AUTHOR : SAYYED NUZAT

DATE : MAY 13, 2024

In recent years, the digital payment landscape in India has witnessed a significant transformation, propelled by technological advancements and evolving consumer preferences. This article delves into the intricacies of fiat-to-crypto payment services in India, exploring their significance, functionality, challenges, and opportunities.

Introduction to Fiat-to-Crypto Payment Services

Understanding Fiat-to-Crypto Payments

Fiat-to-crypto payment services facilitate the conversion of fiat currency, such as the Indian Rupee (INR), into various cryptocurrencies like Bitcoin, Ethereum, and Ripple. Conversely, users can also convert cryptocurrencies back into fiat currency, enabling seamless transitions between digital and traditional forms of money. Therefore, these services bridge the gap between the two worlds, allowing for fluid and convenient financial transactions.

Importance in the Indian Market

With the growing popularity[1] of cryptocurrencies and the increasing adoption of digital payment solutions in India, fiat-to-crypto payment services[2] play a crucial role in bridging the gap between traditional financial systems and the emerging digital economy[3].

Current Landscape of Payment Services in India

Regulatory Framework for Cryptocurrencies in India

Despite the growing interest in cryptocurrencies[4], India has maintained a cautious approach towards their regulation. In contrast, other countries have embraced more progressive stances on cryptocurrency legislation and integration. This careful stance reflects the need to balance innovation with the potential risks associated with digital currencies[5]. This cautious stance reflects the country’s broader strategy of balancing innovation with regulatory prudence. The Reserve Bank of India (RBI) has issued several advisories warning against the use of cryptocurrencies for financial transactions, citing concerns related to money laundering, security risks, and market volatility.

Fiat-to-Crypto Payment Services: The Need of the Hour

Accessibility and Convenience

Fiat-to-crypto payment services offer users a convenient and accessible platform to buy, sell, and store cryptocurrencies without the need for specialized knowledge or technical expertise. This accessibility fosters greater participation in the digital asset economy, democratizing access to financial services.

Facilitating Global Transactions

By enabling seamless cross-border transactions, fiat-to-crypto payment services empower businesses and individuals to engage in international trade and investment opportunities. This facilitates economic growth and fosters greater financial integration on a global scale.

Challenges and Opportunities

Regulatory Uncertainty

The regulatory ambiguity surrounding cryptocurrency in India poses a significant challenge for fiat-to-crypto payment service providers, leading to operational uncertainties and compliance burdens.

Security Concerns

The inherent security risks associated with cryptocurrencies, such as hacking, fraud, and theft, pose challenges for both users and service providers. Despite these concerns, advancements in blockchain technology and cybersecurity measures offer opportunities to enhance the security and resilience of fiat-to-crypto payment ecosystems.

Market Competition and Innovation

As the demand for fiat-to-crypto payment services grows, the market becomes increasingly competitive, with new entrants vying for market share. This competition drives innovation and prompts service providers to differentiate themselves through innovative features, competitive pricing, and superior user experience.

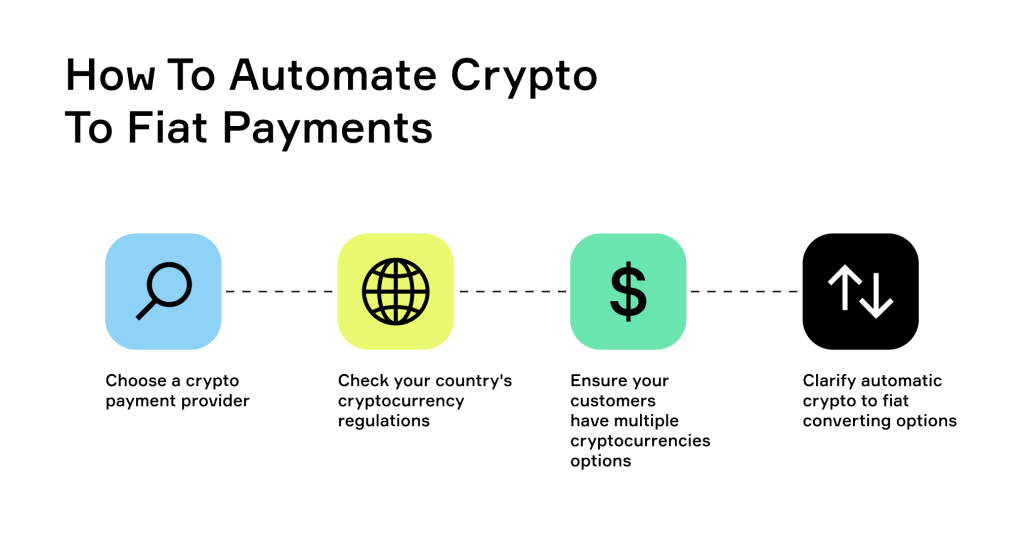

How Fiat-to-Crypto Payment Services Work

User Registration and Verification

To use fiat-to-crypto payment services, users are typically required to register an account and undergo identity verification procedures to comply with regulatory requirements and mitigate the risk of fraud and illicit activities.

Fiat Currency Deposits and Conversion

Once the deposited funds are received, subsequently, they are then converted into cryptocurrencies at the prevailing exchange rates.

Cryptocurrency Wallet Management

Upon successful conversion, the cryptocurrencies are credited to the user’s digital wallet, where they can be stored securely and accessed whenever needed. In addition, users have the option to manage their wallets through web-based platforms or dedicated mobile applications.

