Author : Nuzzu.S

Date : August 26, 2024

Introduction

Cryptocurrency has become more than just a buzzword in the financial[1] world. It’s a dynamic and rapidly evolving asset class that has captured the imagination of millions, particularly in India. With the rise of Bitcoin, Ethereum, and other cryptocurrencies[2], Indian investors are increasingly looking at this new frontier of finance. But what influences the value of these digital currencies? Global events, both positive and negative, have a significant impact on the cryptocurrency market. This article delves into how these events shape the cryptocurrency landscape[3] in India, offering insights for both seasoned investors and newcomers.

Global Events Shaping Cryptocurrency

Global events have always had a profound impact on financial markets[4], and cryptocurrency is no exception. Unlike traditional assets[5] like stocks and bonds, cryptocurrencies are highly volatile and react quickly to global developments. Whether it’s a pandemic, geopolitical tension, or regulatory change, these events can cause significant fluctuations in cryptocurrency prices.

The COVID-19 Pandemic

Initial Impact on Global Markets

The COVID-19 pandemic caused significant upheaval in financial markets worldwide.Stock markets plummeted, economies went into recession, and traditional assets lost their value. However, amid this chaos, cryptocurrency emerged as a potential safe haven. Bitcoin[1], in particular, saw a surge in demand as investors sought alternatives to traditional investments.

Surge in Cryptocurrency Adoption During the Pandemic

In India, the pandemic accelerated the adoption of cryptocurrency. With lockdowns and economic uncertainty, many Indians turned to digital assets as a means of preserving wealth. The decentralized nature of cryptocurrencies[2] also appealed to those who were skeptical of government-controlled financial systems.

The Long-Term Effects on the Indian Market

The pandemic’s long-term impact on the Indian cryptocurrency market has been profound. Increased adoption has led to more awareness and interest in cryptocurrencies. However, it has also highlighted the need for clear regulations to protect investors and ensure the stability of the market.

Geopolitical Tensions

Trade Wars and Economic Sanctions

Geopolitical tensions, such as trade wars and economic sanctions, have a direct impact on the global economy. When traditional markets suffer due to these tensions, investors often flock to alternative assets like cryptocurrency.

Impact on Cryptocurrency Prices and Volatility

Cryptocurrency[3] prices tend to be highly volatile during periods of geopolitical tension. For instance, the U.S.-China trade war led to fluctuations in Bitcoin’s price as investors looked for safe havens. In India, similar trends have been observed, with global tensions influencing the local cryptocurrency market.

Case Studies: India’s Reaction to Global Tensions

India’s response to global tensions often involves a mix of caution and innovation. The country’s tech-savvy population and growing fintech sector have enabled quick adaptation to changes in the global cryptocurrency landscape. This adaptability has helped India remain a significant player in the cryptocurrency market, despite global challenges.

Regulatory Developments Worldwide

Crypto Regulations in Major Economies

Regulatory developments in major economies like the United States, China, and the European Union have a ripple effect on the global cryptocurrency market. Stricter regulations can lead to market downturns, while more favorable regulations can boost confidence among investors.

India’s Stance on Cryptocurrency Regulation

India’s approach to cryptocurrency regulation has been cautious. The government has oscillated between banning and regulating cryptocurrencies, creating uncertainty among investors. However, recent developments suggest a move towards more comprehensive regulation, which could stabilize the market.

How Global Regulatory Changes Influence the Indian Market

Global regulatory changes have had a significant impact on the Indian cryptocurrency market. For instance, a crackdown on cryptocurrencies in China led to a surge in demand in India. Conversely, positive regulatory developments in other countries can inspire confidence among Indian investors.

Economic Crises and Inflation

Global Recession Scenarios

Global economic crises, such as recessions, often lead to a flight to safe-haven assets. While gold has traditionally been the go-to asset, cryptocurrency is increasingly being viewed as an alternative.

Cryptocurrency as a Hedge Against Inflation

In times of inflation, traditional currencies lose their value, prompting investors to look for alternatives. Cryptocurrencies, with their decentralized nature, offer a hedge against inflation. In India, where inflation has been a persistent issue, this has led to increased interest in digital assets[4].

The Indian Perspective on Economic Uncertainty

India’s economic landscape is characterized by uncertainty, making it fertile ground for cryptocurrency adoption. As more Indians seek to protect their wealth from inflation and economic instability, the demand for cryptocurrencies is likely to grow.

Technological Advancements

Global Tech Innovations in Blockchain

The technology underpinning cryptocurrencies—blockchain—is constantly evolving. Global advancements in blockchain technology have a direct impact on the usability, security, and appeal of cryptocurrencies.

Impact on Cryptocurrency Adoption in India

India, with its vibrant tech industry, has been quick to adopt and innovate in the blockchain space. Indian tech firms are playing a crucial role in driving global cryptocurrency trends, from developing new blockchain solutions to creating user-friendly cryptocurrency platforms.

The Role of Indian Tech Firms in Global Cryptocurrency Trends

Indian tech companies are not just passive observers but active contributors to the global cryptocurrency ecosystem. Their innovations in blockchain[5] and fintech have helped shape the global cryptocurrency market, making India a key player in this space.

Media and Public Perception

How Global Media Shapes Cryptocurrency Perception

Global media plays a crucial role in shaping public perceptions of cryptocurrencies. Positive news can lead to a surge in prices, while negative coverage can cause panic and sell-offs.

Influence on Indian Investors

Indian investors are heavily influenced by global media coverage of cryptocurrencies. News about regulatory crackdowns, technological advancements, or market trends in other countries often has a direct impact on the behavior of Indian investors.

