AUTHOR : SAYYED NUZAT

DATE : MAY 12, 2024

Cryptocurrency has been gaining popularity globally, and India is no exception. As the adoption of cryptocurrencies rises, the need for efficient payment methods becomes imperative. One such method is the integration of crypto wallet payments. In this article, we’ll delve into the intricacies of crypto wallet payment integration in India, exploring its importance, types, benefits, challenges, integration steps, and future prospects.

Introduction to Crypto-Wallet Payment Integration

In recent years, the world has witnessed a surge in the use of cryptocurrencies as a medium of exchange. Crypto wallet payment integration refers to the process of enabling businesses to accept payments in cryptocurrencies through digital wallets. This integration allows customers to make seamless transactions using their preferred cryptocurrencies.

importance of Crypto Wallets in India

India, with its vast population and growing digital economy, presents a significant opportunity for crypto wallet payment integration. With the increasing interest in cryptocurrencies among Indians, businesses need to adapt to the changing payment landscape to stay competitive. Crypto wallets[1] offer a convenient and secure way for users to store and transact digital assets, making them an essential component of the modern financial ecosystem.

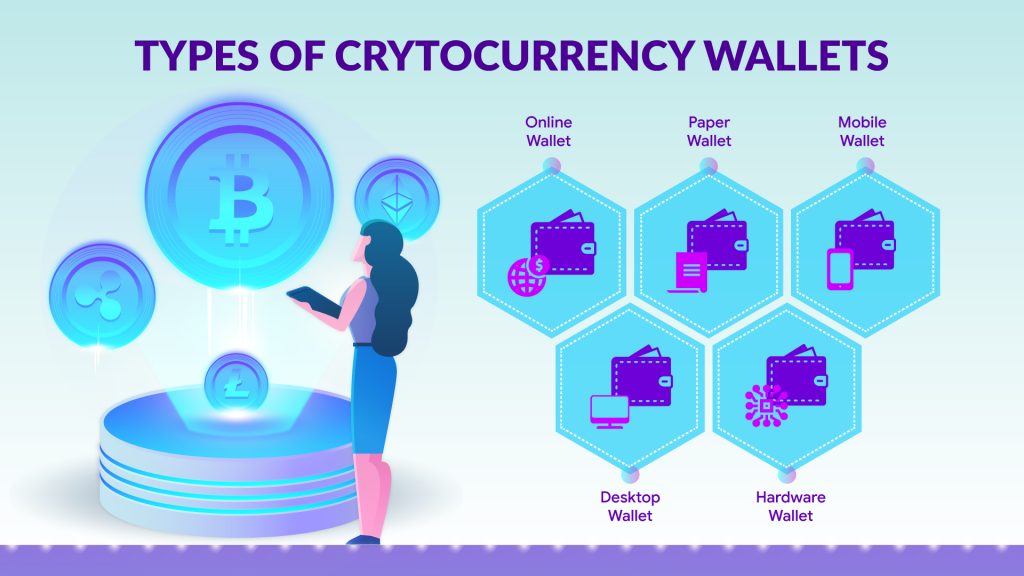

Types of Crypto Wallets

A variety of crypto wallet options exist, designed to accommodate diverse user preferences and security requirements.

Hardware Wallets

Hardware wallets are physical devices that store the user’s private keys offline, providing enhanced security against hacking and malware attacks.

Software Wallets

Software wallets, also known as desktop wallets, are applications installed on computers[2] or laptops. They offer a balance between security and convenience, allowing users to access their funds from a designated device.

Mobile Wallets

Mobile wallets serve as smartphone[3] applications, facilitating users in managing their cryptocurrencies while they are on the move. They offer convenience and accessibility, making them popular among users who prefer mobile-centric solutions.

Popular Cryptocurrencies in India

Bitcoin, Ethereum, Ripple, and Litecoin stand out as some of the widely favored cryptocurrencies within the Indian market. These digital assets[4] are widely accepted and traded across various crypto exchanges in the country.