Transaction Execution and Settlement

The transaction is executed on the blockchain network, verified by network nodes, and settled within a predetermined timeframe.

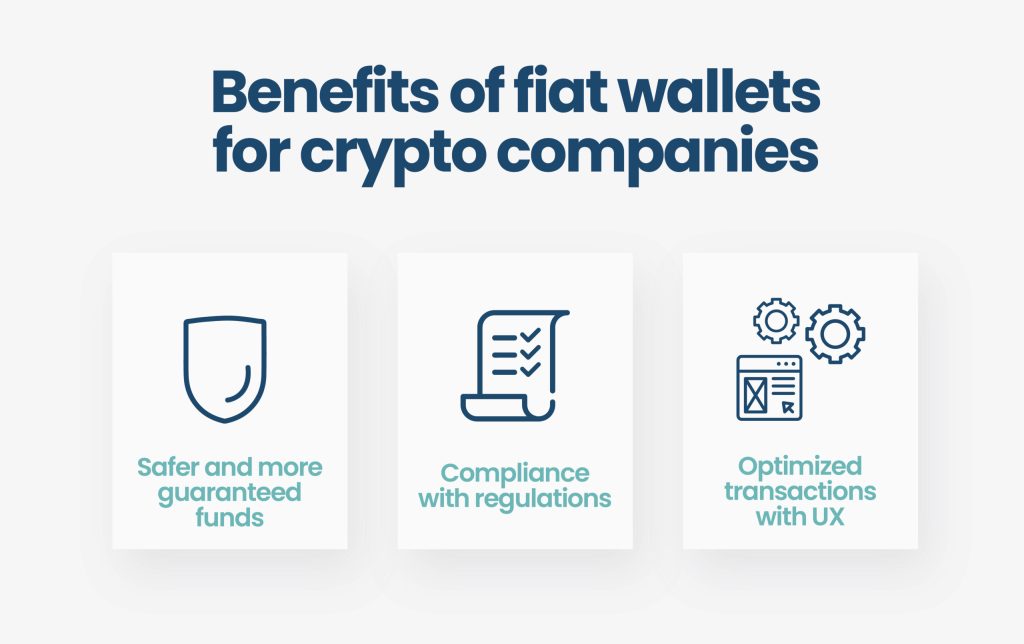

Advantages of Using Fiat-to-Crypto Payment Services

Lower Transaction Fees

While traditional banking and remittance services often involve higher fees, on the other hand, fiat-to-crypto payment services typically offer lower transaction costs. This makes them a cost-effective option for transferring value across borders or conducting large-volume transactions.

Faster Transaction Speeds

With blockchain technology enabling near-instantaneous settlement of transactions, fiat-to-crypto payment services, therefore, offer faster transaction speeds compared to traditional banking systems. In contrast, traditional systems may involve delays due to intermediary processes and clearance procedures.

Enhanced Security Measures

Fiat-to-crypto payment services employ advanced security measures such as encryption, multi-factor authentication, and cold storage solutions to safeguard users’ funds and personal information against unauthorized access and cyber threats.

Portfolio Diversification Opportunities

By providing access to a diverse range of cryptocurrencies, fiat-to-crypto payment services empower users to diversify their investment portfolios and hedge against market volatility.Moreover, enhancing their financial resilience and long-term wealth accumulation strategies.

Case Studies: Real-Life Examples

Case Study 1: E-Commerce Transactions

This enhances payment flexibility and expands the platform’s user base.

Case Study 2: Freelance Payments

This streamlines the payment process and improves freelancers’ earning potential.

Case Study 3: Cross-Border Remittances

This improves financial inclusion and contributes to economic development.

Future Outlook and Trends

Integration with Mainstream Financial Systems

As cryptocurrencies gain broader acceptance and regulatory clarity improves, fiat-to-crypto payment services are expected to integrate more seamlessly with mainstream financial systems, facilitating greater interoperability and adoption.

Evolving Regulatory Landscape

The regulatory landscape governing cryptocurrencies in India is expected to evolve in response to market dynamics and technological advancements. Hence, clearer regulations and industry guidelines will provide greater certainty and confidence to stakeholders, fostering sustainable growth and innovation.

Conclusion

In conclusion, fiat-to-crypto payment services represent a transformative force in India’s digital payment ecosystem, offering users greater financial flexibility, accessibility, and security. Despite regulatory challenges and market uncertainties, these services hold immense potential to drive financial inclusion, promote economic growth, and usher in a new era of digital finance in India.

FAQs

1. Are fiat-to-crypto payment services legal in India? Yes, fiat-to-crypto payment services operate within the legal framework established by regulatory authorities in India. However, users are advised to comply with applicable laws and regulations governing cryptocurrency transactions.

2. How do fiat-to-crypto payment services ensure the security of user funds? Fiat-to-crypto payment services employ robust security measures such as encryption, multi-factor authentication, and cold storage solutions to safeguard users’ funds against unauthorized access and cyber threats.

3. Can I use fiat-to-crypto payment services for international transactions? Yes, fiat-to-crypto payment services facilitate cross-border transactions, allowing users to send and receive cryptocurrencies to and from counterparties located anywhere in the world. This offers greater convenience and cost-effectiveness compared to traditional remittance methods.

4. What cryptocurrencies can I trade using fiat-to-crypto payment services? Fiat-to-crypto payment services support a wide range of cryptocurrencies, including Bitcoin, Ethereum, Ripple, Litecoin, and many others. Users can choose from various trading pairs depending on their preferences and investment goals.