AUTHOR : NUZZU.S

Date : August 28, 2024

Introduction

Cryptocurrency[1] has become a buzzword in India, with a growing number of people exploring this new frontier in finance. From tech-savvy millennials [2] to seasoned investors, the interest in digital currencies is surging. But with so many options available, understanding which cryptocurrencies hold the most potential[3] is crucial. This article will dive deep into the analysis[4] of the top cryptocurrencies in India, offering insights that can help guide your investment decisions.

The Current State of Cryptocurrency in India

India’s relationship with cryptocurrency has been anything but straightforward. On one hand, the government has shown apprehension, frequently discussing regulations[5] and potential bans. On the other hand, there’s a thriving community of crypto enthusiasts who see digital currencies as the future of finance.

Government Regulations and Policies

The Indian government has taken a cautious approach to cryptocurrency. While there is no outright ban, the Reserve Bank of India (RBI) has issued multiple warnings about the risks associated with investing in digital currencies. However, recent developments suggest that the government is considering regulating the market rather than banning it altogether, which could open up new opportunities for investors.

Public Sentiment Towards Cryptocurrencies

Despite the regulatory uncertainties, the public sentiment towards cryptocurrencies in India remains largely positive. Many see it as a way to diversify their investment portfolios, while others are intrigued by the potential for high returns. The growing interest is evident from the increasing number of crypto exchanges and the rising volume of transactions.

Impact of Recent Events on the Market

The cryptocurrency market in India has been influenced by several key events, including global market trends and local regulations. For instance, the market saw significant volatility following the announcement of potential crypto regulations in 2021. However, it has since rebounded, reflecting the resilience of the Indian crypto market.

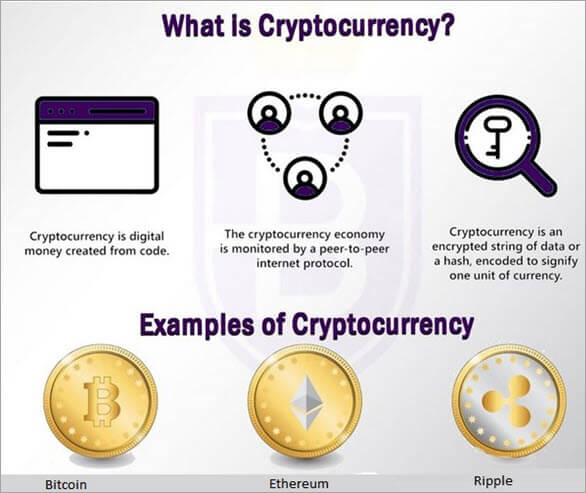

Understanding the Basics of Cryptocurrency

Before diving into the analysis of specific cryptocurrencies, it’s essential to understand the basics. Cryptocurrency is digital or virtual currency that uses cryptography for security. Unlike traditional currencies, cryptocurrencies are decentralized and operate on a technology called blockchain.

What is Cryptocurrency?

At its core, analysis of top cryptocurrencies in India is a form of digital money designed to be secure and, in many cases, anonymous. It’s decentralized, meaning it’s not controlled by any government or financial institution, which gives it a unique position in the global economy.

How Does Cryptocurrency Work?

Cryptocurrencies use blockchain technology to operate. A blockchain is a distributed ledger that records all transactions across a network of computers. This technology ensures that once a transaction is recorded, it cannot be altered, making it highly secure.

Importance of Blockchain Technology

Blockchain is the backbone of analysis of top cryptocurrencies in India, providing the infrastructure needed to ensure security and transparency. Its decentralized nature makes it nearly impossible to hack, which is one of the reasons why cryptocurrencies are gaining popularity as a secure investment option.

The Rise of Cryptocurrency in India

Analysis of top cryptocurrencies in india rise in India can be attributed to several factors, including the increasing use of digital payment systems and the influence of global trends. As more people in India gain access to the internet and digital services, the adoption of cryptocurrencies is expected to grow.

Factors Driving Cryptocurrency Adoption in India

Several factors contribute to the growing adoption of cryptocurrencies in India. The most significant is the increasing penetration of smartphones and the internet, making it easier for people to access digital currencies. Additionally, the growing awareness and education about cryptocurrencies are helping more people understand and trust this new form of investment.

