AUTHOR : EMILY

DATE : 29 / 08 /2024

As cryptocurrencies[1] continue to gain traction in India, an increasing number of businesses are exploring the benefits of accepting digital currencies[2] as a form of payment. This shift not only caters to a growing demographic of crypto-savvy consumers but also positions businesses at the forefront of the digital economy[3]. However, selecting the right crypto payment provider[4] is crucial for ensuring seamless and secure transactions. This guide will walk you through the essential factors to consider when choosing a crypto payment provider in India.

Understanding the Importance of a Crypto Payment Provider

A crypto payment provider is a service that facilitates transactions in cryptocurrencies, enabling businesses to accept payments in digital currencies like Bitcoin, Ethereum[5], and others. These providers offer various services, including currency conversion, transaction processing, and security measures, making it easier for businesses to integrate crypto payments into their operations.

Choosing the right provider is vital as it directly impacts the security, efficiency, and cost-effectiveness of your transactions. The right provider can help you minimize risks associated with crypto volatility, enhance the customer experience, and ensure compliance with regulatory standards.

Key Considerations When Selecting a Crypto Payment Provider

1. Security Features

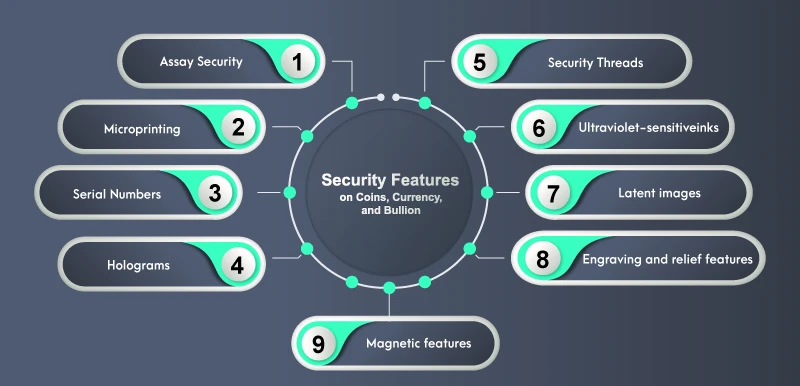

Ultimately, security should unequivocally be your top priority when carefully selecting a crypto payment provider. Cryptocurrency transactions are irreversible, and any security breach can lead to significant financial losses. Here are some key security features to look for:

- Encryption: Ensure that the provider uses advanced encryption[1] protocols to protect sensitive data during transactions.

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring users to verify their identity through a second method, such as a mobile app or SMS code.

- Multi-Signature Wallets: These wallets require multiple private keys to authorize a transaction, reducing the risk of unauthorized access.

- Cold Storage: First, check if the provider stores a significant portion of your funds in cold storage; this method, which is offline, is consequently less vulnerable to hacking.

2. Supported Cryptocurrencies

Different crypto payment providers support varying numbers of cryptocurrencies. While Bitcoin and Ethereum are commonly accepted, it’s important to consider whether the provider supports other altcoins that your customers might use.

3. Fiat Currency Conversion

Crypto prices can be highly volatile, so it’s essential to choose a provider that offers instant conversion of cryptocurrencies into fiat currencies like INR (Indian Rupee). Some providers also offer the option to hold a portion of your earnings in cryptocurrency,

4. Transaction Fees

Transaction fees are an important consideration, as they directly affect your profit margins. Crypto payment providers typically charge fees for processing transactions[2], converting currencies, and withdrawing funds. These fees can vary widely depending on the provider and the type of service offered. It’s essential to compare the fee structures of different providers to find one that offers a balance between cost and service quality. Be wary of providers that charge hidden fees or have complex pricing models.

5. Ease of Integration

The ease of integrating a crypto payment gateway with your existing systems is crucial for minimizing disruption to your business operations. Look for providers that offer:

- API Documentation: Comprehensive and well-documented APIs make it easier for your developers to integrate the payment gateway with your website, mobile app, or point-of-sale system.

- Plugins: Some providers offer plugins for popular e-commerce platforms[3] like Shopify, WooCommerce, and Magento, simplifying the integration process.

- Customization Options: Depending on your business needs, you might require a provider that allows you to customize the payment gateway to match your brand’s look and feel.

6. Customer Support

Reliable customer support is essential, especially if you encounter technical issues or need assistance with transactions. Evaluate the provider’s customer support by considering the following:

- Availability: Check if the provider offers 24/7 customer support, which is crucial for addressing issues that may arise outside regular business hours.

- Response Time: Assess how quickly the support team responds to inquiries. Providers that offer live chat, phone support, or dedicated account managers tend to have faster response times.

- Knowledge Base: A comprehensive knowledge base or help center can be a valuable resource for troubleshooting common issues without the need to contact support.

7. Regulatory Compliance

The regulatory landscape for cryptocurrencies in India is still evolving, with the government considering various frameworks to regulate digital assets[4]. It’s important to choose a provider that adheres to local regulations, including KYC (know your customer) and AML (anti-money laundering) protocols. This ensures that your business remains compliant and reduces the risk of legal complications.

- KYC Compliance: Providers that require KYC verification help prevent fraud and ensure that only legitimate users can transact on their platform.

- AML Compliance: Anti-money laundering measures are designed to detect and prevent illegal activities such as money laundering and terrorist financing.

8. Reputation and Reviews,How To Choose a Crypto Payment Provider In India

The reputation of a crypto payment provider can provide valuable insights into the quality of their service. Look for providers with a proven track record and positive reviews from other businesses. You can check online forums, review websites, and social media to gauge the experiences of other users.

9. Scalability

As your business grows, your payment processing[5] needs may evolve. Choose a provider that can scale with your business, offering additional features and higher transaction limits as needed. A scalable solution ensures that you won’t need to switch providers as your business expands, saving you time and resources.

Conclusion.

Choosing the right crypto payment provider in India is a critical decision that can significantly impact your business’s success in the digital economy. By carefully considering factors such as security, supported cryptocurrencies, transaction fees, ease of integration, and customer support, you can select a provider that meets your specific needs and helps you stay competitive in a rapidly evolving market. As the regulatory landscape continues to develop,

FAQs:

Q1: Why is it important to choose the right crypto payment provider in India? Selecting the right provider ensures secure, efficient, and cost-effective transactions, which is essential for maintaining customer trust and maximizing profits in the evolving crypto market.

Q2: What security features should I look for in a crypto payment provider? Key security features to consider include encryption, two-factor authentication, multi-signature wallets, and cold storage options to protect your transactions and funds.

Q3: How does fiat currency conversion work with crypto payment providers? Many providers offer instant conversion of cryptocurrencies into fiat currencies like INR, helping to mitigate the risk of price volatility and ensuring you receive stable value for your payments.

Q4: What are the typical fees associated with crypto payment providers? Fees can include transaction processing, currency conversion, and withdrawal fees. It’s important to compare these costs across providers to find the most cost-effective option for your business.

Q5: How important is customer support when choosing a crypto payment provider? Reliable customer support is crucial for resolving technical issues and ensuring smooth transactions. Look for providers that offer 24/7 support and quick response times.