AUTHOR : EMILY

DATE : 23/8/2024

Introduction

Cryptocurrency technology has rapidly evolved from a niche interest to a global phenomenon. As digital currencies continue to gain traction worldwide, India finds itself at a critical juncture. With a vast pool of IT talent, a growing tech-savvy population, and increasing interest in digital assets, the future of cryptocurrency in India is a topic of significant importance. However, the path forward is riddled with challenges, including regulatory uncertainty, technological infrastructure, and public acceptance[1]. This blog explores the potential future of cryptocurrency technology in India, examining the opportunities, challenges, and role of government policy in shaping this emerging sector.

The Current Landscape of Cryptocurrency in India

India’s relationship with cryptocurrency has been complex. The Reserve Bank of India (RBI) initially imposed a ban on cryptocurrency transactions in 2018, citing concerns over financial stability, money laundering, and consumer protection. However, the Supreme Court overturned this ban in 2020, allowing cryptocurrency exchanges[2] to operate once again. Since then, interest in digital currencies has surged, with millions of Indians investing in cryptocurrencies like Bitcoin, Ethereum, and others.

Despite the legal clarity provided by the Supreme Court ruling, the Indian government remains cautious. Various government agencies have debated the need for a comprehensive regulatory framework, leading to uncertainty in the market. The introduction of a bill to ban all private cryptocurrencies while exploring the possibility of a central bank digital currency (CBDC) has added to the uncertainty.

The Rise of Central Bank Digital Currencies (CBDCs)

One of the most significant developments in the global financial landscape is the rise of Central Bank Digital Currencies (CBDCs). CBDCs are digital versions of a country’s fiat currency, issued and regulated by the central bank. They represent a potential middle ground between traditional currencies and cryptocurrencies, offering the benefits of digital currency while maintaining regulatory oversight.

India is actively exploring the possibility of launching its own CBDC, often referred to as the digital rupee. The RBI has been conducting research and exploring various models for implementing a digital rupee, with pilot programs expected in the near future. The global acceptance of CBDCs could significantly influence India’s approach to digital currencies, pushing the country towards more progressive strategies in the crypto space.

The introduction of a digital rupee could have several advantages. It could reduce the reliance on cash, improve financial inclusion, and enhance the efficiency of the payment system. Additionally, a digital rupee could provide the government with greater control over monetary policy and help combat issues like black money and tax evasion. However, the success of a CBDC in India will depend on the government’s ability to create a secure and user-friendly infrastructure that can handle the scale of India’s population.

Opportunities for Cryptocurrency Technology in India

India’s tech-savvy population, coupled with its status as a global IT hub, presents significant opportunities for the adoption of cryptocurrency technology. Here are some areas where cryptocurrencies could play a transformative role:

- Financial Inclusion: Cryptocurrencies have the potential to provide financial services to the unbanked and underbanked populations in India. With a significant portion of the population still lacking access to traditional banking services, digital currencies could offer an alternative means of storing and transferring value. Blockchain technology, which underpins cryptocurrencies, could also be used to streamline remittances, reduce transaction costs, and increase transparency in financial transactions.

- Blockchain for Governance: Blockchain technology, a decentralized ledger system, has applications beyond cryptocurrencies. In India, blockchain could be used to improve governance by providing secure and transparent systems[3] for voting, land registry, and public service delivery. The Indian government has already shown interest in using blockchain for land records and other administrative processes, indicating a willingness to explore the technology’s potential.

- Boosting the Tech Industry: India’s IT industry stands to benefit immensely from the growth of cryptocurrency technology. The demand for blockchain developers, cybersecurity experts, and other related professionals is likely to increase as the sector grows. India, with its vast pool of skilled IT professionals, is well-positioned to become a global leader in blockchain and cryptocurrency technology development.

