Author : Nuzzu.S

Date : August 30, 2024

Introduction

Cryptocurrency, a digital or virtual form of currency that uses cryptography for security, has taken the world by storm. From Bitcoin to Ethereum, these digital assets[1] have revolutionized the financial landscape, offering decentralized, peer-to-peer transactions that challenge traditional banking systems. However, with innovation comes the need for regulation, especially in a country as vast and diverse as India. As the cryptocurrency market grew, so did the demand for a legal framework to govern its use. This article delves into the intricate world of cryptocurrency[2] regulations in India, exploring the evolution of the legal landscape and what the future may hold.

Cryptocurrency Regulations in India

Early Days: Lack of Regulation

In the initial stages[3], cryptocurrency in India operated in a legal gray area. There were no specific regulations or guidelines, leaving traders and investors uncertain about the future of digital currencies in the country. Despite the absence of regulation, the popularity of cryptocurrencies[4] surged, drawing the attention of regulatory bodies.

Growing Need for Legal Frameworks

As cryptocurrency trading gained momentum, the Indian government[5] recognized the need for a comprehensive legal framework. The lack of regulation posed risks to consumers, financial stability, and the broader economy, prompting authorities to consider how best to manage this emerging asset class.

The Reserve Bank of India (RBI) Stance

Initial Ban on Cryptocurrency (2018)

In April 2018, the Reserve Bank of India (RBI) took a firm stance against cryptocurrency, issuing a circular that effectively banned banks and financial institutions from dealing with or providing services related to cryptocurrencies. This move was seen as a precautionary measure to safeguard the country’s financial system from the potential risks associated with digital currencies.

Supreme Court Ruling (2020) and Its Impact

The RBI’s ban was met with significant opposition from the cryptocurrency community, leading to a legal challenge that culminated in a landmark Supreme Court[1] ruling in March 2020. The court ruled in favor of the petitioners, lifting the ban and allowing banks to resume providing services to cryptocurrency businesses. This ruling marked a significant turning point in India’s approach to cryptocurrency regulation.

RBI’s Recent Developments

In the wake of the Supreme Court ruling, the RBI has taken a more cautious approach, focusing on understanding the implications of cryptocurrency on monetary policy[2], financial stability, and consumer protection. While the central bank has expressed concerns, it has also acknowledged the need for a balanced approach that fosters innovation while mitigating risks.

Government of India’s Position

Draft Bill: “Banning of Cryptocurrency and Regulation of Official Digital Currency Bill, 2019”

In 2019, the Indian government[3] proposed the “Banning of Cryptocurrency and Regulation of Official Digital Currency Bill,” which sought to prohibit all private cryptocurrencies while laying the groundwork for a central bank digital currency (CBDC). Although the bill was never passed, it highlighted the government’s cautious stance on cryptocurrencies and its interest in exploring a state-controlled digital currency.

Introduction of Central Bank Digital Currency (CBDC)

The concept of a Central Bank Digital Currency (CBDC) has gained traction in India, with the government and RBI actively exploring its potential. A CBDC[4] would be a digital form of the Indian Rupee, offering the benefits of cryptocurrency without the associated risks. The introduction of a CBD could significantly impact the future of digital currencies in India.

Current Government Initiatives

The Indian government has taken several steps to address the challenges posed by cryptocurrency. These include setting up committees to study the impact of digital currencies, engaging with international bodies to understand global best practices, and working towards a legal framework that balances innovation with security.

Ministry of Finance’s Role

Cryptocurrency as an Asset Class

The Ministry of Finance has played a crucial role in shaping the regulatory landscape for cryptocurrency in India. While the government has not yet recognized cryptocurrency as legal tender, it has acknowledged its potential as an asset class. This recognition is an important step towards creating a legal framework that provides clarity for investors and businesses.

Taxation Policies on Cryptocurrency

Taxation is a key aspect of the Ministry of Finance’s[5] approach to cryptocurrency. The government has introduced guidelines for the taxation of cryptocurrency transactions, treating them as assets rather than currencies. This has provided some clarity for investors, although the lack of specific regulations continues to pose challenges.

Financial Stability and Consumer Protection

The Ministry of Finance has emphasized the importance of financial stability and consumer protection in its approach to cryptocurrency regulation. By working closely with the RBI and other regulatory bodies, the ministry aims to create a legal framework that addresses the risks associated with digital currencies while fostering innovation.

