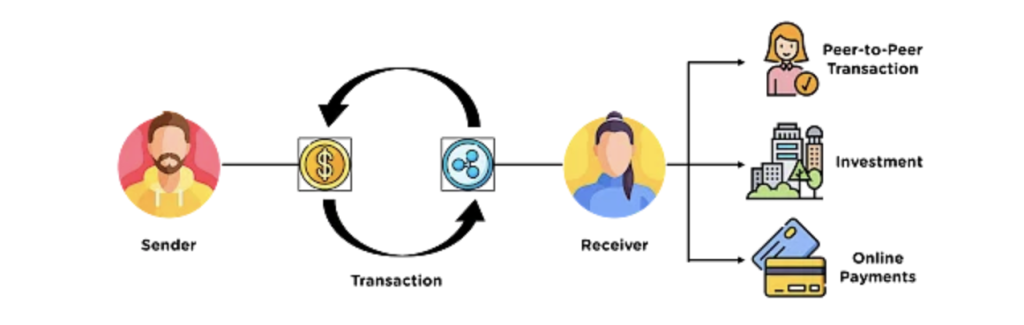

6. Ripple (XRP)

Ripple’s XRP is a unique cryptocurrency focused on facilitating cross-border payments and remittances. Unlike most cryptocurrencies that operate on decentralized platforms, Ripple works closely with financial institutions, offering blockchain solutions for faster and more cost-effective international transactions.

Why invest in Ripple?

Best Cryptocurrencies to Invest In India

- Partnerships with Banks: Ripple has established partnerships with several banks and financial institutions worldwide.

- Real-World Use Case: XRP’s use case as a bridge currency for cross-border payments gives it a practical application, distinguishing it from speculative assets.

- Legal Clarity: Ripple’s ongoing legal battle with the SEC in the U.S. has caused uncertainty, but a favorable outcome could lead to significant gains.

Investment Strategy

XRP is a high-risk, high-reward investment. If you’re willing to take a chance on the outcome of legal challenges, investing in Ripple could pay off handsomely.

7. Polkadot (DOT)

Polkadot is a multi-chain network that aims to enable different blockchains to communicate and share data seamlessly. Founded by Dr. Gavin Wood, another Ethereum co-founder, Polkadot’s unique approach to interoperability and scalability has attracted significant interest from developers and investors.

Why Invest in Polkadot?

- Interoperability: Polkadot’s ability to connect multiple blockchains is crucial for the future of decentralized technology.

- Scalability: The platform’s parachain model allows for parallel processing, improving efficiency and throughput.

- Developer Community: Polkadot’s developer-friendly environment has resulted in a growing ecosystem of projects.

Investment Strategy

Polkadot’s success hinges on the adoption of its parachain model. For those who believe in a multi-chain future, DOT is a strategic investment.

8. Chainlink (LINK)

Chainlink is a decentralized network that provides smart contracts with access to real-world data through its Oracle system. Oracles are critical for the functioning of DeFi applications, as they provide data feeds that smart contracts rely on for execution. Chainlink is the dominant player in this space, with partnerships across multiple blockchain networks.

Why Invest in Chainlink?

- Vital to DeFi: Chainlink’s technology underpins a significant portion of Crucial for DeFi: Chain Link’s technology supports a major segment of the DeFi landscape, making it essential to the ecosystem.

- Robust Partnerships: Chain Link has partnered with leading blockchain[5] projects like Ethereum, Binance Smart Chain, and more.

- Innovation: Chain Link continues to innovate, with developments like hybrid smart contracts and advanced data solutions.

Investment Strategy

Chainlink is a must-have for investors focused on DeFi growth. LINK’s value is closely tied to the overall adoption of decentralized finance.

9. Shiba Inu (SHIB)

For those interested in meme coins, Shiba Inu has emerged as a popular choice in India. While it started as a joke, SHIB has grown into a community-driven project with ambitious plans, including its own decentralized exchange (ShibaSwap) and upcoming blockchain projects.

Why Invest in Shiba Inu?

- Community Support: Shiba Inu has a passionate community that drives its popularity and development.

- Low Cost of Entry: SHIB is priced at a fraction of a rupee, allowing investors to hold a large number of tokens with a small investment.

- Potential for Gains: Despite its meme status, Shiba’s development roadmap suggests future growth possibilities.

Investment Strategy

SHIB is highly speculative, making it suitable for risk-tolerant investors looking for quick gains. A small allocation can provide exposure to the high-risk, high-reward meme coin sector.

Conclusion

Investing in cryptocurrencies in India requires careful consideration of your financial goals, risk tolerance, and market understanding. A balanced portfolio should ideally include a mix of established assets like Bitcoin and Ethereum, growth-oriented altcoins like Solana and Polygon, and speculative plays like Shiba Inu.

FAQs

1. What are the best cryptocurrencies to invest in India?

The best cryptocurrencies to invest in India in 2024 include:

- Bitcoin (BTC) is the first and most widely recognized cryptocurrency, known for its stability and long-term growth potential.

- Ethereum (ETH) is known for its smart contract capabilities and large ecosystem of decentralized applications.

- Polygon (MATIC): An Indian-origin blockchain providing scalable solutions for Ethereum.

- Solana (SOL) offers high-speed transactions and low fees, with a growing ecosystem.

- Cardano (ADA): emphasizes sustainability and academic rigor with its proof-of-stake mechanism.

- Ripple (XRP): focuses on cross-border payments and has significant partnerships with financial institutions.

- Polkadot (DOT): enables interoperability between blockchains, enhancing scalability.

- Chainlink (LINK): Provides crucial data feeds for decentralized applications.

- Shiba Inu (SHIB): A meme coin with a strong community and potential growth, though highly speculative.

2. What criteria should I use to select the best cryptocurrency for investment?

Choosing the right cryptocurrency involves:

- Investigate the technology, purpose, and team associated with the cryptocurrency to make an informed decision.

- Volatility: Consider your risk tolerance, as cryptocurrencies can be highly volatile.

- Adoption and Use Case: Look at the real-world applications and adoption of the cryptocurrency.

- Market Position: Evaluate its market capitalization and historical performance.

- Regulation: Stay informed about regulatory developments in India affecting the cryptocurrency.

3. Is it safe to invest in cryptocurrencies in India?

Investing in cryptocurrencies involves risks due to market volatility and regulatory uncertainties. However, you can mitigate risks by:

- Diversifying: Spread your investment across multiple cryptocurrencies.

- Using Reputable Exchanges: Choose well-known exchanges with strong security measures.

- Staying Informed: Keep up with market trends and regulatory updates.

- Investing Only What You Can Afford to Lose Cryptocurrencies can be highly volatile.

4. What are the legal considerations for investing in cryptocurrencies in India?

In India, cryptocurrency regulations are evolving. Key considerations include:

- Regulatory Framework: Stay updated on legal guidelines from the Reserve Bank of India (RBI) and other regulatory bodies.

- Taxation: Understand the tax implications of cryptocurrency transactions and capital gains.

- Compliance: Ensure compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations on exchanges.

5. How can I buy cryptocurrencies in India?

To buy cryptocurrencies in India, follow these steps:

- Choose an exchange: Select a cryptocurrency exchange like Wazir X, Coin DCX, or Zeb Pay.

- Create an account: Register and complete the KYC process on the exchange.

- Deposit Funds: Transfer INR or other currencies to your exchange account.

- Buy Cryptocurrency: Use the exchange’s trading platform to purchase your chosen cryptocurrencies.

- Store Safely: Transfer your assets to a secure wallet if you’re not trading frequently.