AUTHOR- ELIZA FERNZ

DATE- 25/8/2024

INTRODUCTION

In recent years, cryptocurrency has evolved from a niche interest to a prominent player in the global financial ecosystem. As digital currencies like Bitcoin(1) and Ethereum gain traction worldwide, India has emerged as a dynamic market for crypto enthusiasts and investors. However, with the rise in popularity, ensuring the security of crypto payments[2] has become crucial; consequently, it is essential to adopt robust security measures.

Understanding Crypto Payments in India

Crypto payments involve the use of cryptocurrencies to conduct transactions, bypassing traditional(3) banking systems. In India, the adoption of cryptocurrencies has been marked by a growing number of businesses and individuals embracing digital currencies for payments. The Indian government and regulatory bodies have been cautious, introducing regulations to mitigate risks associated with digital currencies. Despite the regulatory uncertainties, the trend towards adopting cryptocurrency is gaining momentum; thus, more businesses and individuals are increasingly embracing digital currencies.

The Importance of Security in Crypto Payments

Security is paramount in the realm of crypto payments due to the decentralized(4) and digital nature of cryptocurrencies; moreover, unlike traditional payment systems, crypto transactions are irreversible, and once a transaction is confirmed on the blockchain, it cannot be undone. This irreversibility underscores the importance of securing payment processes to prevent fraud, theft, and loss.

Best Practices for Securing Crypto Payments

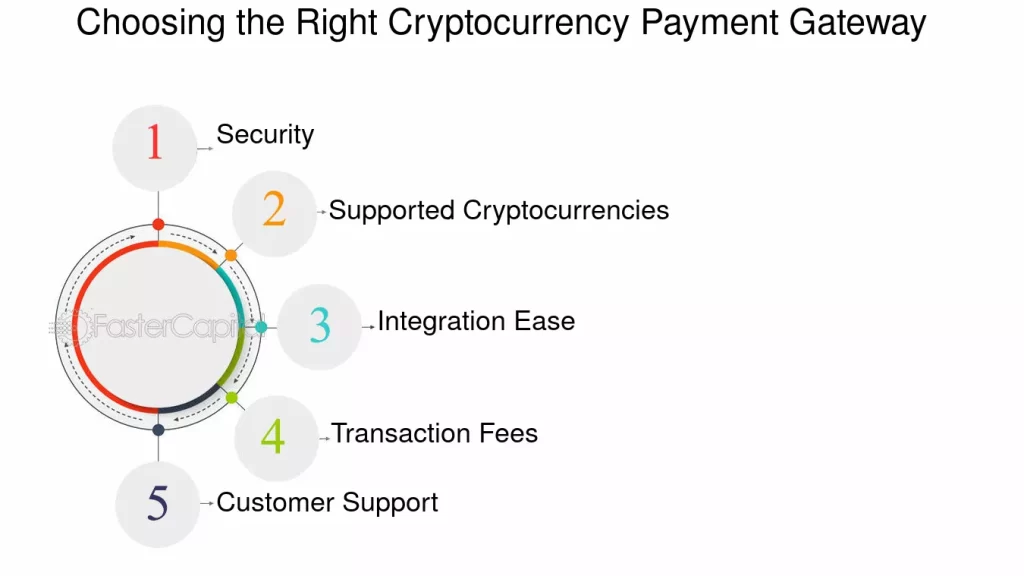

- Use Reputable Wallets and Exchanges The first line of defense in securing crypto payments is selecting reputable wallets and exchanges. Wallets are digital tools that store your cryptocurrency securely, while exchanges facilitate buying, selling, and trading of digital assets. Opt for wallets with robust security features like multi-signature authentication(5), encryption, and regular software updates. Likewise, choose exchanges with a strong track record of security and compliance.

- Enable Two-Factor Authentication (2FA)Two-Factor Authentication (2FA) adds an extra layer of security by requiring a second form of verification in addition to your password. This typically involves a code sent to your mobile device or generated by an authentication app. Enabling 2FA on your crypto wallet and exchange accounts significantly reduces the risk of unauthorized access.

- Be Wary of Phishing AttacksPhishing attacks involve tricking users into revealing their private information, such as passwords or private keys. Be cautious of unsolicited communications requesting sensitive information or directing you to unfamiliar websites. Always verify the authenticity of the source and ensure you are using official channels for transactions.