- Innovation and Startups: The rise of cryptocurrency has led to a surge in fintech innovation. Indian startups are increasingly exploring blockchain and cryptocurrency-related products and services, from crypto exchanges to blockchain[4]-based supply chain solutions. The startup ecosystem in India could see significant growth as entrepreneurs develop new applications for cryptocurrency technology.

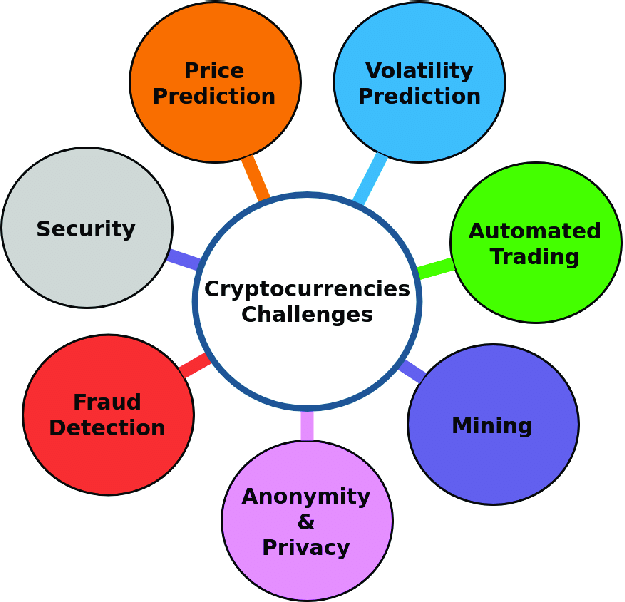

Challenges Facing Cryptocurrency in India

Despite the opportunities, several challenges could impede the growth of cryptocurrency technology in India:

- Regulatory Uncertainty: The lack of a clear regulatory framework is perhaps the most significant challenge. While the Supreme Court’s ruling provided temporary relief, the ongoing debate over whether to ban or regulate cryptocurrencies creates an atmosphere of uncertainty. Businesses and investors are hesitant to fully commit to the sector without clear guidelines from the government.

- Security Concerns: The security of digital assets is a major concern for both consumers and regulators. High-profile hacks and scams have highlighted the risks associated with cryptocurrencies. For widespread adoption, India will need to develop robust cybersecurity measures to protect users and ensure the integrity of digital currency systems.

- Public Awareness and Education: Cryptocurrencies are still relatively new to the average Indian consumer. There is a need for greater public awareness and education about how digital currencies work, their benefits, and the associated risks. Without proper understanding, consumers may be susceptible to misinformation or fraud.

- Infrastructure Limitations: Implementing a digital currency system on a national scale requires significant infrastructure development. This includes not only technological infrastructure but also the creation of legal and regulatory frameworks, consumer protection mechanisms, and financial literacy programs. India will need to address these challenges to ensure the successful implementation[5] of cryptocurrency technology.