Role of Digital Payment Systems

Digital payment systems like UPI have revolutionized the way Indians transact, and this shift towards digital payments has created fertile ground for the adoption of cryptocurrencies. As people become more comfortable with digital transactions, they are more likely to explore cryptocurrencies as an alternative investment.

Influence of Global Trends on Indian Markets

Global trends also play a significant role in shaping the Indian cryptocurrency market. As more countries embrace digital currencies, India is likely to follow suit, especially if the government provides a clear regulatory framework.

Overview of Top Cryptocurrencies in India

In this section, we will explore the top cryptocurrencies that are currently making waves in India. The selection is based on factors such as market capitalization, adoption rates, and potential for future growth.

Criteria for Selecting Top Cryptocurrencies

The top cryptocurrencies in India are selected based on several criteria, including market capitalization, trading volume, and adoption rates. These metrics provide a clear picture of which digital currencies are leading the market.

Key Metrics for Analysis

When analyzing the analysis of the top cryptocurrencies in India, it’s essential to consider factors such as market performance, adoption rates, and the underlying technology. These metrics help in understanding the potential of a cryptocurrency to provide long-term returns.

Bitcoin (BTC)

Bitcoin, the first and most well-known cryptocurrency, continues to dominate the market in India. Its strong brand recognition and large market capitalization make it a popular choice among Indian investors.

Overview of Bitcoin

Bitcoin was created in 2009 by an anonymous individual or group known as Satoshi Nakamoto. It operates on a decentralized network and uses blockchain technology to ensure secure transactions.

Market Performance in India

In India, Bitcoin has seen significant growth, especially after the 2020 bull run. Its market performance remains strong, with many investors viewing it as a safe haven asset similar to gold.

Adoption and Use Cases in India

Bitcoin’s adoption in India is primarily driven by its potential as an investment asset. While its use as a medium of exchange is limited, more businesses are starting to accept Bitcoin payments, indicating a growing trend.

Ethereum (ETH)

Ethereum is another top cryptocurrency that has gained considerable traction in India. Known for its smart contract functionality, Ethereum offers more than just a digital currency; it provides a platform for decentralized applications (DApps).

Overview of Ethereum

Ethereum was created in 2015 by Vitalik Buterin and is often seen as the next step in the evolution of cryptocurrency. Unlike Bitcoin, which is primarily a store of value, Ethereum’s blockchain allows for the creation of smart contracts and DApps.

Market Performance in India

Ethereum has shown impressive market performance in India, particularly due to its versatility. Many Indian developers are using Ethereum to create blockchain-based applications, further driving its adoption.

Adoption and Use Cases in India

Ethereum’s adoption in India is not just limited to investors. It is also popular among developers and businesses looking to leverage blockchain technology for various applications, from finance to supply chain management.

Binance Coin (BNB)

Binance Coin (BNB) has emerged as a significant player in the Indian cryptocurrency market, primarily due to its association with the Binance exchange, one of the largest cryptocurrency exchanges globally.

Overview of Binance Coin

Binance Coin was initially created as a utility token for the Binance exchange, offering users discounts on trading fees. Over time, it has evolved into a full-fledged cryptocurrency with multiple use cases.

Market Performance in India

In India, Binance Coin has gained popularity due to its utility on the Binance exchange and its potential for growth. Its market performance has been robust, with many Indian investors adding BNB to their portfolios.

Adoption and Use Cases in India

BNB’s adoption in India is largely driven by its use on the Binance exchange. However, it is also being used for payments, staking, and even as collateral for loans on various platforms.

Ripple (XRP)

Ripple (XRP) is known for its focus on facilitating real-time global payments. It has gained a foothold in the Indian market, particularly among financial institutions looking for efficient cross-border payment solutions.

Overview of Ripple

Ripple was created in 2012 by Ripple Labs and is designed to enable fast, low-cost international payments. Unlike Bitcoin or Ethereum, Ripple does not use a blockchain but a consensus ledger.

Market Performance in India

Ripple’s market performance in India has been mixed, partly due to ongoing legal challenges in the United States. However, its strong use case in cross-border payments has kept it relevant in the Indian market.

Adoption and Use Cases in India

Ripple is primarily used by financial institutions in India for cross-border payments. Its ability to settle transactions in seconds has made it a preferred choice for banks and payment providers.

