AUTHOR : EMILY

DATE : 24/08/2024

Introduction

Decentralized Finance[1] (DeFi) has been making waves across the global financial landscape, and India is no exception. As the world’s largest democracy and a growing digital economy, India holds significant potential for shaping the future of financial services[2] through DeFi innovations. DeFi represents a new frontier of financial services that aims to decentralize, democratize, and disintermediate the traditional financial[3] system. Built primarily on blockchain technology, DeFi offers a wide range of financial services, including lending, borrowing, trading, and investing, without relying on centralized institutions like banks or brokers.

The State of DeFi in IndiaDeFi (Decentralized Finance) innovations in india

India has witnessed exponential growth in cryptocurrency adoption and blockchain[4] technology over the past few years. With a young population that is tech-savvy and open to innovation, the DeFi ecosystem in India has the potential to grow rapidly. Although India’s regulatory landscape[5] around cryptocurrencies remains ambiguous, interest in DeFi continues to rise. Numerous startups and financial technology firms are exploring DeFi applications, paving the way for innovation in this space.

Key Innovations Driving DeFi Growth in India

1. Blockchain Infrastructure and Protocol Development

The foundation of DeFi lies in blockchain technology. In India, several projects are focused on building robust blockchain networks that can support decentralized applications (dApps) and DeFi protocols. Projects like Polygon (formerly Matic Network) are making significant strides in scaling Ethereum and other blockchain platforms[1], reducing transaction fees, and increasing speed. By offering layer-2 solutions, Polygon has become a global leader, enabling many DeFi applications that serve not only Indian users but also a worldwide audience.

2. Decentralized Lending and Borrowing Platforms

DeFi lending and borrowing platforms are gaining traction in India. These platforms allow users to lend or borrow cryptocurrencies without needing a traditional bank or financial intermediary. Platforms like InstaDapp, which was developed by an Indian team, offer a user-friendly interface to interact with various DeFi protocols such as Compound, Aave, and Maker. Through such innovations, users can access global financial markets, earn interest, and take loans in a decentralized manner.

3. Yield Farming and Staking Solutions

Yield farming and staking have become popular methods for earning passive income within the DeFi ecosystem. In India, users are increasingly participating in liquidity provision and staking activities. Protocols like EasyFi, a layer-2 DeFi lending platform[2] built on the Polygon network, focus on offering high-yield opportunities while maintaining low transaction costs. Yield farming in India is expanding as more users discover the benefits of decentralized, permissionless finance.

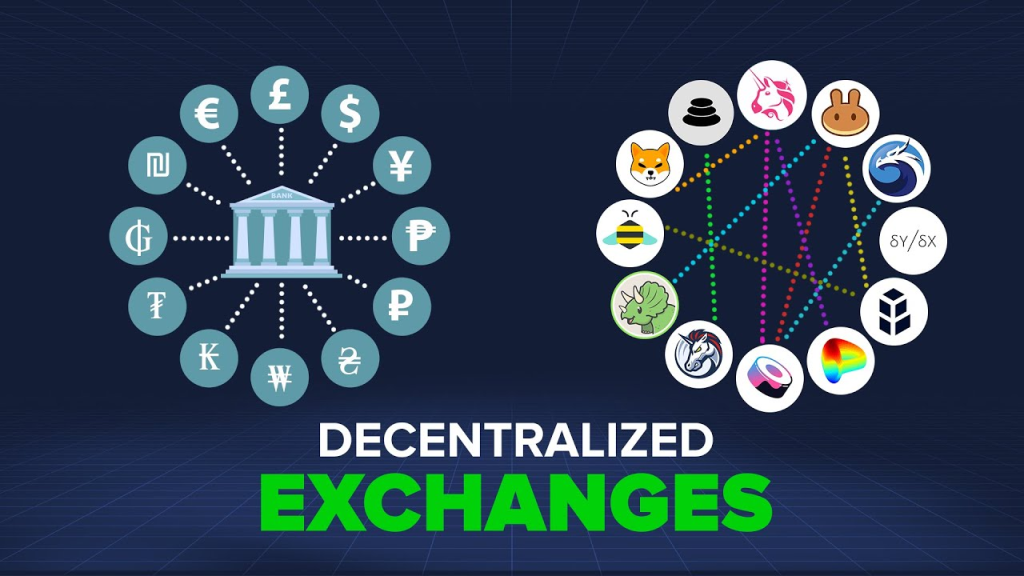

4. Decentralized Exchanges (DEXs)

Centralized exchanges (CEXs) like Wazir X and Coin DCX have played a crucial role in introducing cryptocurrencies to Indian users. However, the emergence of decentralized exchanges (DEXs) is changing how users trade digital assets. DEXs like Uniswap and Pancake Swap have witnessed significant participation from Indian users. DEX aggregators and local projects are also being developed to offer better liquidity, enhanced security, and reduced slippage for Indian traders.