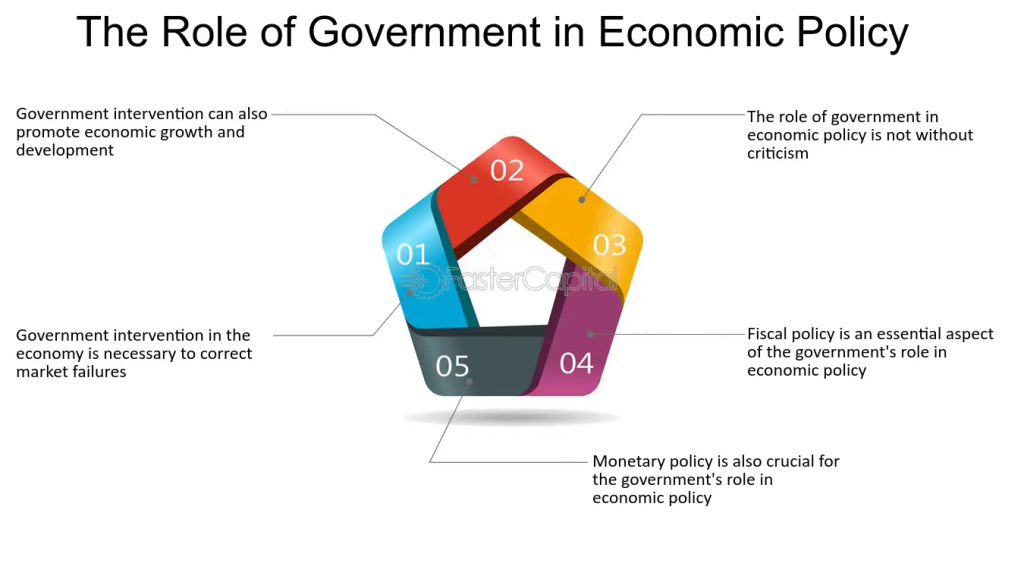

The Role of Government Policy

Government policy will play a crucial role in determining the future of cryptocurrency technology in India. A balanced approach that addresses the risks while fostering innovation is essential. Rather than an outright ban, the government could consider regulating cryptocurrencies, setting guidelines for exchanges, and implementing KYC (Know Your Customer) and AML (Anti-Money Laundering) measures.

Additionally, collaboration between the government, the private sector, and academia could help create a supportive ecosystem for cryptocurrency innovation. By encouraging research and development, investing in infrastructure, and promoting public awareness, the government can help India become a leader in the global cryptocurrency space.

Conclusion

The future of cryptocurrency technology in India is filled with both promise and uncertainty. As the country navigates the challenges of regulation, security, and infrastructure, the potential for growth and innovation in the sector remains immense. With the right policies and a forward-thinking approach, India has the opportunity to leverage its IT expertise and become a global leader in cryptocurrency technology. The coming years will be crucial in determining whether India embraces the digital currency revolution or remains on the sidelines.

FAQ:

What is the present legal standing of cryptocurrency in India?

Cryptocurrency is currently legal in India, following the Supreme Court’s 2020 ruling that lifted the Reserve Bank of India’s (RBI) ban on banks dealing with cryptocurrency exchanges. However, the regulatory environment remains uncertain as the government continues to discuss potential legislation that could further regulate or even ban certain aspects of cryptocurrency use.

2. What is the present legal standing of cryptocurrency in India?

A Central Bank Digital Currency (CBDC) is a digital form of a country’s fiat currency, issued and regulated by the central bank. In India, the RBI is exploring the possibility of introducing a digital rupee, which would offer the benefits of digital transactions while maintaining government oversight and control.

3. How could a digital rupee impact India’s economy?

A digital rupee could enhance financial inclusion by providing digital financial services to those without access to traditional banking. It could also streamline payments, reduce reliance on cash, and improve the efficiency of monetary policy implementation. Additionally, it may help in combating illegal activities by providing a transparent and traceable transaction system.

4. What are the main challenges facing cryptocurrency adoption in India?

The major challenges include regulatory uncertainty, security risks associated with digital assets, public awareness and education gaps, and infrastructure limitations. Without clear regulations, businesses and investors face risks, and the general public may be hesitant to adopt cryptocurrencies due to security concerns and a lack of understanding.

5. What opportunities does cryptocurrency technology present for India?

Cryptocurrency technology offers numerous opportunities, including boosting financial inclusion, fostering innovation in fintech, and leveraging blockchain for governance and administrative purposes. India’s strong IT industry and tech-savvy population position it well to become a global leader in blockchain and cryptocurrency innovation.

6. How is the Indian government approaching cryptocurrency regulation?

The Indian government is currently cautious in its approach to cryptocurrency regulation. While there is no outright ban, discussions around potential legislation to regulate or even prohibit certain private cryptocurrencies are ongoing. The government is also exploring the development of a CBDC as a regulated alternative to private cryptocurrencies.