Cardano (ADA)

Cardano is a newer entrant in the Indian cryptocurrency market but has quickly gained popularity due to its focus on sustainability and scalability.

Overview of Cardano

Cardano was created by Charles Hoskinson, one of the co-founders of Ethereum. It is a proof-of-stake blockchain platform that aims to provide a more balanced and sustainable ecosystem for cryptocurrencies.

Market Performance in India

Cardano has shown promising market performance in India, particularly after the launch of its Alonzo upgrade, which introduced smart contract functionality.

Adoption and Use Cases in India

Cardano’s adoption in India is still in its early stages, but it is gaining traction among developers and investors alike. Its focus on sustainability and scalability makes it an attractive option for long-term investments.

Factors Influencing Cryptocurrency Performance in India

Several factors influence the performance of the analysis of top cryptocurrencies in India, including regulatory developments, market demand, and technological advancements.

Regulatory Environment

The regulatory environment in India plays a crucial role in shaping the cryptocurrency market. Uncertainty around regulations can lead to volatility, while clear and supportive regulations can boost market confidence.

Market Demand and Supply

Market demand and supply dynamics also significantly impact cryptocurrency performance. High demand coupled with limited supply can drive up prices, while an oversupply can lead to price declines.

Technological Advancements

Technological advancements in blockchain and related technologies can also influence the performance of cryptocurrencies. Innovations that enhance security, scalability, and usability are likely to drive adoption and boost market performance.

Risks and Challenges of Investing in Cryptocurrencies

While investing in cryptocurrencies offers the potential for high returns, it also comes with significant risks and challenges that investors need to be aware of.

Volatility of the Cryptocurrency Market

The cryptocurrency market is highly volatile, with prices capable of swinging dramatically in a short period of time. This volatility can result in significant gains but also substantial losses.

Regulatory Uncertainties

Regulatory uncertainties in India pose a significant risk to cryptocurrency investors. The lack of a clear regulatory framework means that the market could be subject to sudden changes, affecting prices and investor confidence.

Security Concerns and Fraud Risks

Security is a major concern in the cryptocurrency market. Hacks, scams, and fraud are common, and investors need to take precautions to protect their assets.

Future of Cryptocurrencies in India

The future of cryptocurrencies in India looks promising, but it will depend heavily on how the government approaches regulation and how the market evolves in response to global trends.

Predictions for Market Growth

Many experts predict that the Indian cryptocurrency market will continue to grow, driven by increasing adoption, technological advancements, and potentially supportive regulations.

Potential Changes in Regulations

Regulatory changes are likely to play a significant role in shaping the future of cryptocurrencies in India. A supportive regulatory framework could boost adoption, while restrictive regulations could stifle growth.

Impact of Global Cryptocurrency Trends on India

Global trends, such as the adoption of cryptocurrencies by major institutions and the development of central bank digital currencies (CBDCs), are likely to influence the Indian market. India’s position in the global cryptocurrency landscape will depend on how it adapts to these trends.

Conclusion

Cryptocurrencies have emerged as a significant force in India’s financial landscape, offering new opportunities for investment and innovation. However, the market is still in its early stages, and several challenges need to be addressed. Investors should approach cryptocurrency investment with caution, staying informed about market trends and regulatory developments. With the right strategy, cryptocurrencies can be a valuable addition to an investment portfolio.

FAQs

What is the best cryptocurrency to invest in India?

The best cryptocurrency to invest in depends on your risk tolerance and investment goals. Bitcoin and Ethereum are popular choices due to their large market capitalization and widespread adoption.

How is cryptocurrency taxed in India?

Cryptocurrency is subject to taxation in India, with profits from trading classified as capital gains. The exact tax rate depends on the holding period and other factors.

Is cryptocurrency legal in India?

Cryptocurrency is not illegal in India, but it is currently unregulated. The government is working on a regulatory framework, and until then, the legal status remains uncertain.

What are the risks of investing in cryptocurrencies?

Investing in cryptocurrencies carries risks such as market volatility, regulatory uncertainties, and security concerns. It’s important to do thorough research and consider these risks before investing.

How can I start investing in cryptocurrencies in India?

To start investing in cryptocurrencies, you need to choose a reliable cryptocurrency exchange, create an account, complete the KYC process, and fund your account. From there, you can buy, sell, and trade various cryptocurrencies.