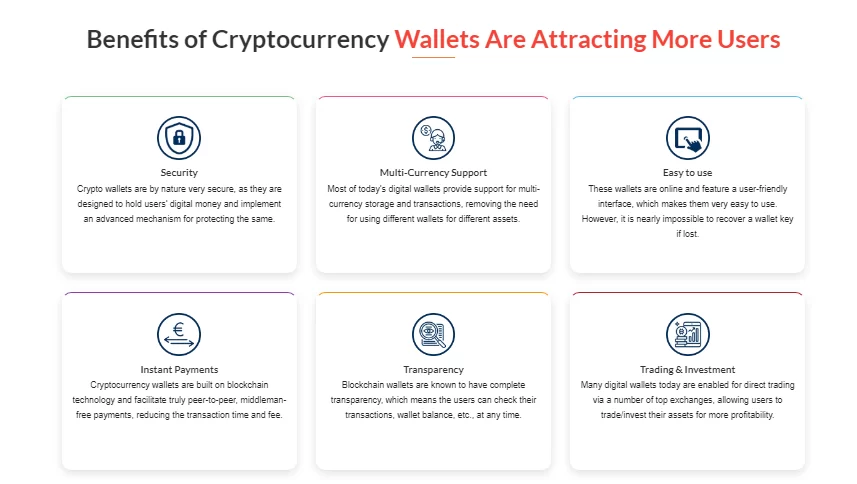

Benefits of Integrating Crypto-Wallet Payments

Security

Crypto wallet payments offer enhanced security compared to traditional payment methods. With features like encryption and decentralized[5] ledger technology, they provide protection against fraud and unauthorized access.

Transparency

Blockchain technology, which serves as the foundational technology supporting cryptocurrencies, guarantees the transparency and immutability of transactions.This transparency fosters trust between buyers and sellers, reducing disputes and chargebacks.

Accessibility

Crypto wallet payments eliminate barriers to financial inclusion by providing access to digital assets for individuals without traditional banking services. This inclusivity empowers underserved populations to participate in the digital economy.

Challenges of Crypto Wallet Payment Integration in India

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies in India is still evolving, leading to uncertainty among businesses regarding compliance requirements and legal implications.

Lack of Awareness

Many consumers and merchants in India are unfamiliar with cryptocurrencies and the benefits of using them for transactions. Educating stakeholders about the advantages of crypto wallet payments is essential for widespread adoption.

Volatility

The volatile nature of cryptocurrencies poses a challenge for businesses accepting crypto payments. Fluctuations in value can affect pricing strategies and profit margins, requiring risk management measures to mitigate exposure.

Steps to Integrate Crypto Wallet Payments

Integrating crypto wallet payments into existing payment systems involves several steps:

- Choose a Payment Gateway: Select a payment gateway that supports crypto transactions and integrates seamlessly with your e-commerce platform.

- Set Up a Merchant Account: Create a merchant account with the chosen payment gateway to receive crypto payments from customers.

- Generate Payment Addresses: Generate unique payment addresses for each transaction to ensure proper tracking and reconciliation.

- Test Transactions: Conduct thorough testing of the payment integration to identify and resolve any issues before going live.

Examples of Businesses Integrating Crypto Wallet Payments in India

Several Indian businesses have embraced crypto wallet payments to cater to the growing demand for digital transactions. Companies in sectors such as e-commerce, hospitality, and gaming are leading the way in adopting crypto-friendly payment solutions.

Future of Crypto Wallet Payment Integration in India

Despite the challenges, the future looks promising for crypto wallet payment integration in India. As regulatory clarity improves and awareness increases, more businesses are likely to explore crypto payment options to tap into the benefits of blockchain technology.

Conclusion

Crypto wallet payment integration offers a glimpse into the future of finance, where digital assets play a central role in facilitating transactions. In India, the adoption of crypto wallet payments is poised to accelerate, driven by factors such as security, transparency, and accessibility. By embracing this emerging payment method, businesses can stay ahead of the curve and cater to the evolving needs of their customers.

FAQs

- Are crypto wallet payments legal in India?

- The legal status of cryptocurrencies in India is still evolving, with regulatory clarity awaited. However, there are no specific laws prohibiting the use of crypto wallet payments.

- How secure are crypto wallets?

- Crypto wallets employ advanced encryption techniques and blockchain technology to ensure the security of users’ funds. However, users must follow best practices, such as storing private keys securely and using reputable wallet providers.

- Can businesses accept multiple cryptocurrencies through wallet integration?

- Yes, businesses can integrate multiple cryptocurrencies into their payment systems to offer flexibility to customers. Payment gateways typically support a variety of digital assets for transactions.

- How do crypto wallet payments benefit consumers?

- Crypto wallet payments offer consumers greater control over their finances, lower transaction fees, faster settlement times, and enhanced privacy compared to traditional payment methods.

- Is there a risk of losing funds in a crypto wallet?

- While crypto wallets provide security features to safeguard funds, users must exercise caution and adhere to security best practices to minimize the risk of loss due to hacking or other vulnerabilities.