AUTHOR : SAYYED NUZAT

DATE : MAY 8, 2024

Blockchain technology in 2024, with its decentralized and secure nature, will revolutionize various industries, including finance. In India, where digital payment systems are rapidly evolving, blockchain-based payment solutions offer a promising alternative. Let’s delve into the world of blockchain payment solutions in India, exploring their benefits, challenges, adoption, popular platforms, and future prospects.

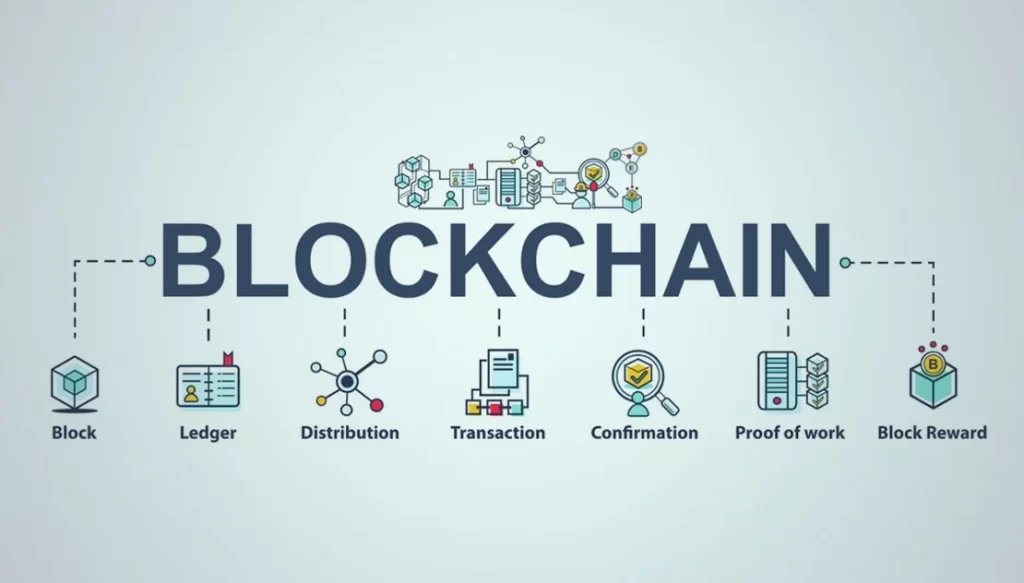

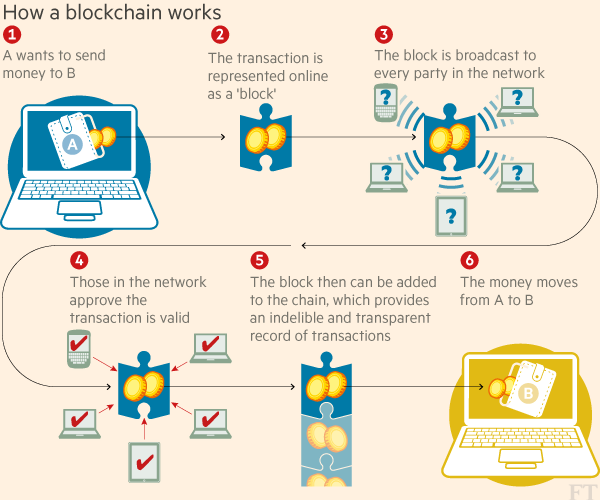

Introduction to Blockchain Payment Solutions

Blockchain technology operates as a decentralized ledger mechanism, diligently documenting transactions spanning a network of interconnected computers. Every transaction finds its repository within a block intricately tethered to its antecedent, thereby fashioning an unbroken chain of records. This technology ensures the transparency, security, and immutability of data. Similarly, in India, blockchain payment solutions leverage this technology to facilitate secure and efficient transactions.

Advantages of Blockchain Payment Solutions

Transparency and Security

Blockchain payment[1] solutions offer transparent and secure transactions by eliminating the need for intermediaries. Each transaction[2] is recorded on a decentralized ledger, making it tamper-proof and also resistant to fraud.

Lower Transaction Costs

By removing intermediaries and streamlining[3] the payment process, blockchain solutions reduce transaction costs significantly. This makes it an attractive option for businesses looking to cut down on operational expenses.

Faster Transactions

Blockchain [4]technology enables near-instantaneous transactions, eliminating the delays associated with traditional banking systems. This speed is particularly beneficial for cross-border transactions, which can take days to process using traditional methods[5].

Challenges and Adoption of Blockchain Payment Solutions in India

Regulatory Challenges

The regulatory landscape surrounding blockchain technology in India is still evolving. Uncertainty regarding regulations and compliance poses a challenge to the widespread adoption of blockchain payment solutions.

Lack of Awareness

Despite the potential benefits, many businesses and consumers in India are still unfamiliar with blockchain technology and its applications in payments. Educating stakeholders about the advantages of blockchain is crucial for its adoption.

Adoption by Businesses and Consumers

While some businesses in India have begun exploring blockchain payment solutions, widespread adoption is still in its nascent stage. Overcoming resistance to change and integrating blockchain into existing systems pose challenges.

Popular Blockchain Payment Solutions in India

Introduction to Popular Blockchain Payment Platforms

Several blockchain payment platforms are gaining traction in India, offering solutions tailored to different use cases. Platforms like Ripple, Stellar, and Ethereum provide secure and efficient payment solutions for businesses and consumers alike.

Use Cases in Various Sectors

Blockchain payment solutions are being adopted across various sectors in India, including banking, healthcare, supply chain, and e-commerce. These solutions streamline processes, enhance security, and also reduce costs for businesses.

Comparison of Different Platforms

Each blockchain payment platform has its own unique features and strengths. Comparing factors such as transaction speed, scalability, and security can help businesses choose the platform that best suits their needs.

Future of Blockchain Payment Solutions in India

Emerging Trends

As blockchain technology continues to evolve, new trends are shaping the future of blockchain payment solutions in India. These include the integration of artificial intelligence, the Internet of Things (IoT), and smart contracts to enhance functionality and security.

Potential for Growth

The potential for growth in the blockchain payments sector in India is immense. With increasing digitization and a growing emphasis on financial inclusion, blockchain has the potential to revolutionize the way payments are made and processed in the country.

Government Initiatives and Regulations

The Indian government has shown interest in exploring blockchain technology for various applications, including payments. Regulatory clarity and supportive policies will be crucial in fostering the growth of blockchain payment solutions in India.

Conclusion

Blockchain payment solutions hold immense promise for India’s evolving financial landscape.Moreover, with their transparency, security, and efficiency, they offer a viable alternative to traditional payment systems. Despite challenges such as regulatory uncertainty and a lack of awareness, the future looks bright for blockchain payments in India.

FAQs

- Are blockchain payments legal in India?

- Yes, blockchain payments are legal in India, but regulations are still evolving.

- How secure are blockchain payments?

- Blockchain payments are highly secure due to their decentralized nature and cryptographic encryption.

- Can blockchain payments reduce transaction costs?

- Yes, blockchain payments typically have lower transaction costs compared to traditional banking systems.

- What industries can benefit from blockchain payments?

- Industries such as banking, healthcare, and supply chain can benefit from blockchain payments.

- Is blockchain technology only for cryptocurrencies?

- No, blockchain technology has various applications beyond cryptocurrencies, including payments, smart contracts, and decentralized finance (DeFi).