5. DeFi Insurance and Risk Management

As DeFi adoption grows, so does the need for risk management solutions. Decentralized insurance[3] platforms [5] provide coverage for smart contract failures, hacks, and other risks associated with DeFi protocols. Indian startups are exploring insurance products that cater to both retail and institutional users. Platforms like Nexus Mutual and Cover Protocol have already captured attention among Indian DeFi enthusiasts, offering decentralized alternatives to traditional insurance.

6. Tokenized Assets and Stablecoins

Stablecoins like USDC and DAI play a critical role in the DeFi ecosystem by offering price stability in a volatile market. In India, there is growing interest in the creation of rupee-backed stablecoins, which could bring more users into the DeFi space. Additionally, tokenization of real-world assets such as real estate, art, and commodities is an emerging trend. This allows fractional ownership and improved liquidity, potentially transforming investment opportunities in India.

Regulatory Landscape and Challenges

While DeFi presents significant opportunities, it also faces challenges, particularly in India’s regulatory environment. The Reserve Bank of India (RBI) and other financial regulators have maintained a cautious stance towards cryptocurrencies and blockchain technology. The lack of clear regulations often results in uncertainty, hindering widespread DeFi adoption. However, ongoing dialogues between industry stakeholders and policymakers could pave the way for a more supportive regulatory[4] framework.

The Social Impact of DeFi (Decentralized Finance) innovations in india

India is home to millions of unbanked and underbanked individuals. Traditional financial institutions often fail to reach rural areas or charge high fees for their services. DeFi can democratize access to financial services by leveraging mobile internet and blockchain technology. By reducing the reliance on intermediaries and offering borderless financial solutions, DeFi could play a transformative role in improving financial inclusion in India.

The Future of DeFi (Decentralized Finance) innovations in india

The DeFi ecosystem in India is still in its nascent stage, but it is evolving rapidly. As more developers, investors, and users enter this space, India is poised to become a significant player in the global DeFi landscape. Education and awareness will be crucial in driving adoption, especially among non-tech-savvy individuals. Initiatives from industry bodies, blockchain[5] communities, and educational institutions are already working towards spreading knowledge about DeFi and its potential benefits.

Conclusion

Decentralized Finance (DeFi) holds immense potential in reshaping India’s financial landscape. From lending and borrowing to trading and insurance, DeFi innovations are enabling a shift towards a more inclusive and democratized financial system. Despite regulatory challenges, the pace of development in India’s DeFi sector is promising. With the right mix of technology, regulatory support, and user adoption, India could emerge as a global leader in the DeFi revolution. As more projects, investors, and users get involved, the future of finance in India looks increasingly decentralized, open, and accessible to all.

faqs:

1. What is decentralized finance (DeFi)?

- Answer: Decentralized finance, or DeFi, refers to a system of financial services that operate on blockchain technology without relying on traditional intermediaries like banks. DeFi platforms use smart contracts to automate financial transactions, enabling users to lend, borrow, trade, and invest in a decentralized manner.

2. How is DeFi different from traditional finance?

- Answer: DeFi differs from traditional finance in that it operates on decentralized networks, typically using blockchain technology. This eliminates the need for intermediaries, such as banks, which reduces costs and increases transparency. DeFi also allows for greater accessibility, as anyone with an internet connection can access DeFi services.

3. What are some key DeFi platforms in India?

- Answer: Some key DeFi platforms in India include:

- Instadapp is a platform that simplifies DeFi management and automates complex strategies.

- Polygon (formerly Matic Network): A layer-2 scaling solution for Ethereum, widely used in DeFi applications.

- WazirX is a cryptocurrency exchange that also offers a decentralized exchange (DEX) and staking services.

- Biconomy: A startup focused on simplifying blockchain transactions for DeFi users.

4. What are the benefits of DeFi in India?

- Answer: DeFi offers several benefits in India, including:

- Financial Inclusion: DeFi can provide access to financial services for unbanked and underbanked populations.

- Lower Costs: By eliminating intermediaries, DeFi can reduce transaction costs.

- Transparency: DeFi transactions are recorded on public blockchains, increasing transparency and trust.

- Accessibility: Anyone with internet access can use DeFi platforms, regardless of location.

5. What are the challenges facing DeFi in India?

- Answer: Some challenges facing DeFi in India include:

- Regulatory Uncertainty: The lack of clear regulatory guidelines for cryptocurrencies and DeFi creates uncertainty for investors and developers.

- Lack of Awareness: Many people in India are still unfamiliar with DeFi and its benefits.

- Security Concerns: DeFi platforms can be vulnerable to hacks and smart contract risks, which can affect user trust.