- Regularly Update SoftwareKeeping your wallet and exchange software up-to-date is essential for security. Developers regularly release updates to address vulnerabilities and enhance security features. Ignoring these updates can leave your digital assets exposed to potential threats.

- Implement Strong PasswordsUse complex and unique passwords for your crypto accounts and wallets. Avoid using easily guessable passwords or reusing passwords across different platforms. A strong password, combined with 2FA, offers a formidable defense against unauthorized access.

- Backup Your WalletRegularly backing up your wallet ensures that you can recover your funds in case of hardware failure, loss, or theft. Most wallets provide options to create backup files or seed phrases. Store these backups in a secure location, separate from your primary devices.

- Use Secure NetworksWhen conducting crypto transactions, ensure you are connected to a secure network. Avoid public Wi-Fi for accessing your crypto accounts, as it can be vulnerable to interception. Using a virtual private network (VPN) can add an extra layer of security when accessing your accounts remotely.

Regulatory Landscape and Compliance

In India, the regulatory environment for cryptocurrencies is evolving. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have issued guidelines and regulations concerning the use and trading of digital assets. It is crucial for businesses and individuals to stay informed about the latest regulations and ensure compliance to avoid legal complications.

In 2022, the Indian government introduced a tax regime for digital assets, which included taxation on capital gains and income derived from cryptocurrencies. Adhering to these regulations is essential for maintaining a compliant and secure crypto payment system.

Technological Advancements Enhancing Security

- Blockchain Technology, the underlying framework for cryptocurrencies, inherently provides security through its decentralized and immutable nature. Transactions recorded on the blockchain are transparent and secure, making it difficult for malicious actors to alter or tamper with transaction data.

- Smart Contracts Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically execute and enforce the terms when predefined conditions are met. They enhance security by reducing the need for intermediaries and minimizing human error.

- Advanced EncryptionEncryption plays a critical role in securing cryptographic transactions. Advanced cryptographic techniques ensure that transaction data and private keys are protected from unauthorized access. Ongoing advancements in encryption technologies continue to strengthen the security of digital payments.

- Multi-Signature WalletsMulti-signature wallets require multiple private keys to authorize a transaction. This adds an extra layer of security, as a single compromised key is insufficient to execute transactions. Multi-signature wallets are particularly useful for businesses and high-value transactions.

Future Outlook

The future of secure crypto payments in India looks promising as technology advances and regulatory frameworks mature. As more individuals and businesses adopt cryptocurrencies, the demand for robust security measures will continue to grow. Innovations in blockchain technology, encryption, and compliance will play a crucial role in shaping the landscape of digital payments.

Education and awareness will also be key in fostering a secure crypto payment ecosystem. As users become more knowledgeable about best practices and emerging threats, they will be better equipped to protect their digital assets.

Conclusion

In conclusion, secure crypto payments in India require a multifaceted approach that includes adopting best practices, staying informed about regulatory developments, and leveraging technological advancements. By focusing on security and compliance, individuals and businesses can navigate the digital financial frontier with confidence. As the cryptocurrency landscape continues to evolve, prioritizing security will be essential in ensuring the safe and successful adoption of digital currencies in India.

FAQ’S

1. What is a secure cryptocurrency payment?

A secure cryptocurrency payment ensures that the transaction is protected from fraud, theft, and unauthorized access. It involves using best practices like encryption, secure wallets, and authentication measures to safeguard digital assets.

2. Are cryptocurrency payments legal in India?

As of the latest update, cryptocurrency payments are legal in India, but they are subject to regulatory scrutiny. The government has expressed interest in regulating and potentially taxing cryptocurrency transactions. Always check the latest legal updates and guidelines from the Reserve Bank of India (RBI) and other regulatory bodies.

3. How can I ensure my cryptocurrency payments are secure?

To ensure secure cryptocurrency payments, consider the following:

- Use Reputable Wallets: Choose wallets with strong security features and a good track record.

- Enable two-factor authentication (2FA): Add an extra layer of security to your accounts.

- Verify addresses: Double-check wallet addresses before making transactions to avoid errors.

- Keep Private Keys Safe: Never share your private keys and store them securely.

- Be Wary of Scams: Be cautious of phishing attempts and fraudulent schemes.