The Legal Environment for Cryptocurrency in India

Existing Laws Impacting Cryptocurrency

Several existing laws impact the use and regulation of cryptocurrency in India, including the Foreign Exchange Management Act (FEMA), the Prevention of Money Laundering Act (PMLA), and the Income Tax Act. While these laws were not designed with cryptocurrency in mind, they play a role in shaping the regulatory environment for digital currencies.

Recent Legislative Proposals

In addition to existing laws, the Indian government has proposed several legislative measures to address the challenges posed by cryptocurrency. These proposals aim to create a comprehensive legal framework that provides clarity for investors, businesses, and regulators.

The Involvement of SEBI (Securities and Exchange Board of India)

Oversight of Crypto Exchanges

The Securities and Exchange Board of India (SEBI) has taken an active role in overseeing cryptocurrency exchanges. While SEBI’s regulatory framework is still evolving, its involvement is seen as a positive step towards creating a transparent and secure environment for cryptocurrency trading.

SEBI’s Regulatory Framework

SEBI’s regulatory framework for cryptocurrency exchanges includes guidelines for registration, disclosure, and compliance. These measures aim to protect investors and ensure that exchanges operate in a fair and transparent manner.

International Comparisons

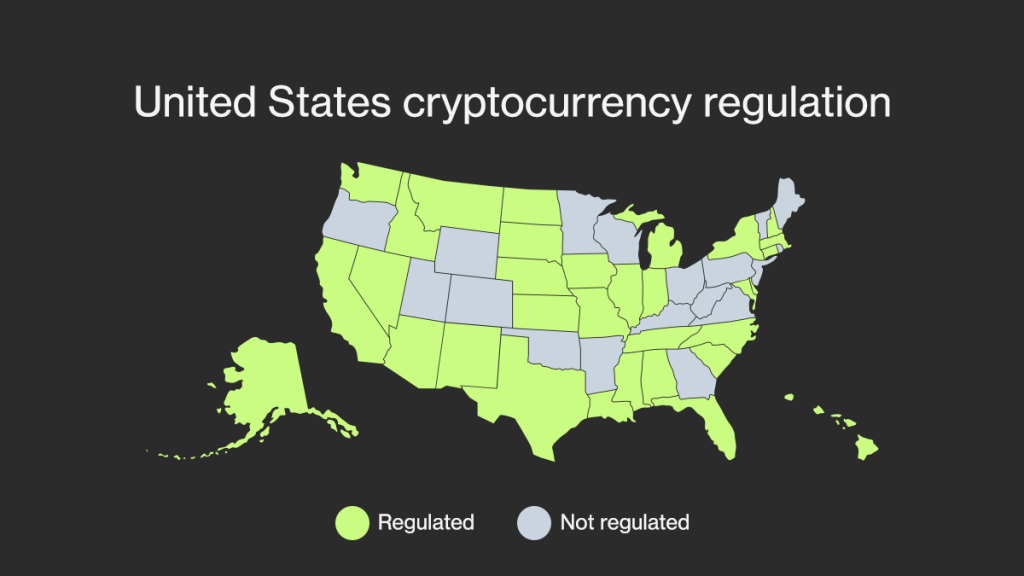

Cryptocurrency Regulations in the United States

The United States has taken a more fragmented approach to cryptocurrency regulation, with different states implementing their own rules. While the federal government has introduced guidelines, the regulatory landscape remains complex.