The Role of Social Media in Cryptocurrency Trends

Social media platforms like Twitter, Reddit, and Telegram have become important sources of information for cryptocurrency enthusiasts. In India, these platforms are widely used to discuss market trends, share investment strategies, and spread news about global events that may impact cryptocurrency prices.

Environmental Concerns

Global Debates on Crypto Mining and Energy Usage

Cryptocurrency mining, particularly Bitcoin mining, has come under scrutiny for its environmental impact. The energy-intensive process has sparked global debates about the sustainability of cryptocurrencies.

Impact on Indian Crypto Market

In India, environmental concerns have led to calls for more sustainable mining practices and the exploration of alternative cryptocurrencies with lower energy consumption. This has influenced the choices of Indian investors, who are increasingly considering the environmental impact of their investments.

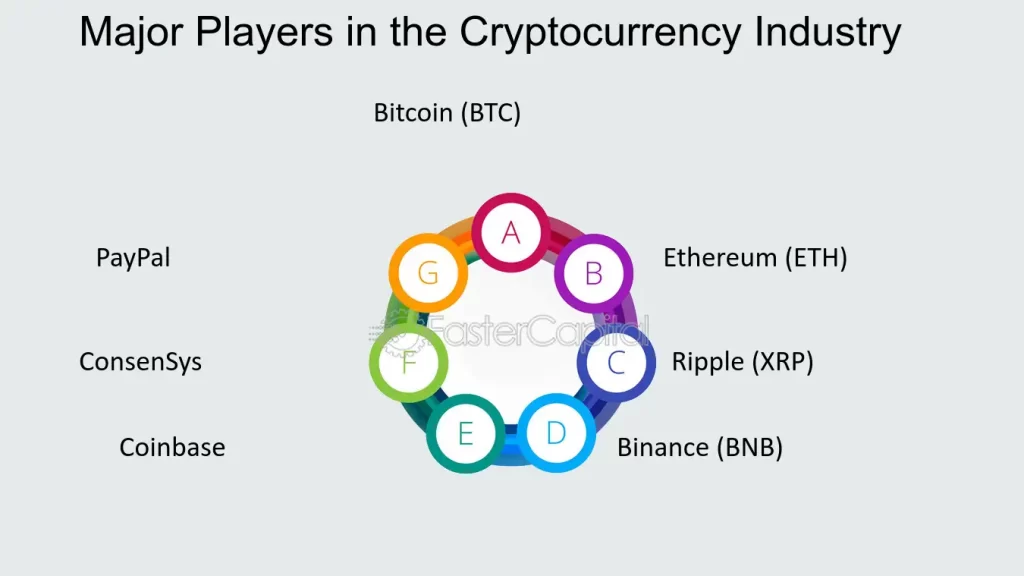

The Role of Major Crypto Market Players

Global Cryptocurrency Exchanges and Platforms

Major global cryptocurrency exchanges like Binance, Coinbase, and Kraken play a significant role in shaping the cryptocurrency market. Their policies, security measures, and innovations can influence market trends.

Influence on Indian Investors and Traders

Indian investors and traders often rely on global exchanges for their cryptocurrency transactions. The actions of these exchanges, whether they’re listing a new cryptocurrency or implementing new trading features, have a direct impact on the Indian market.

Financial Institutions and Cryptocurrency

Global Banks and Cryptocurrency Integration

Global financial institutions are increasingly integrating cryptocurrency into their services. From offering crypto custody solutions to facilitating cryptocurrency transactions, banks are beginning to embrace this new asset class.

Indian Financial Institutions and Cryptocurrency

In India, financial institutions have been more cautious. However, with growing demand from consumers, banks and financial services companies are slowly beginning to explore the potential of cryptocurrencies. This gradual acceptance is likely to drive further adoption in the coming years.

Future Predictions

Possible Global Events and Their Impact

Looking ahead, several global events could significantly impact the cryptocurrency market. These include technological advancements, changes in regulatory environments, and geopolitical developments. The cryptocurrency market in India will likely continue to be shaped by these global forces.

Predictions for Cryptocurrency in India

The future of cryptocurrency in India looks promising, despite regulatory uncertainties. As global events continue to shape the market, Indian investors are likely to become more sophisticated in their approach to cryptocurrency. With the right regulatory framework and continued technological innovation, India could become a major player in the global cryptocurrency market.

Conclusion

Global events have a profound impact on the cryptocurrency market, and India is no exception. From the COVID-19 pandemic to geopolitical tensions, these events shape investor behavior, market trends, and regulatory approaches. As India continues to navigate the complex world of cryptocurrency, it is clear that global events will play a crucial role in determining the future of this dynamic asset class. For Indian investors, staying informed about global developments and understanding their potential impact on cryptocurrency is key to making informed investment decisions.

FAQs

- How do global events affect cryptocurrency prices?

- Global events, such as economic crises, geopolitical tensions, and regulatory changes, can cause significant fluctuations in cryptocurrency prices. These events often lead to increased volatility in the market.

- Is cryptocurrency a safe investment in India?

- Cryptocurrency is a highly volatile and speculative investment. While it offers the potential for high returns, it also carries significant risks. Investors should conduct thorough research and consider their risk tolerance before investing.

- What are the regulatory challenges for cryptocurrency in India?

- India’s regulatory environment for cryptocurrency is still evolving. The lack of clear regulations has created uncertainty for investors. However, recent developments suggest that the government is moving towards more comprehensive regulation.

- How can Indian investors protect their cryptocurrency investments?

- Indian investors can protect their cryptocurrency investments by diversifying their portfolio, staying informed about global events, and using secure wallets and exchanges. It’s also important to keep an eye on regulatory developments in India.

- What is the future of cryptocurrency in India?

- The future of cryptocurrency in India looks promising, but it will be shaped by global events and regulatory developments. With the right approach, India could become a major player in the global cryptocurrency market.