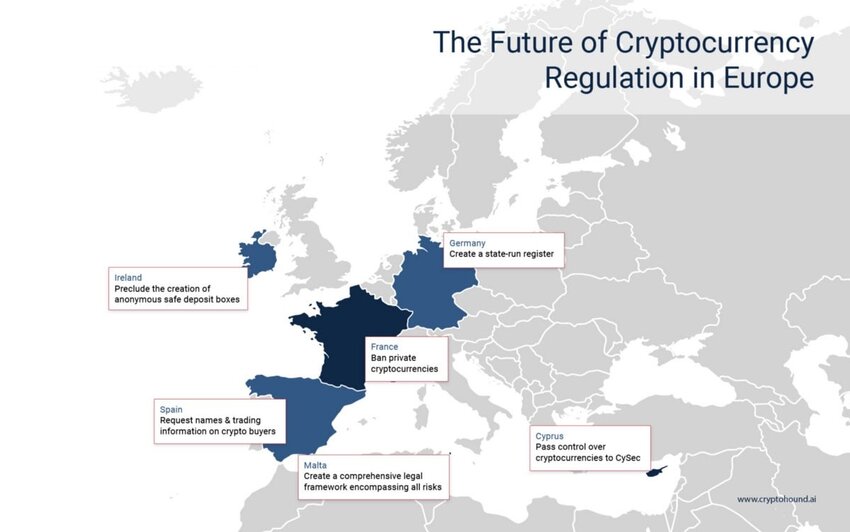

Cryptocurrency Regulations in Europe

Europe has adopted a more harmonized approach to cryptocurrency regulation, with the European Union introducing comprehensive guidelines that apply across member states. This approach has provided greater clarity for businesses and investors.

Cryptocurrency Regulations in Asia

Asian countries have taken a varied approach to cryptocurrency regulation, with some embracing digital currencies and others imposing strict restrictions. China, for example, has banned cryptocurrency trading, while Japan has created a legal framework that supports innovation.

How India’s Regulations Compare

India’s approach to cryptocurrency regulation falls somewhere in the middle of the global spectrum. While the government has expressed concerns about the risks associated with digital currencies, it has also recognized their potential and is working towards creating a balanced legal framework.

Public Perception and Market Impact

Public Response to Regulations

The Indian public’s response to cryptocurrency regulations has been mixed. While some investors are concerned about the government’s cautious approach, others welcome the potential for greater clarity and security.

Market Reaction and Volatility

The market’s reaction to cryptocurrency regulations in India has been marked by volatility. Regulatory uncertainty has contributed to fluctuations in the value of digital currencies, with prices often reacting to government announcements.

Challenges in Regulating Cryptocurrency

Technology-Driven Challenges

Regulating cryptocurrency presents unique challenges, particularly given the technology-driven nature of digital currencies. The rapid pace of innovation in this space makes it difficult for regulators to keep up with developments.

Balancing Innovation with Security

One of the key challenges facing regulators is finding the right balance between fostering innovation and ensuring security. While digital currencies offer significant potential, they also pose risks that need to be managed.

Global Coordination Issues

Cryptocurrency is a global phenomenon, and regulating it requires international cooperation. India faces the challenge of coordinating its regulatory efforts with other countries to ensure a consistent approach.

The Future of Cryptocurrency in India

Potential Regulatory Changes

The future of cryptocurrency regulation in India is likely to involve further changes as the government continues to study the impact of digital currencies. These changes could include new legislation, revised guidelines, and increased oversight.

Future of CBDC in India

The introduction of a Central Bank Digital Currency (CBDC) could have a significant impact on the future of cryptocurrency in India. A CBDC could offer the benefits of digital currencies while mitigating some of the risks associated with private cryptocurrencies.

Predictions and Expectations

Looking ahead, the future of cryptocurrency in India remains uncertain. While the government is likely to continue taking a cautious approach, there is also the potential for significant developments as the legal framework evolves.

Conclusion

India’s approach to cryptocurrency regulation is complex and evolving. While the government has expressed concerns about the risks associated with digital currencies, it has also recognized their potential and is working towards creating a balanced legal framework. As the landscape continues to evolve, the future of cryptocurrency in India will depend on the ability of regulators to manage these risks while fostering innovation.

FAQs

- What is the present situation regarding cryptocurrency in India? Cryptocurrency is legal but not recognized as legal tender in India. The government is working on a regulatory framework to govern its use.

- How does India’s regulatory stance on cryptocurrency stack up against that of other countries?

India’s approach is cautious, with the government focusing on balancing innovation with security. This approach is similar to that of many other countries, although the specifics vary. - What are the main challenges India faces in regulating cryptocurrency? The main challenges include technology-driven changes, balancing innovation with security, and coordinating with international regulatory efforts.

- Is it legal to trade cryptocurrency in India? Yes, it is legal to trade cryptocurrency in India, although the government has not yet recognized it as legal tender.

- What is the future of cryptocurrency in India? The future of cryptocurrency in India is uncertain, with potential regulatory changes on the horizon. The government is also exploring the introduction of a Central Bank Digital Currency (CBDC).